Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 7 – Futures Trading – Part 2

A step-by-step approach to Futures and Options is a must. After touching upon the basics of the Futures contracts, you need to get to brass tacks.

Execution of Futures contract trade

Assuming that you are bullish about Nifty and want to take advantage of this scenario, you take a long position (buy) on Nifty Futures and decide to purchase 1 lot of contracts.

Suppose Nifty Futures is trading at Rs. 25,000 and initial margin is 18% and minimum margin is 16%. Do you recall the margin requirements from the earlier chapters?

Note: These margins can be changed from time to time and vary with index or stock. Also, we are not assuming any transaction costs like brokerage, taxes, etc. in this example.

Nifty Futures price: Rs. 25,000

Lot size: 75

Lot value: 75* 25,000 = Rs. 18,75,000

Initial margin: 18%* 18,75,000 = Rs. 3,37,500

This means that both buyer and seller need to deposit an initial margin of Rs. 3,37,500 with their brokers. Let‘s see how margin settlement takes place daily from a buyer’s perspective. Every broker maintains a ledger for clients and makes all margin deposit and mark-to-market (MTM) profit/loss entries in it. Ledger balance will be equal to margin paid +/- MTM profit/loss.

Mark-to-market measures the fair value of contracts according to the current market price.

|

Did you know? The payoff in a Futures contract is a zero-sum game. The loss of one party is equal to the gain of another party. |

Day 0 (Trade day)

Suppose Nifty settles down at 25,100 on the same day.

MTM profit = Rs. (25,100 – 25,000) * 75 = Rs. 100*75 = Rs. 7,500

Total ledger balance = Rs. 3,37,500 + Rs. 7,500 = Rs. 345,000

Margin requirement = 18%*25,100*75 = Rs. 3,38,850

Increment in margin requirement = Rs. 3,38,850 – Rs. 3,37,500 = Rs. 1,350

As your incremental margin requirement is much lesser than MTM profit, you need not worry and no further payment is required.

If you want to exit from this position now, you can exit and can book a profit of Rs. (25,100 - 25,000)*75 = Rs. 7,500. You can also confirm this by the difference in the ledger balance.

- Initially, you paid Rs. 3,37,500 and now your balance is Rs. 3,45,000

- Therefore, profit is Rs. 3,45,000 – Rs. 3,37,500 = Rs. 7,500

Day 1

Your day starts with a ledger balance of Rs. 3,45,000. Suppose Nifty closes at 24,900 i.e. 200 points below the previous day’s close. The MTM profit or loss here will be considered from the previous day’s closing price, not from your purchase price.

MTM loss = Rs. (25,100 – 24,900)*75 = Rs. 200*75 = Rs. 15,000

Total ledger balance = Rs. 3,45,000 – Rs. 15,000 = Rs. 3,30,000

New margin requirement = 18%*24,900*75 = Rs. 3,36,150

As your balance is lower than the margin requirement, maintenance margin needs to be checked to hold the position.

Maintenance margin = 16%*24,900*75 = Rs. 2,98,800

It means your position can be held without paying any additional margin. However, to safeguard yourself, it is better to pay the balance margin i.e. Rs. 3,36,150 – Rs. 3,30,000 = Rs. 6,150

- The maintenance margin will play a role in case of a loss or if the margin falls because of the exchange in between. In any case, if you are unable to meet the maintenance margin in your account, the broker will square off your position.

If you think that the market may go down further and you want to exit from this position, you can exit by selling your open position. Your loss from this position would be (Rs. 24,900 – Rs. 25,000)*75 = – Rs. 7,500.

You can also confirm this by the difference in the ledger balance.

- Initially, you paid Rs. 3,37,500 and now your balance is 3,30,000

- Therefore, loss is Rs. 3,37,500 – Rs. 3,30,000 = Rs. 7,500

Day 2

Your day will start with a ledger balance of Rs. 3,30,000. Suppose Nifty reaches a level of 25,060 during the day and you square off your position. In this case:

MTM profit = (Rs. 25,060 – Rs. 24,900)*75 = Rs. 12,000

Total ledger balance = Rs. 3,30,000 + Rs. 12,000 = Rs. 3,42,000

Total profit = (Rs. 25,060 – Rs. 25,000)*75 = Rs. 4,500

You can also verify this by checking the difference in the ledger balance.

- Initially, you paid Rs. 3,37,500 and now your balance is 3,42,000

- Therefore, profit will be Rs. 3,42,000 – Rs. 3,37,500 = Rs. 4,500

You can also calculate your total profit by adding your total MTM profit/loss.

- Total profit = Rs. 7,500 – Rs. 15,000 + Rs. 12,000 = Rs. 4,500

If you want, you can carry your position until the expiry of the contract. Your open position will be settled at the closing price on expiry.

