Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 5: All About Short Call in Options Trading

Subhanshu is introduced to the world of Options by a knowledgeable friend, Deb. So far, Subhanshu understands a bit about Options. One morning, Deb calls Subhanshu. “Take my advice and go short on ABC Ltd.’s Call Option,” he says.

Subhanshu knows going short means to take a position to sell. But what does that really mean here?

Understanding the short Call

A short Call is an obligation to sell an underlying asset to a Call buyer at the strike price if the Call Option is exercised by the buyer of an Option.

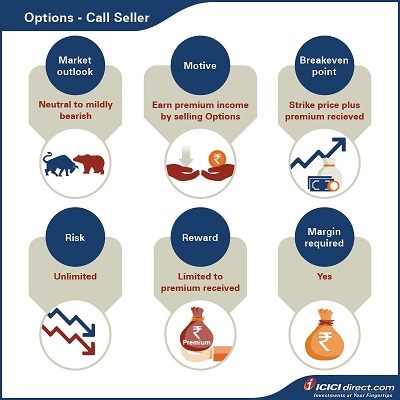

Short Call position or Call Option writing is useful when you are mildly bearish about the market. You expect the underlying asset to stay in the narrow range i.e. either stick to its current price or show a slightly downside movement.

In the above example, Deb asks Subhanshu to go short on ABC Ltd. Let’s dig deeper and understand why.

Assume Subhanshu sells ABC Ltd.’s Rs. 1,000 Call Option at a premium of Rs.50. It means he has an obligation to sell ABC at Rs. 1,000 on expiry and have receives Rs. 50 from the buyer of the Option. In other words, Subhanshu will have to sell ABC Ltd. at Rs. 1,000 on the expiry of the contract, if the buyer exercises his right to purchase. The buyer will prefer to exercise his right if it is favorable to him i.e. the price is more than Rs. 1,000.

Let us look at three scenarios within this:

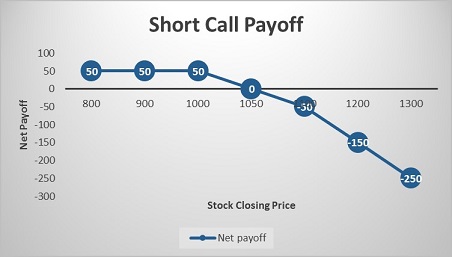

Scenario 1: ABC closes at Rs. 1,200 on expiry

In this case, the buyer would prefer to exercise his right and purchase ABC at Rs. 1,000. It means that Subhanshu will need to sell it at a discounted price of Rs. 1,000 in comparison to the market price of Rs. 1,200. He will incur a loss of Rs. 200 – Rs.50 (Premium received) = Rs. 150 on this position.

Note:

Rs. 50, which has been received from the seller, is the upfront profit which will be adjusted against loss on expiry, if any. In any case, Subhanshu’s profit will not be more than the premium received. The breakeven point in this case would be Rs. 1,000 + Rs. 50 = Rs. 1,050.

Alternatively, we can also calculate the profit/loss by the difference in premium paid and premium received.

Premium received = Rs. 50

Premium needed to be paid on expiry (equal to intrinsic value) = Max {0, (Spot price – Strike price)} = Max {0, (1200 –1000)} = Max (0, 200) = Rs. 200

Net profit/loss = Premium received – Premium paid = 50 – 200 = – Rs. 150 i.e. loss of Rs. 150

Scenario 2: ABC closes at Rs. 800 on expiry

In this case, the buyer won’t prefer to exercise his right and won’t purchase ABC at Rs. 1,000. This means that he will lose the premium paid i.e. incur a loss of Rs. 50 which you will gain. Subhanshu’s profit here is limited only to the premium received.

Alternatively, we can also calculate the profit/loss by the difference in premium paid and premium received.

Premium received = Rs. 50

Premium needed to be paid on expiry (equal to intrinsic value) = Max {0, (Spot price – Strike price)} = Max {0, (800 – 1000)} = Max (0, – 200) = 0

Net profit/loss = Premium received – Premium paid = 50 – 0 = Rs. 50

Scenario 3: ABC closes at Rs. 1,050 on expiry

In this case, the buyer will prefer to exercise his right and purchase ABC at Rs. 1,000. It means a loss of Rs. 50 for Subhanshu but this will be compensated by the premium received. So, there won’t be any profit or loss in this case.

As discussed in scenario 1, the breakeven point in this case is Rs. 1,050, so there won’t be any profit if ABC closes at Rs. 1,050.

Alternatively, we can also calculate the profit/loss by the difference in premium paid and premium received.

Premium received = Rs. 50

Premium needed to be paid on expiry (equal to intrinsic value) = Max {0, (Spot price – Strike price)} = Max {0, (1050 – 1000)} = Max (0, 50) = Rs. 50

Net profit/loss = Premium received – Premium paid = 50 – 50 = 0

The payoff in various scenarios is listed in the table below:

x`

x`

What situation do you think Deb anticipated?

With Deb’s advice, if scenario 1 played out, Subhanshu would incur a loss of Rs 150. If scenario 3 had played out, he would have reached break even. However, Deb was probably expecting Scenario 2, which is why he advised Subhanshu to go short on ABC Ltd.

|

Did you know? If you are expecting a large downside movement, buying a Put Option is useful. This is because you can exercise your right to sell at a higher price in comparison to the current market price.< |

Since Deb studied the market and expected only a slight downfall, he felt it would be better to take a short Call instead of a long Put.

Let’s understand why with an example. Let’s assume that:

Nifty Spot value on Jan 16, 2025 = 23,400

Nifty 23,400 Jan 30, 2025 Call Option premium = Rs. 71

Nifty 23,400 Jan 30, 2025 Put Option premium = Rs. 68

Let’s see the payoff, if Nifty moves down by 50 points as per expectation i.e. Nifty’s closing value on expiry = 23,350

|

Nifty short Call |

Nifty long Put |

|

Premium received = Rs. 71 |

Premium paid = Rs. 68 |

|

Call Option premium paid on expiry = Max {0, (Spot price – Strike price)} = Max {0, (23350 – 23400)} = Max (0, – 50) = 0 |

Put Option premium received on expiry = Max {0, (Strike price – Spot price)} = Max {0, (23400 – 23350)} = Max (0, 50) = Rs. 50 |

|

Net profit = 71 – 0 = Rs. 71 |

Net loss = 68 – 50 = Rs. 18 |

As you can see, you can get more profit with a short Call rather than a long Put. That’s why it is better to go with a short Call if you are moderately bearish. However, writing an Option has higher risks as you may have an unlimited loss.

Summary

- A short Call is an obligation to sell an underlying asset to a Call buyer at the strike price if the Call Option is exercised by the buyer of an Option.

- Short Call position or Call Option writing is useful when you are mildly bearish about the market. It is a good strategy to earn profits in this scenario.

- If you are expecting a large downside movement, buying a Put Option is useful.

In these last two chapters, we have looked at Call Options. In the next two chapters, we will look more closely at Put Options.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Centre, H. T. Parekh Marg, Churchgate, Mumbai - 400020, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. The contents herein mentioned are solely for informational and educational purpose.

COMMENT (0)