Learning Modules Hide

Hide

- Chapter 1: Introduction to Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10: Debt Fund Types - What Are the Different Debt Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 11 : Exchange Traded Funds: Part 1

Ritika’s mother is always telling her to choose a smart lunch. So, one day, Ritika decides to order a salad. It has a nice variety of fruits, vegetables, protein and a healthy amount of fat - all at the price of just one dish.

Similarly, when you invest in an Exchange Traded Fund, you get to own a variety of shares from different companies for one price in one transaction.

What are Exchange Traded Funds (ETFs)?

Exchange Traded Funds are a type of investment instrument that invest in a basket of securities depending on some underlying asset, like stocks, debt instruments, gold or an equity index like NIFTY or Sensex.

That sounds like a mutual fund, you say? Here’s the twist: ETFs are traded on exchanges just like stocks. Therefore, ETFs are instruments that combine the benefits of mutual funds with equity stocks. They’re the salad equivalent of investment securities: you get diversification benefits as well as trading benefits!

An investor investing in ETFs buys a unit of the fund, just like in mutual funds. The price of each unit is divided into parts as per the price of an asset. For instance, let’s assume an investor buys a gold ETF. If the market price of gold is Rs. 80,000 per 10 grams, then the price of a gold ETF will be close to Rs. 8,000, which corresponds to the price of 1 gram of gold. In some cases, the price may be approximately Rs. 80, equivalent to the cost of 0.01 grams of gold.

What are the Key Pointers About ETFs?

- Exchange Traded Funds try to follow or replicate the performance of the underlying commodity or the underlying index.

- ETF returns are slightly lower than the market returns of the underlying assets, due to fund management charges and tracking errors. Tracking error is the difference between an ETF’s returns and the index it follows.

- However, expense ratios for ETFs are much lower since they are passively managed funds. They are cost efficient. This means that fund managers do not actively choose securities to invest in. Instead, they follow an index or an underlying asset to achieve the desired results.

- ETF units are held in dematerialized or demat form. This means that you hold the units in electronic form, which makes it easier to trade them.

- You will need a trading and a demat account to invest in ETFs.

- ETFs are perfect for those looking for diversified investment options.

Now, let’s look at one specific kind of ETF to understand these instruments better.

Did you know?

In India, equity, bonds and gold ETFs are popular options. In other parts of the world, real estate, commodities, currencies, and multi-asset funds ETFs are also options.

What is a Gold ETF?

A gold ETF tracks the price of physical gold in the Indian market. These funds invest according to the price of high-quality physical gold. When you invest or trade gold ETFs, you will not get physical gold. Instead, you will receive a cash equivalent depending upon the market price of units you have invested in.

Just like any other ETF, gold ETFs can be bought or sold on stock exchanges through a broker. A brokerage fee and fund management charges are applicable when trading gold ETFs.

Advantages of Gold ETFs

- Gold ETFs are a convenient and easy way of investing in gold without having to physically purchase gold. The hassle of trying to find a locker and paying locker charges for holding gold are eliminated.

- You do not have to worry about the purity of gold as ETFs invest only in gold of the highest quality and purity. However, you also do not get direct physical access to gold, so the purity is not of much concern as long as you get your returns.

- Since they are listed on exchanges, prices are real-time and transparent.

- It is also easy to redeem gold ETF units and use the money to purchase physical gold if required for specific purposes like marriage etc.

- You can also use gold ETF units as collateral to avail a loan against them.

Risks involved in Gold ETFs

- Gold ETFs are subject to market risks that can impact the price of gold in the market.

- SEBI guidelines regulate gold ETFs, and hence regular audit by a statutory auditor of physical gold bought by the fund houses is mandatory.

Other ways to invest in Gold

Apart from gold ETFs, there are also other ways to invest in gold:

1. Physical gold:

You can purchase gold coins or bars.

2. Gold fund:

These are mutual funds that invest primarily in gold.

3. Sovereign Gold Bond (SGB):

The Government of India offers sovereign gold bonds, backed by gold, from time to time. However, they come with a fixed lock-in period. However, since February 24, no new tranches have been launched.

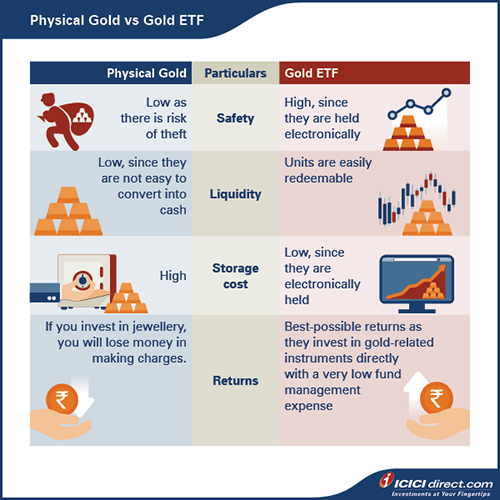

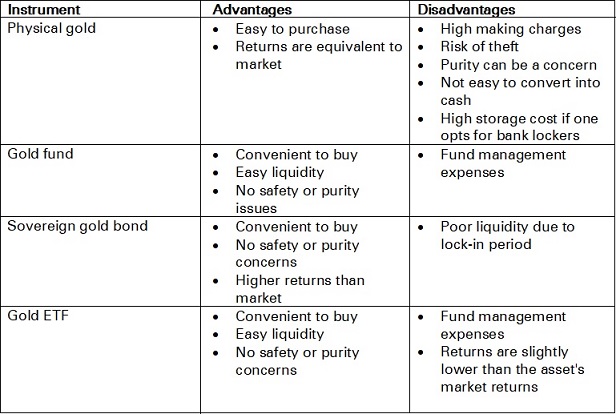

Here is how each of these instruments stack up against gold ETFs:

Gold ETFs are an excellent option for investors who are looking for liquidity, do not want to worry about ensuring the purity of the product and want an easy way to invest in gold. Gold mutual funds are also a good alternative.

Tax Implications on ETFs

When you redeem ETF units, you will have to pay tax. If Gold ETFs are held for more than 1 year, a long-term capital gains tax of 12.5% plus cess is applicable. If you sell it before 1 year, then a short-term capital gains (STCG) tax is imposed. This is applicable according to your income-tax slab rate. The tax rates are as per FY 24-25.

Summary

- Exchange Traded Funds are instruments that invest in a basket of securities that follow the performance of an underlying asset. They can be traded on stock exchanges. Consider them having the dual advantages of both mutual funds and stocks.

- ETFs:

- Are passively managed

- Are held in demat form

- Give slightly lower returns than the assets they invest in

- A gold ETF tracks the price of physical gold in the Indian market. When you buy gold ETFs, you do not get physical gold. Instead, you invest in the price-equivalent of gold.

- Just like any other ETF, gold ETFs can be bought or sold on BSE or NSE through a broker.

- Gold ETFs are an excellent option for investors who are looking for liquidity and convenience.

Gold ETFs are just one kind of ETF available in the market. The next chapter will cover two other ETFs: Equity ETFs and Debt ETFs.

COMMENT (1)

Very informative.

Reply