Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 3: All About Bull Put Spread

It is important to understand here that Put writing brings with it the risk of sizeable losses for the trader if the value of the stock falls to a level substantially lower than the strike price. As the trader is left with no option but to buy the stock at the Put strike price, he ends up in the red.

However, this risk is lessened in the case of a Bull Put Spread as here, the trader simultaneously purchases a Put at a lower price. This lowers the premium received, but also the risk involved. Read on to know more.

Looking at the Bull Put Spread

In the Bull Put Spread strategy, the investor buys an OTM (Out-of-the-Money) Put Option (of a lower strike price) and simultaneously sells an ITM (In-the-Money) Put Option (of a higher strike price), with the same expiry, on the same underlying asset and involving the same number of Options. This strategy is similar to a Bull Call Spread but is adopted so as to receive a net cash inflow at the start of trade, as the premium paid is less than that which is received.

Abhinav’s manager tells him to use this strategy if he is moderately bullish about prices of the underlying and believes that prices will either increase or remain rangebound. With this position, he can protect the downside risk of the Put sold (obligation to buy the asset) by purchasing a Put of a higher strike price (or the right to sell the asset).

|

Did you know? Bull Put Spread is known as credit spread due to net cash inflow. |

- Maximum loss will be incurred when the spot price falls below the lower strike price, i.e., when Abhinav can exercise the Option.

- Maximum profit will be incurred when Options are not exercised, and the spot price is higher than the strike price of the short Put. In this case, Abhinav will receive the net premium amount.

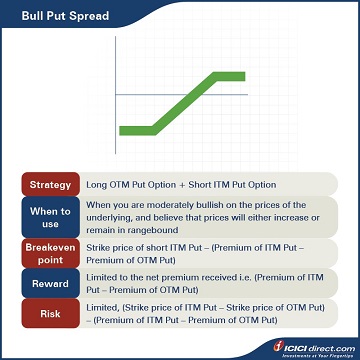

Strategy: Long OTM Put Option (Leg 1) + Short ITM Put Option (Leg 2)

When to use: This should be used when you are moderately bullish on the prices of the underlying and believe that prices will either increase or remain rangebound

Breakeven: Strike price of short ITM Put – (Premium of ITM Put – Premium of OTM Put)

Maximum profit: Limited to the net premium received, i.e. (Premium of ITM Put – Premium of OTM Put)

Maximum risk: Limited (Strike price of ITM Put – Strike price of OTM Put) – (Premium of ITM Put – Premium of OTM Put)

Let’s understand the Bull Put Spread strategy with an example:

Assume that the spot price of ABC Ltd. is Rs. 1,000. Abhinav sells an ABC Ltd. ITM Put of strike price Rs. 1,100 at Rs. 140, and buys an OTM Put Option of strike price Rs. 800 at Rs. 20. He receives a total premium of Rs. 140 – Rs. 20 = Rs. 120, and this will be the maximum profit he can make. He will start losing money if the stock moves beyond the lower strike price, i.e., Rs. 800.

Let’s look at the cash flow in various scenarios here:

|

Closing price of stock on expiry (Rs.) |

Payoff from ITM Put Option (A) (Rs.) |

Payoff from OTM Put Option (B) (Rs.) |

Net payoff (A+B) (Rs.) |

|

600 |

– 360 |

180 |

– 180 |

|

700 |

– 260 |

80 |

– 180 |

|

800 |

– 160 |

– 20 |

– 180 |

|

900 |

– 60 |

– 20 |

– 80 |

|

980 |

20 |

– 20 |

0 |

|

1000 |

40 |

– 20 |

20 |

|

1100 |

140 |

– 20 |

120 |

|

1200 |

140 |

– 20 |

120 |

|

1300 |

140 |

– 20 |

120 |

Examining the payoff will give you a fair idea of how we have arrived at the above values.

If the stock closes at Rs. 800 on expiry: Leg 1 expires OTM while leg 2 expires ITM

Leg 1: The premium paid on the OTM Put Option of strike price Rs. 800 = Rs. 20

Premium received on OTM Put Option of strike price Rs. 800 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (800 – 800)} = Max (0,0) = 0

So, the payoff from the OTM Put Option = Premium received – Premium paid = 0 – 20 = – Rs. 20

Leg 2: The premium received on the ITM Put Option of strike price Rs. 1100 = Rs. 140

The premium paid on ITM Put Option of strike price Rs. 1100 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (1100 – 800)} = Max (0, 300) = Rs. 300

So, the payoff from the ITM Put Option = Premium received – Premium paid =140 – 300 = – Rs. 160

Net payoff = Payoff from ITM Put Option + Payoff from OTM Put Option = (– 160) + (– 20) = – Rs. 180

If the stock closes at Rs. 980 on expiry: Leg 1 expires OTM while Leg 2 expires ITM

Leg 1: The premium paid on the OTM Put Option of strike price Rs. 800 = Rs. 20

The premium received on OTM Put Option of strike price Rs. 800 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (800 – 980)} = Max (0,0) = 0

So, payoff from the OTM Put Option = Premium received – Premium paid = 0 – 20 = – Rs. 20

Leg 2: Premium received on the ITM Put Option of strike price Rs. 1100 = Rs. 140

Premium paid on ITM Put Option of strike price Rs. 1100 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (1100 – 980)} = Max (0, 120) = Rs. 120

So, payoff from the ITM Put Option = Premium received – Premium paid = 140 – 120 = Rs. 20

Net payoff = Payoff from ITM Put Option + Payoff from OTM Put Option = 20 + (– 20) = 0

If the stock closes at 1200 on expiry: Both legs expire OTM

Leg 1: Premium paid on the OTM Put Option of strike price Rs. 800 = Rs. 20

Premium received on OTM Put Option of strike price Rs. 800 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (800 – 1200)} = Max (0,0) = 0

So, payoff from the OTM Put Option = Premium received – Premium paid = 0 – 20 = – Rs. 20

Leg 2: Premium received on the ITM Put Option of strike price Rs. 1100 = Rs. 140

Premium paid on ITM Put Option of strike price Rs. 1100 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (1100 – 1200)} = Max (0, – 100) = 0

So, payoff from the ITM Put Option = Premium received – Premium paid = 140 – 0 = 140

Net payoff = Payoff from ITM Put Option + Payoff from OTM Put Option = 140 + (– 20) = Rs.120

Summary

- A Bull Put Spread strategy involves an investor buying an OTM Put Option(lower strike price) and simultaneously selling an ITM Put Option (higher strike price), with the same expiry, on the same underlying asset and involving the same number of Options.

- This strategy is used when the trader is moderately bullish on the prices of the underlying, and believes that the prices will either increase or remain in a particular range.

- Breakeven: Strike price of short ITM Put – (Premium of ITM Put – Premium of OTM Put)

- Maximum profit: Limited to the net premium received, i.e. (Premium of ITM Put – Premium of OTM Put)

- Maximum risk: Limited, (Strike price of ITM Put – Strike Price of OTM Put) – (Premium of ITM Put – Premium of OTM Put)

Additional Read: Chapter 6: Options Trading – Long Put (Put Buyer)

There are a host of other strategies that traders can deploy, so let’s move on to see how you, as an investor, can benefit from each of these.

COMMENT (0)