Download ICICI Direct app

Invest, Track, and Manage your Portfolio Anytime, Anywhere.

Built by experts, backed by insights

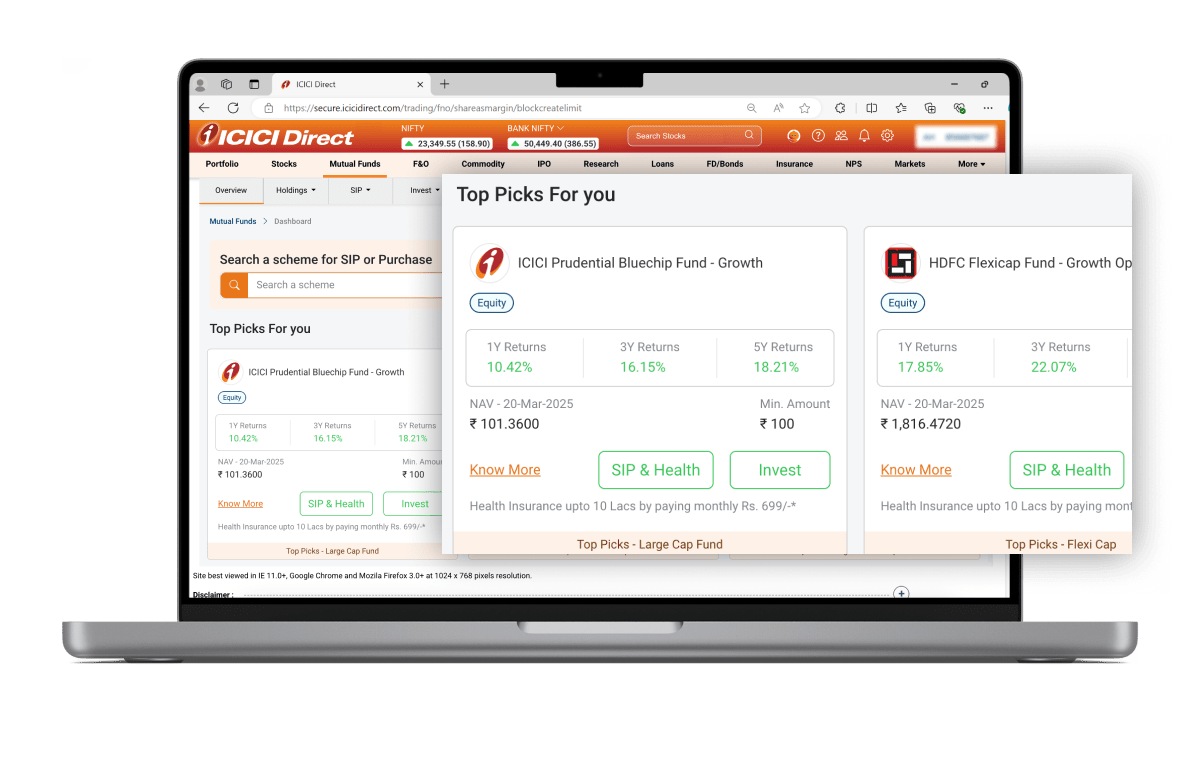

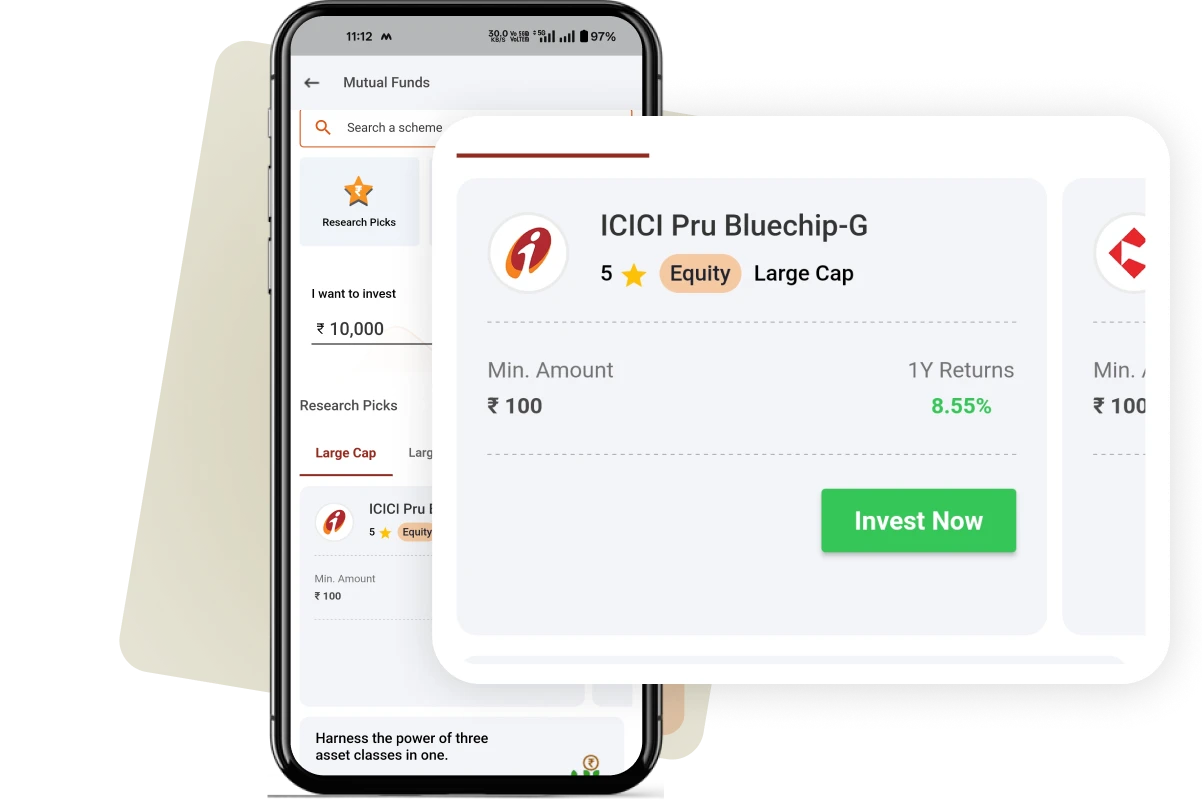

Explore 3,000+ mutual funds tailored to your goals

A mutual fund is a type of investment where a group of investors collectively pool their money to create a large, diversified portfolio managed by fund managers. Instead of buying individual stocks or bonds, investors purchase units of the mutual fund, using the combined capital to invest in a wide range of assets.

This collective approach not only simplifies the mutual fund investment process but also offers the benefits of professional management and diversification, making it an attractive option for both new and seasoned investors.

We have all the schemes that you are looking for!

Schemes highly rated by Value Research to help you make investing decisions and navigate the Mutual Funds landscape

Explore our readymade, theme-based Mutual Fund portfolios consisting of top Mutual Funds

Get in-depth insights into your Mutual Funds portfolio; explore sector allocation, holdings overlap, risk ratios, and performance analysis

