Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 5: Futures Terminology

When you learn a language, you have to start with the basics. From alphabets to common words, your vocabulary strengthens over a period of time. When it comes to learning the language of Futures contracts, familiarizing yourself with certain key terms can make it much easier to grasp the workings of the product.

This chapter is a short glossary of important jargon you may come across while dealing with Futures contracts.

Futures terminology

1.Lot size

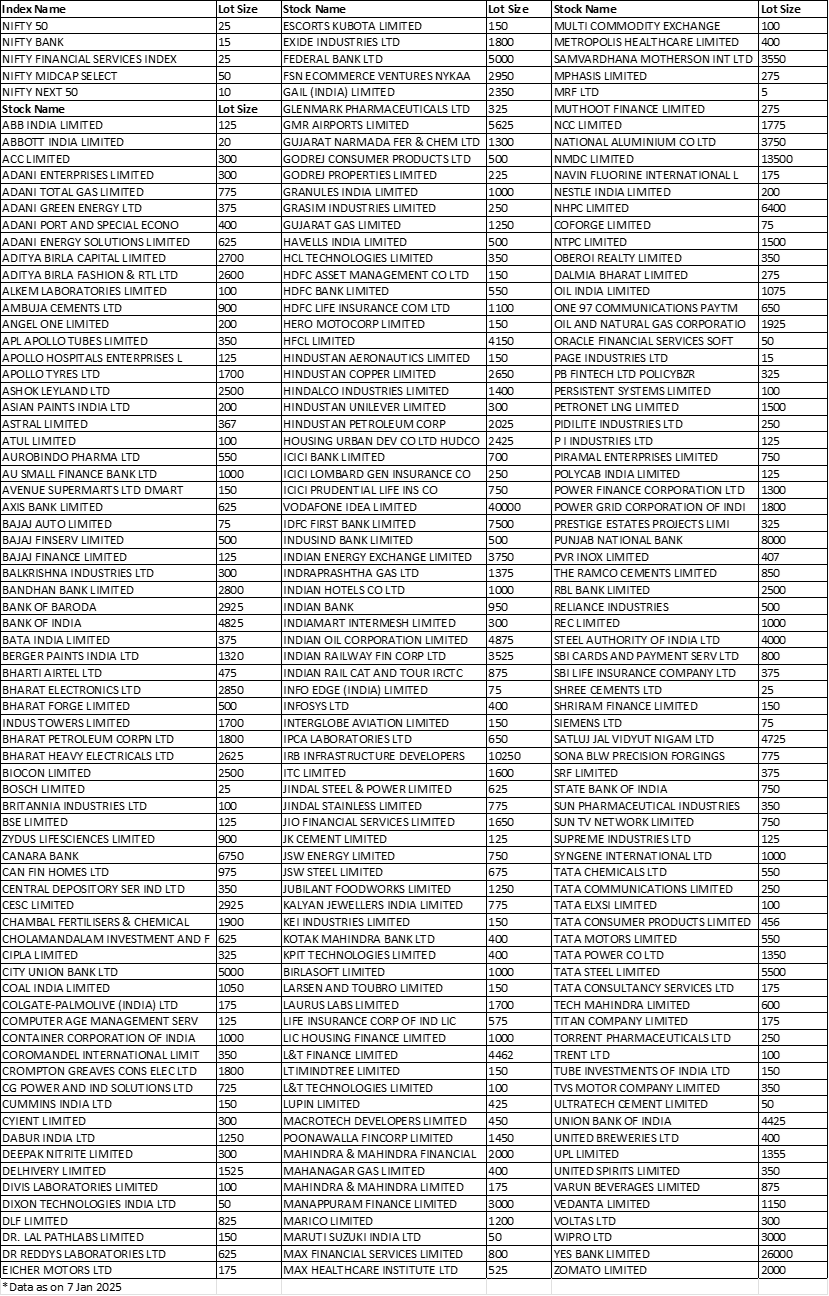

A Futures contract is a standardized contract with certain specifications. One such specification is the lot size, market lot or contract size. A lot size is the minimum number or quantity of units that have to be bought or sold under a contract. Lot size will differ from one derivative contract to another.

For example, an equity derivative on stock A might have a lot size of 300 shares whereas lot size on equity derivatives on stock B might be 100 shares. You can trade in derivatives in multiples of lot sizes only. To calculate the value of a derivate contract, you must multiply the lot size you wish to enter into with the current market price per unit. For instance, if the current market price of a stock is Rs. 300, and the lot size is 6,000 shares, then the value of one lot becomes Rs. 300*6000 = Rs. 18,00,000.

|

Did you know? The minimum value of a Futures lot size on NSE cannot be less than Rs. 5 lakhs at the time of introduction in the exchange. |

Exercise

Can you find out the value of one lot of Aurobindo Pharma Ltd. Futures contract today?

(Tip: Find out Aurobindo Pharma’s market price as of today and multiply with the current lot size.)

2.Expiry date

-

The expiry date is the date on which the buyer and seller of a Futures contract have to honor their obligations as per the contract specifications.

- This clearly implies that every Futures or derivative contract has a finite life.

- To avoid confusion, it has been pre-decided that every derivative contract will expire on the last Thursday of the month. In case that is a trading holiday, the previous trading day shall be considered the expiry date.

- For instance, at the end of Jan 2025, a one-month Futures contract on Nifty will expire on the last Thursday of Feb 2025. This Futures contract will cease to exist after Feb 27, 2025 contract will cease to exist after July 29, 2021.

