Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

Aisha is learning the ropes. She is pleased that she knows much more about Options now than before. But, it is time for her to choose a suitable Options contract. She knows that Options are available at many strike prices. Few Options have strike prices below the current market price and few Options have strike prices above the current market price. What are things she should look into before choosing an Options contract? Let's figure this out for Aisha.

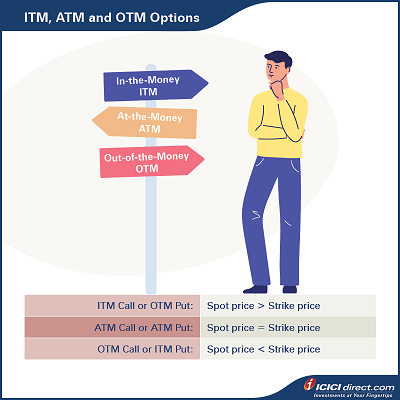

In-the-Money (ITM), At-the-Money (ATM) and Out-of-the-Money (OTM) Options

Options that have positive intrinsic value are called In-the-Money (ITM) Options.

Out-of-the-Money (OTM) and At-the-Money (ATM) Options have zero intrinsic value.

An Option is ITM when it gives positive pay off to the long, whenever it is exercised during the contract period (time to expiry). In case of a Call Option, when the spot price of the underlying security is greater than the contract/strike price, then the Option is called ITM. In case of a Put Option, when the contract price/strike price is greater than the spot price of the underlying, then the Option is called an ITM Option.

- For example, a 3-month Call on Stock A with a strike price of Rs. 540 would be ITM when the spot price becomes greater than Rs. 540. If this would have been a Put Option, then the Option would have become ITM when the spot price would go below Rs. 540.

An Option is ATM when it gives zero pay off to the long, whenever it is exercised during the contract period (time to expiry). In case of both Call and Put Options, when the spot price of the underlying is equal to contract/strike price, then the Option is said to be ATM.

- For example, a 3-month Call or Put Option on Stock A with a strike price of Rs. 540 would be ATM when the spot price is equal to Rs. 540.

An Option is OTM when the spot price of the underlying is better than the strike/contract price for the long. In other words, it would have given a loss to the long position if such an Option would have been exercised immediately. In case of a Call Option, when the spot price of the underlying is less than the contract/strike price, then the Option is called OTM. In case of a Put Option, when the contract price/strike price is less than the spot price of the underlying, then the Option is called OTM.

- For example, a 3-month Call on Stock A with a strike price of Rs. 650 would be OTM when the spot price becomes lesser than Rs. 650. If this would have been a Put Option, then the Option would be OTM when the spot price goes above Rs. 650.

|

Did you know? The OTM Option is usually cheaper than an ITM Option. As a result, it is more popular among traders with limited capital. |

How to choose the right Option?

Some of the important things to consider while taking an Options position is your investment objective, the risk and reward ratio of the contract, market volatility and market view, among other things. Let’s flesh these out for Aisha.

- Investment objective: An investor should first be clear about their investment objective. Are they bullish or bearish? For instance, if Aisha is bullish about Nifty price in the future, she could enter into a long Call position. If Aisha is bearish, she could take a long Put position on Nifty. The important thing is to select the Option strategy that matches their market view.

- Ratio of risk/reward: The risk and reward ratio of the Option strategy should match the risk tolerance of the trader. Writing an Option is riskier than holding an Option. The trader should consider the risk to reward ratio before taking a position.

- Deep In-the-Money (ITM) Option, which has an exercise or strike price quite lower (for a Call Option) or quite higher (for a Put Option) than the market price of the underlying asset. It will have low ROI as the premium paid is higher.

- Similarly, the Out-of-the-Money (OTM) Option, in which a Call Option’s underlying asset trades below the strike price of the Call and a Put Option’s underlying trades above the Put's strike price can provide much higher ROI if the market moves significantly.

- For example, if Aisha is aggressively bullish that the spot prices of Nifty will see a drastic upside in the next one month, then she can buy a deep OTM Call Option. The deep OTM Call is at a higher strike price but will be available at a lower premium.

- On the contrary, if Aisha is aggressively bearish that spot price of Nifty will see a drastic downside in the next one month, then she can buy a deep OTM Put Option. The deep OTM Put is at a lower strike but will be available at a lower premium.

- If Aisha expects a flat or range-bound market with a mild bearish or bullish outlook, she can choose to sell At-the-Money (ATM) Call or Put Option respectively.

- The Option which has lower bid-ask spread is considered to have higher liquidity. Open interest indicates the number of unsettled positions at a particular price, therefore higher open interest would signify higher liquidity.

- A higher amount of traded volume over the life of the contract would also signify higher liquidity.

- Implied volatility: Implied volatility is the expected movement in the price of the underlying. Lower implied volatility will lead to lower premiums and vice-versa. If the implied volatility is low and the trader expects the spot price of the underlying to move reasonably to make the Option ITM, then they can take a long position in the Option.

- Market view: The decision to choose which Option to trade, from the number of Options available in the market, will effectively depend on how bullish or bearish the trader is and the time within which he expects his view to materialize.

- Liquidity: Liquidity is a very important criterion for trading in Options as it determines the speed and the price at which the trade gets executed. The liquidity of the Option can be determined from the bid-ask spread, the number of open interest contracts, and traded volume. The bid-ask spread is the difference between the asking price and the bid price for any asset (Options in this case). The ask price is usually higher than the bid price.

Is it better to trade a low-priced Nifty Option over a high-priced Nifty Option?

No, trading in a low-priced Nifty Option in comparison to a high-priced Nifty one may not be the right strategy until the trader is sure of the trend in spot price. That is because the low-priced Nifty Options would be OTM Options that are much cheaper than ATM and ITM Options but they also have less probability of getting exercised or being profitable for a buyer. So, the risk to reward ratio can be very high in case of low-priced Nifty Options.

Summary

- Options that have positive intrinsic value are called In-the-Money (ITM) Options.

- In case of a Call Option, when the spot price of the underlying is greater than the contract/strike price, then the Option is called ITM.

- In case of a Put Option, when the contract price/strike price is greater than the spot price of the underlying, then the Option is called an ITM Option.

- Out-of- the-Money (OTM) and At-the-money (ATM) Options have zero intrinsic value.

- In case of a Call Option, when the spot price of the underlying is less than the contract/strike price, then the Option is called OTM.

- In case of a Put Option, when the contract price/strike price is less than the spot price of the underlying, then the Option is called OTM.

- To choose the right Option, you must consider:

- Investment objective

- Risk/reward ratio

- Implied volatility

- Market view

- Liquidity of the Option

- Trading in low-priced Nifty Options when compared to high-priced ones may not be the right strategy until a trader is sure of the trend in spot price.

COMMENT (0)