Compare Mutual Fund Schemes

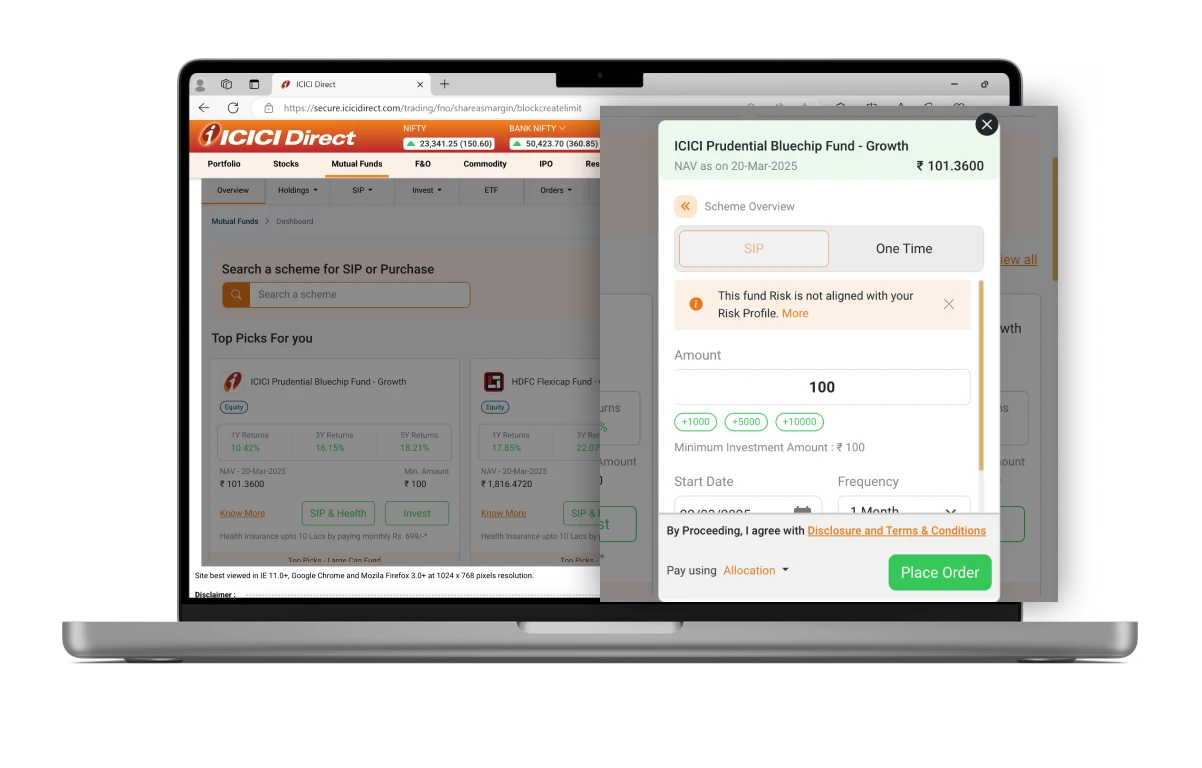

