Learning Modules Hide

Hide

- Chapter 1: Introduction to Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10: Debt Fund Types - What Are the Different Debt Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 1: Decoding the Mutual Fund Factsheet

Your relationship with numbers is complicated. You either love numbers or hate them based on your interest. The relationship you have with money or wealth is uncomplicated. You love your wealth and want it to grow consistently. Financial statements and factsheets give you a sense of that direction. They tell you about the performance of your investment and helps you to compare those numbers against a suitable benchmark.

The factsheet is an essential resource for mutual fund investors. What does the factsheet contain? Let’s take a look:

Investment objective: Find out how the scheme plans to generate returns and where it will invest. Use this information to choose a mutual fund scheme that matches your financial goals and your risk appetite.

Did you know?

The Securities and Exchange Board of India mandates that all mutual fund houses put out an updated factsheet every month. Mutual funds are also required to send annual report or abridged annual report to unitholders. You can find the factsheet on the AMC’s website.

Fund details: Under this section, you can examine several important scheme-related details. These include:

- Type of fund: Check whether the scheme is an open-ended, close-ended, or interval scheme.

- Total AUM: View the total corpus of the scheme managed by the fund . A high AUM indicates the popularity of the scheme and the confidence of investors in the scheme. However, it is neither an indication nor a guarantee of performance.

- Fund manager details: Go through the fund manager's qualifications and experience, including how long he/she has been managing the fund. The longer the management period, the better! If the fund manager of a mutual fund changes frequently, it may not bode well for the fund's performance. A frequently changing fund strategy may lead to a lot of underperformance in the scheme’s returns..

- Benchmark: A benchmark is a parameter for comparing the performance of the fund. For instance, indices like Nifty, BSE 200, and BSE 500 are often used as benchmarks to assess a fund's performance. Check if the fund beats the benchmark consistently. That is usually a sign of a fund worth investing.

- Miscellaneous information: This section offers details relating to exit load, SIP, minimum investment, plan types, and so on. You should find a range of information to support your investment decision.

Portfolio details: Get a detailed bifurcation of the fund’s portfolio based on the securities and the industries that the fund invests. You can check the weightage and concentration of the portfolio in various sectors and securities. This section gives you an idea about the fund’s composition in different industries and assets.

Quantitative data: Explore information about the critical indicators for assessing the mutual fund's performance. Some vital indicators for equity mutual funds are mentioned below:

- Standard deviation: This signifies the absolute risk of a mutual fund, including systematic and unsystematic risk. As an investor, you should look for a scheme with a lower standard deviation.

- Beta: This measures the fund's volatility to the index, which is also known as market risk. A high beta value signifies a higher risk. A higher beta scheme typically carries more risk, and investors could face losses if the market falls. However, funds with a higher beta could also prove beneficial in a rising market as they tend to show higher growth compared to the index.

- Sharpe ratio: This represents the excess return over the risk-free return offered by the fund per unit of total risk. The higher the Sharpe ratio, the better the fund.

- Portfolio turnover ratio: This shows how frequently the portfolio is churned. To calculate, simply divide the minimum of securities purchased or sold by the total AUM in a year. Here’s the formula:

Portfolio Turnover Ratio = Minimum of Securities Purchased or Sold/Total AUM

Suppose the portfolio turnover ratio is 50%. That means one-half of the securities has been churned in the last one year. Keep in mind that a higher turnover pushes up the fund's expense ratio. That's why a lower rate is usually preferable.

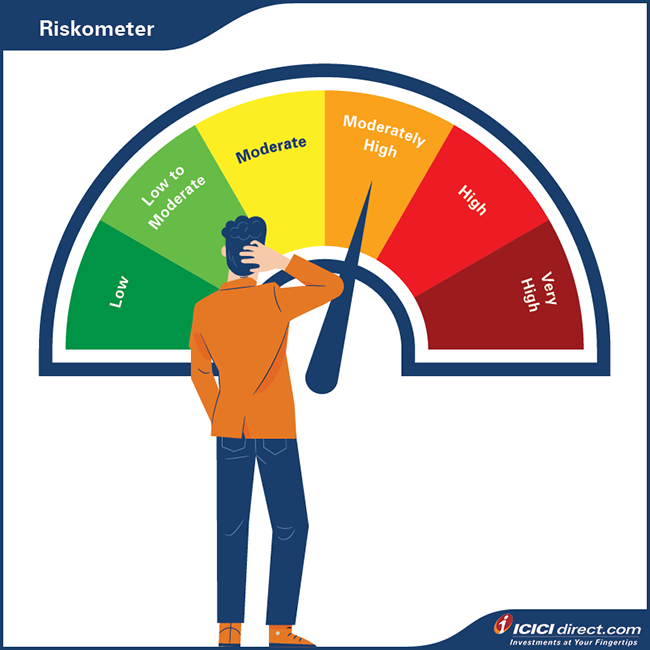

Riskometer: SEBI has categorised mutual funds into six categories based on the risk involved. These are:

- Low risk

- Moderately low risk

- Moderate risk

- Moderately high risk

- High risk

- Very high risk

Keep the risk classifications in mind when choosing a mutual fund based on your financial goals.

If you have shortlisted any schemes, view their factsheets before you invest. You can download factsheets from AMC and mutual fund distributor websites. You could also find them on the website of the Association of Mutual Funds in India.

Summary

- A mutual fund factsheet is a resource for investors that provides a comprehensive overview of a scheme. It is updated every month.

- A factsheet will provide information about:

- The investment objective of the fund.

- Details about the fund like its total assets under management, type of fund, fund manager details, benchmark details, expenses, etc.

- The portfolio, like the different securities and industries it invests in.

- Quantitative data to understand the fund’s performance.

- The fund’s risk level.

In chapters 2-4, we will take a look at how to evaluate equity mutual funds and explore some key metrics for that will help you choose the right funds.

COMMENT (0)