Summary

|

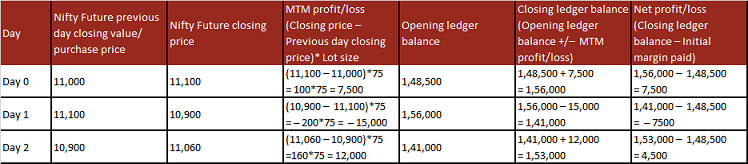

Day |

Nifty Future previous day closing value/ purchase price |

Nifty Future closing price |

MTM profit/loss (Closing price – Previous day closing price)* Lot size |

Opening ledger balance |

Closing ledger balance (Opening ledger balance +/– MTM profit/loss) |

Net profit/loss (Closing ledger balance – Initial margin paid) |

|

Day 0 |

25,000 |

25,100 |

(25,100 – 25,000)*75 =100*75 =7,500 |

3,37,500 |

3,37,500 + 7,500 = 3,45,000 |

3,45,000 – 3,37,500 = 7,500 |

|

Day 1 |

25,100 |

24,900 |

(24,900 – 25,100)*75 = – 200*75 = – 15,000 |

3,45,000 |

3,45,000 –15,000 = 3,30,000 |

3,30,000 – 3,37,500 = – 7500 |

|

Day 2 |

24,900 |

25,060 |

(25,060 – 24,900)*75 =160*75 = 12,000 |

330,000 |

3,30,000 + 12,000 = 3,42,000 |

3,42,000 – 3,37,500 = 4,500 |

Payoff of Futures contract

Payoff of Futures contract

Long position (buyer)

Following is the payoff for a long position in Nifty Futures. Assume that the purchase price is Rs. 25,000.

|

Future closing price |

Profit/Loss of buyer |

|

24800 |

–200 |

|

24900 |

–100 |

|

25000 |

0 |

|

25100 |

100 |

|

25200 |

200 |

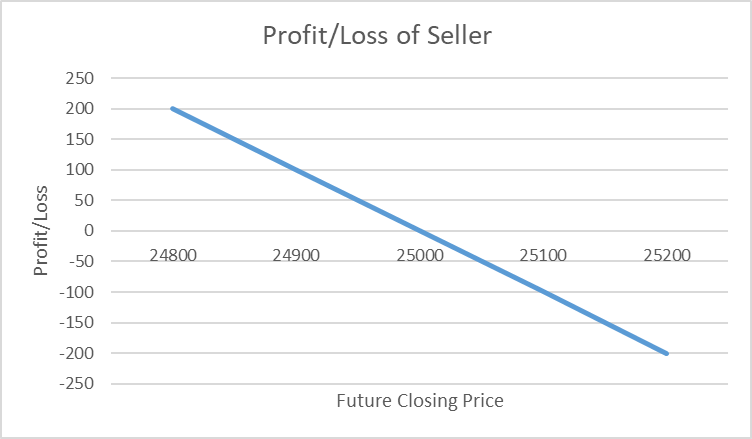

Short position (seller)

Following is the payoff for a short position in Nifty Futures. Assume that the purchase price is Rs. 25,000.

|

Future closing price |

Profit/Loss of seller |

|

24800 |

200 |

|

24900 |

100 |

|

25000 |

0 |

|

25100 |

–100 |

|

25200 |

–200 |

Settlement of Futures contracts

Futures contracts can be settled on a daily MTM basis and on final settlement basis (expiry). Before expiry, the settlement is done on a cash basis where the difference in the closing price is considered for calculating gains or losses on any position.

- In case of MTM settlement, the difference between previous day’s price and settlement day price is determined and the same is credited to or debited from the account.

- In the case of final settlement before expiry, gains and losses are calculated in a similar manner, where the difference between the previous day’s settlement price and final settlement price are considered for gains or losses.

Note: From October 2019, all stocks in the derivatives segment are to be physically settled, if you fail to square-off your position before the expiry date. If you don’t square off your derivatives positions in stocks before the close of trading hours on expiry day, you will either have to take delivery (for long Futures, long Calls, short Puts) or give delivery of the underlying stock (for short Futures, long Puts, short Calls) for the contract.

Summary

- Margin requirements are an integral part of executing Futures contracts.

- Every broker maintains a ledger for clients and makes all margin deposit and MTM profit/loss entries in it. Ledger balance will be equal to margin paid +/– MTM profit/loss.

- Futures contracts can be settled on a daily MTM basis and on final settlement basis.

By now, you should have a fair understanding of Futures Trading. In the next chapter, we will explore few advanced concepts like Open Interest, Rollover, etc.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Centre, H. T. Parekh Marg, Churchgate, Mumbai - 400020, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. The contents herein mentioned are solely for informational and educational purpose.

COMMENT (0)