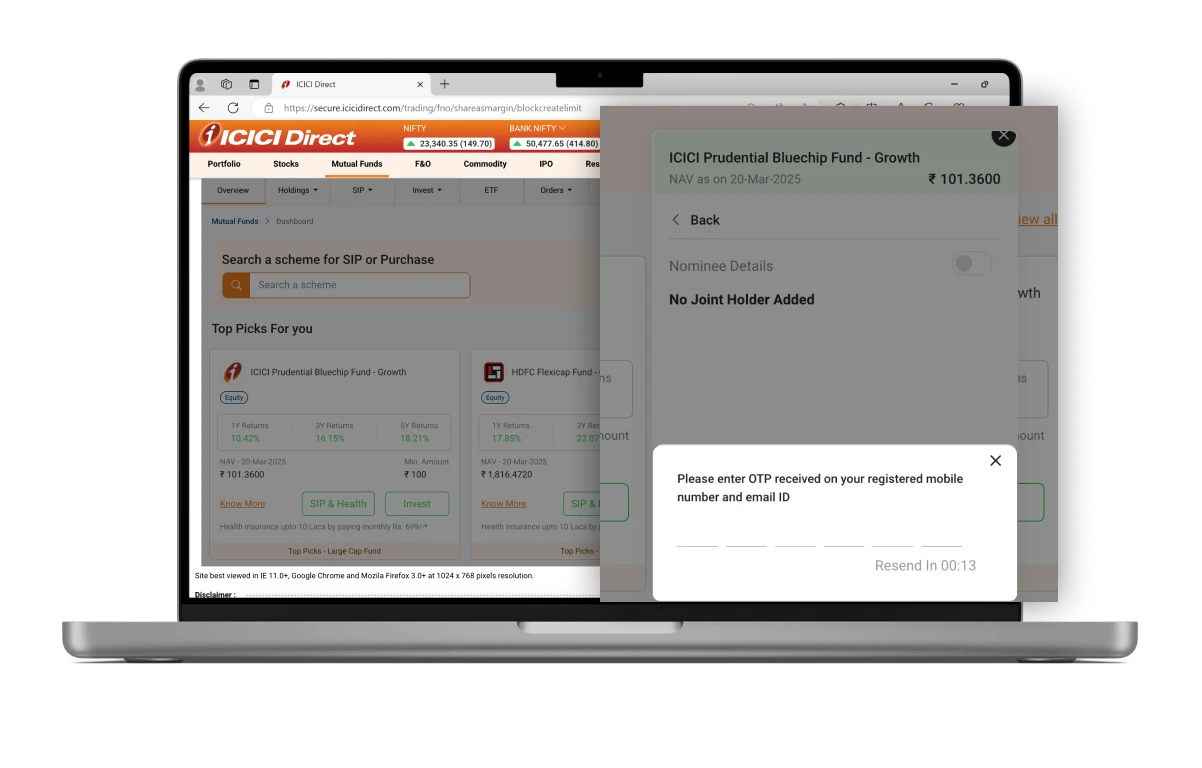

