Learning Modules Hide

Hide

- Chapter 1: Introduction to Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10: Debt Fund Types - What Are the Different Debt Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 7: Mutual Fund Investment Choices – SWP and TIP

Pankaj, who was employed with an MNC, retired in 2021. Now that he doesn’t have any income from salary, he wants to make use of his investments to see him through. Pankaj was smart enough to make mutual fund investments. Now, he wants to make sure he gets regular income to help him with his monthly expenditure.

That’s where a systematic withdrawal plan (SWP) can come in handy!

Systematic Withdrawal Plan (SWP)

A systematic withdrawal plan (SWP) is an option to withdraw money periodically from accumulated units in a mutual fund.

- Usually, investors use the SWP option to receive a fixed income after retirement.

- Suppose you have accumulated a corpus in an equity fund throughout your life and switch all of it to a liquid fund two years before retirement. At the time of retirement, you can use the SWP option to receive a fixed amount every month by redeeming units from the accumulated corpus.

The whole process is hassle-free. All you need to do is issue a one-time standing instruction where you choose the withdrawal frequency (monthly/quarterly, etc.) and the amount. This will automatically be credited to your bank account.

- You can provide instructions for withdrawing a fixed amount or redeeming a fixed number of units. It is the reverse of Systematic Investment Plans or SIPs and the cash flow is from mutual funds to the bank account.

Let us understand SWP with an example. Let’s say Pankaj has Rs. 10,00,000 accumulated in liquid funds and wants to withdraw Rs. 25,000 every month till the corpus is exhausted. He withdraws the amount from January 2017 to September 2020.

At the end of September 2020, Mr. Pankaj will have a balance of Rs. 15,498.87 in the liquid fund.

Benefits of SWP

Choosing SWP has many benefits for an investor:

1. Fixed income:

SWP is a very reliable option for investors who are looking for fixed income over a period of time. This is especially suitable for retired individuals.

2. Rupee cost averaging in the growing market:

Just like other mutual fund investments, SWP also gives you the advantage of rupee cost averaging. The longer the systematic withdrawal plan, the more you benefit.

3. Tax advantage:

- With a systematic withdrawal plan, the amount that you withdraw would be smaller and can continue in the long term. So, most withdrawals qualify for LTCG.

Capital gain in SWP

Similar to other options, in SWP too, units redeemed for capital withdrawal are considered as sale and liable for capital gain as per existing rules.

Target Investment Plan (TIP)

There is another interesting investment choice when it comes to mutual funds. Let’s suppose you have a particular goal you want to save towards. You know the amount and you know the time duration. Based on this, you can decide how much to invest in mutual funds through SIPs.

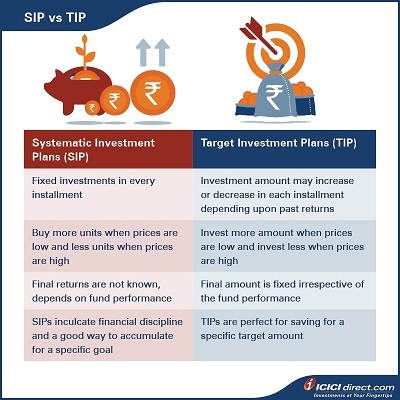

This is called a Target Investment Plan (TIP). TIPs are a modified version of SIPs. In an SIP, you invest a fixed amount every month, but in TIP, the investment amount varies depending upon your target goal.

- TIP is a better way to accumulate an amount for a financial goal.

- You need to define the target amount, time, investment frequency and expected returns of a fund. Based on that, you can determine the periodic investment amount.

- If the actual return of a fund is more than the target return, the excess amount will be reduced in the upcoming investment. Similarly, if there is a shortfall, the amount will be increased in the next instalment.

Usually, concepts make more sense with examples. Here’s one to give you an idea of how TIPs actually function.

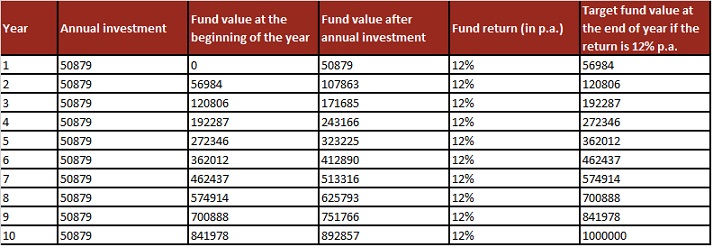

Remember Aman? Now, let’s assume he wants to accumulate Rs. 10,00,000 in 10 years' time. He wants to make annual investments for this and expects a return of 12% p.a. Look at how TIPs would function over the 10-year period:

Assuming the rate of return remains stable over 12 years, Aman will have to invest Rs. 50,879 every year to reach his goal. But, a stable return on mutual funds is unrealistic. Due to market fluctuations, the return over the years is bound to change. So, let’s assume another scenario where the rate of return fluctuates.

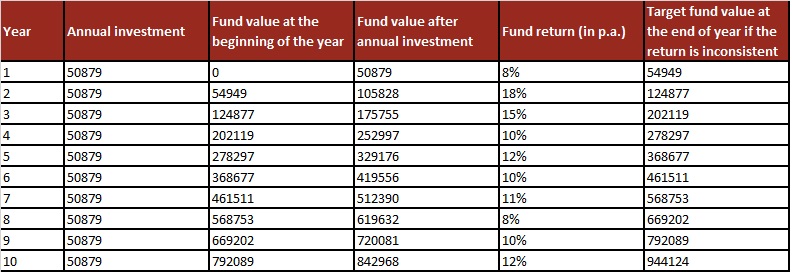

In the first year, Aman started with an annual amount of 50,879. With an 8% return, the corpus becomes 54,949 at the end of the year. The targeted fund value at the end of the year is 56,894. (We can refer to the above table). So there is a shortfall of 56984-54949 = 2035 at the end of the first year. This shortfall amount will be added to the next year's annual investment and next year's investment will be 50879 + 2035 = 52914. This calculation will continue throughout the investment period.

As you can see, the amount of investment varies every year depending upon the shortfall/ gain to meet the goal. Had Aman not used the TIP option, his return would have been Rs. 9, 44,124 with a regular SIP option of Rs. 50,879 per year.

In TIP, every instalment amount depends on the shortfall or excess corpus in comparison to the target fund value. If there is a shortfall, the instalment amount will increase in that proportion and if there is a surplus, it can be reduced by the same amount. The main benefit of TIP is that it helps you secure a corpus for your financial goal irrespective of market fluctuations.

You can find the periodic investment amount and suggested TIP portfolio on ICICIdirect. You don’t have to do any calculations yourself. The system will calculate the amount and it will be auto-debited from your account. You only need to give the instruction once. The whole process is hassle-free.

Summary

- A systematic withdrawal plan (SWP) is an option to withdraw money periodically from accumulated units in a mutual fund.

- SWPs are ideal for retired individuals to make a fixed income post retirement.

- Target Investment Plan is a mutual fund investment option to save towards a particular financial goal. It works like an SIP but the amount of investment varies depending upon the performance of the fund.

In the next chapter, we will discuss how to create and manage the mutual fund portfolio. We will also learn about choosing the right mutual fund schemes.

COMMENT (0)