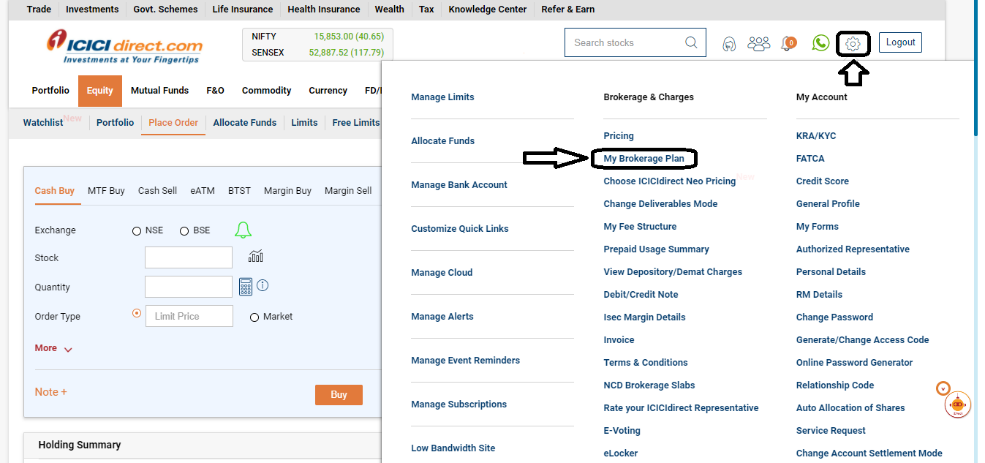

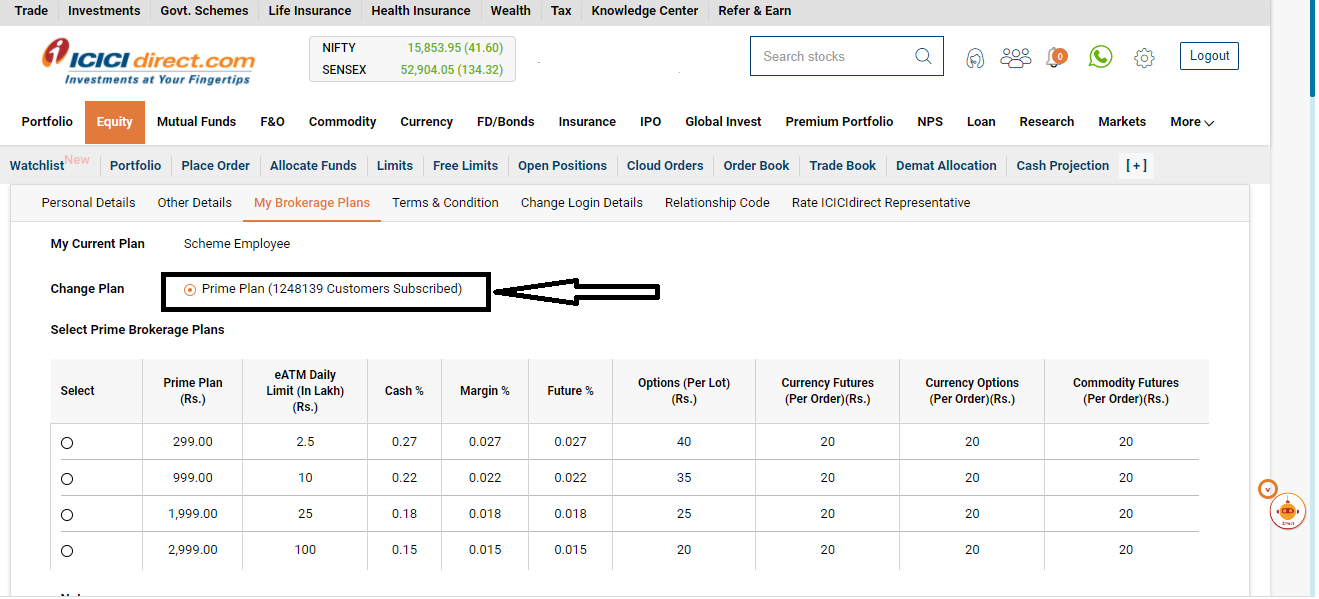

ICICI DIRECT PRIME BROKERAGE PLAN

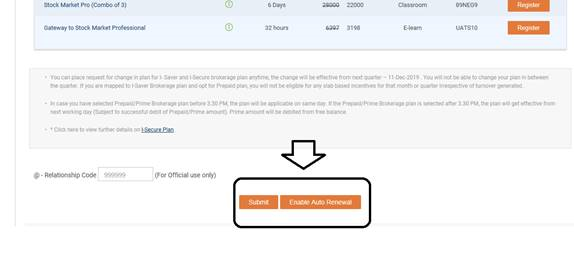

Experience the revolutionary ICICI Direct Prime plans with a significantly enhanced and powerful proposition. You can get lower brokerage of upto 0.07% along with payout within 5 minutes on selling of shares and also interest rates as low as 9.69% when you buy stocks today and pay for them later.

Top Mutual Funds

Top Mutual Funds