However, it is not necessary to hold onto a contract till expiry. You can exit the contract any time before expiry. Similarly, you can also enter into contracts any time before expiry. Weekly expiry contracts on index Options are also available in the market and expire on Thursdays of the given week.

3.Trading cycle

A trading or contract cycle is the time duration for which a Futures contract trades on an exchange. In India, there are three monthly Futures contracts available at a given time based on their expiry date. These are:

- Near-month (one-month expiry) contracts

- Next month (two-month expiry)

- Far month (3-month expiry)

For example, on January 8, 2025, the near-month, next month, and far month contracts are available for Jan 2025, Feb 2025, and Mar 2025 respectively, where each contract will have expiry of the last Thursday of the respective month. A new monthly contract will be introduced after the expiry of a near-month contract. As per the above example, after the expiry of the January 2025 contract on January 30, a new contract of April 2025 will be introduced in the market on January 31, 2025.

In the below image, you can see that three Futures contracts are available as on January 8, 2025.

4.Margin concept in Futures contract

Futures contracts work on leverage or the idea of borrowing. Whenever you want to take a position, you don’t have to pay the full lot value. You only need to pay a certain percentage of the lot value to take a position in Futures contracts. Here’s what you need to know about margins:

Initial margin

The initial margin is the minimum amount of money that both buyers and sellers need at the time of getting into any Futures contract. Let us assume that on Jan 8, 2025, an individual buys a one-month Futures contract on Stock A, with a market price of Rs. 2,500 and contract size of 800 shares. The total value of the contract would be Rs. 20 lakhs (Rs. 2,500*800). If the initial margin is 15% of the contract value, then both parties have to deposit at least Rs. 3,00,000 with their respective brokers.

- The initial margin is based upon the volatility in the price of the stock – higher volatility would lead to a higher initial margin on a Futures contract.

- The exchange can increase or reduce the margin depending on volatility.

- It may also change the margin in a contract between the contract period and the investor will need to comply with the new margin requirement.

Maintenance margin

Maintenance margin is the sum of money that has to be maintained by both buyer and seller in their margin accounts once trading has started. This amount or percentage is lesser than the initial margin.

From the previous example, the initial margin was 15% of the contract value. So, the maintenance margin could perhaps be 12%. This means that the buyer and seller have to have at least Rs. 2.40,000 (12% * 20,00,000) in their account at any point.

As the contract begins, this margin amount may increase or decrease depending upon the value of the stock, but the balance cannot not fall below the maintenance margin level. If it does, then the buyer or the seller have to deposit the differential amount.

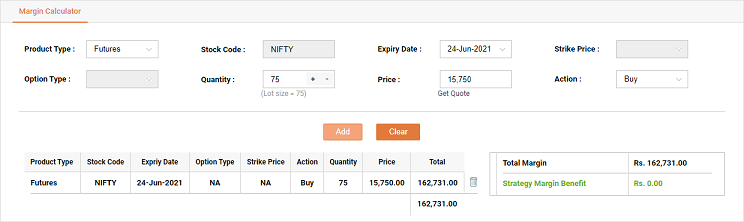

As you can see in the image below, the initial margin on the Nifty February Futures contract, at the price of Rs. 23,800 is Rs. 209,505.

5.Mark-to-market (MTM) profit/loss

Mark-to-market (MTM) is valuing assets according to their most recent market price. An important feature of Futures contracts is that gains and losses are settled on each trading day. This means that the value of the contract is marked to its current market value. The exchange, with the help of brokers and clearing houses, collects this MTM margin from the party making a loss and pays the same to other party making a gain.

For example, if an investor buys one lot of ‘Stock A’ Futures of 200 shares on January 6, 2025 at a price of Rs. 2,500, he is required to deposit a margin of 15% of the lot value i.e. 15%*200*2500 = Rs. 75,000. On July 7, the next trading day, if the price of Futures closes at Rs. 2,530, then the investor has made a gain of Rs. 6,000 (Rs. 30*200). This gain will be credited to his account and debited from the account of the seller on account of MTM settlement. The position will start from Rs. 2,530 on the next day.

Note: If you do not maintain the amount equivalent to the maintenance margin in your margin account, then you are bound to get a margin call from your broker. In simple words, it means the broker will inform you and ask you to credit your account with extra money to bring the balance back to the initial margin level.

Summary

- A lot size is the minimum number or quantity of units that have to be bought or sold under a contract. Lot size will differ from one derivative contract to another.

- The expiry date is the date on which the buyer and seller of a Futures contract have to honor their obligations as per the contract specifications.

- A trading or contract cycle is the time duration for which a Futures contract trades on an exchange. In India, there are three monthly Futures contracts available at a given time based on their expiry date:

- Near-month (one-month expiry) contracts

- Next month (two-month expiry)

- Far month (3-month expiry)

- Margins:

- The initial margin is the minimum amount of money that both buyers and sellers need at the time of getting into any Futures contract.

- Maintenance margin is the sum of money that has to be maintained by both buyer and seller in their margin accounts once trading has started. This amount or percentage is lesser than the initial margin.

- Mark-to-market (MTM) is valuing assets according to their most recent market price. Futures contracts are settled every day based on their MTM value.

With these basics, you’re now ready to roll! In the next chapter, we’ll look into the real thing. How to trade in Futures.

COMMENT (0)