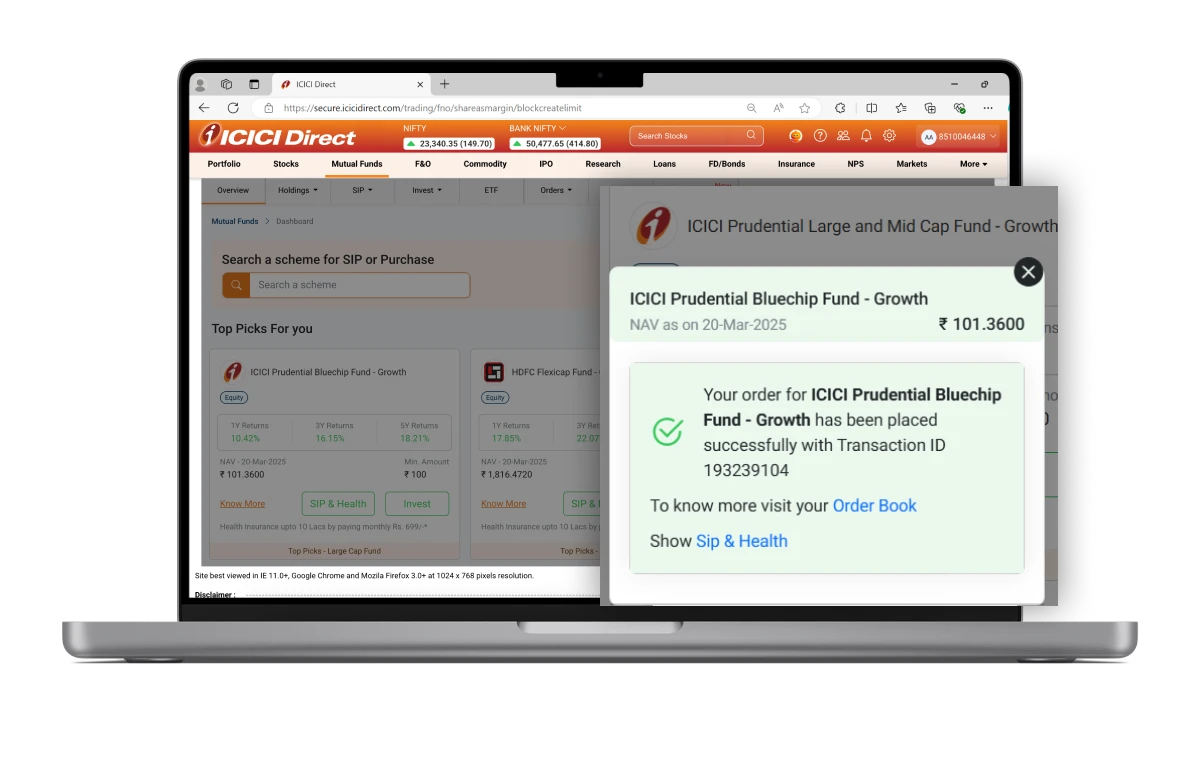

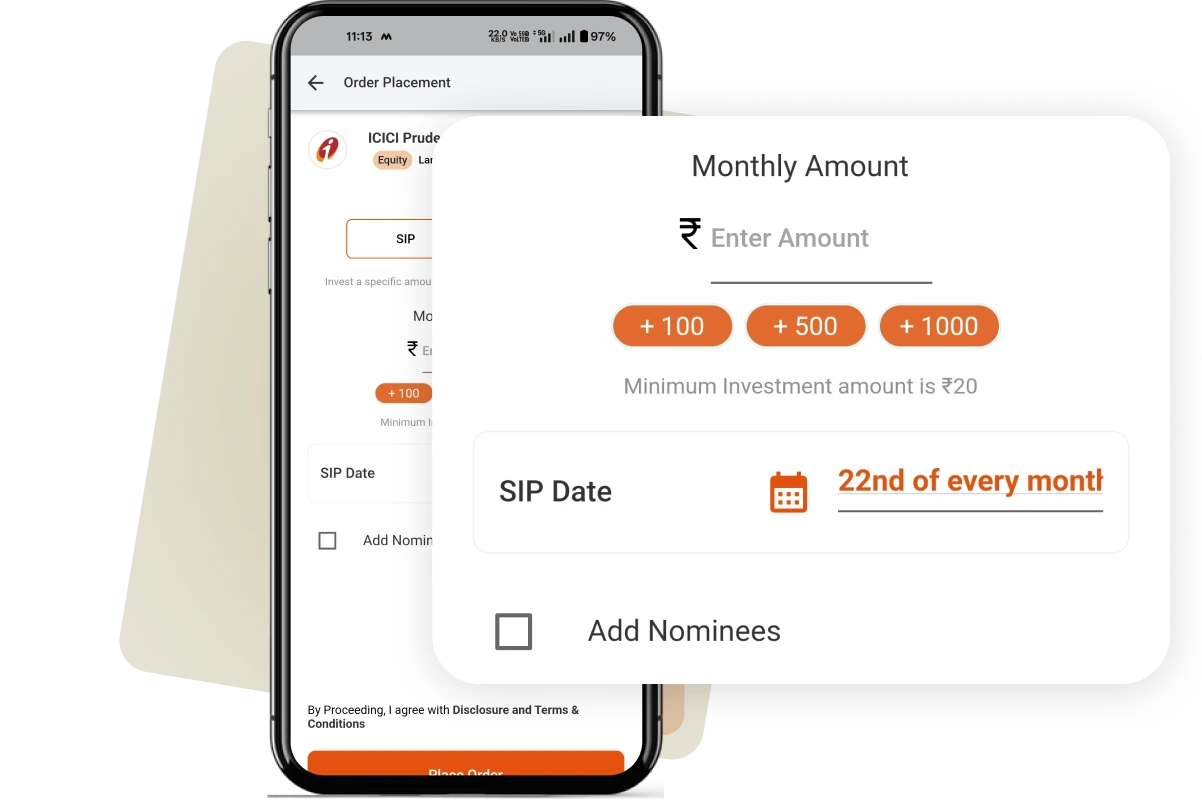

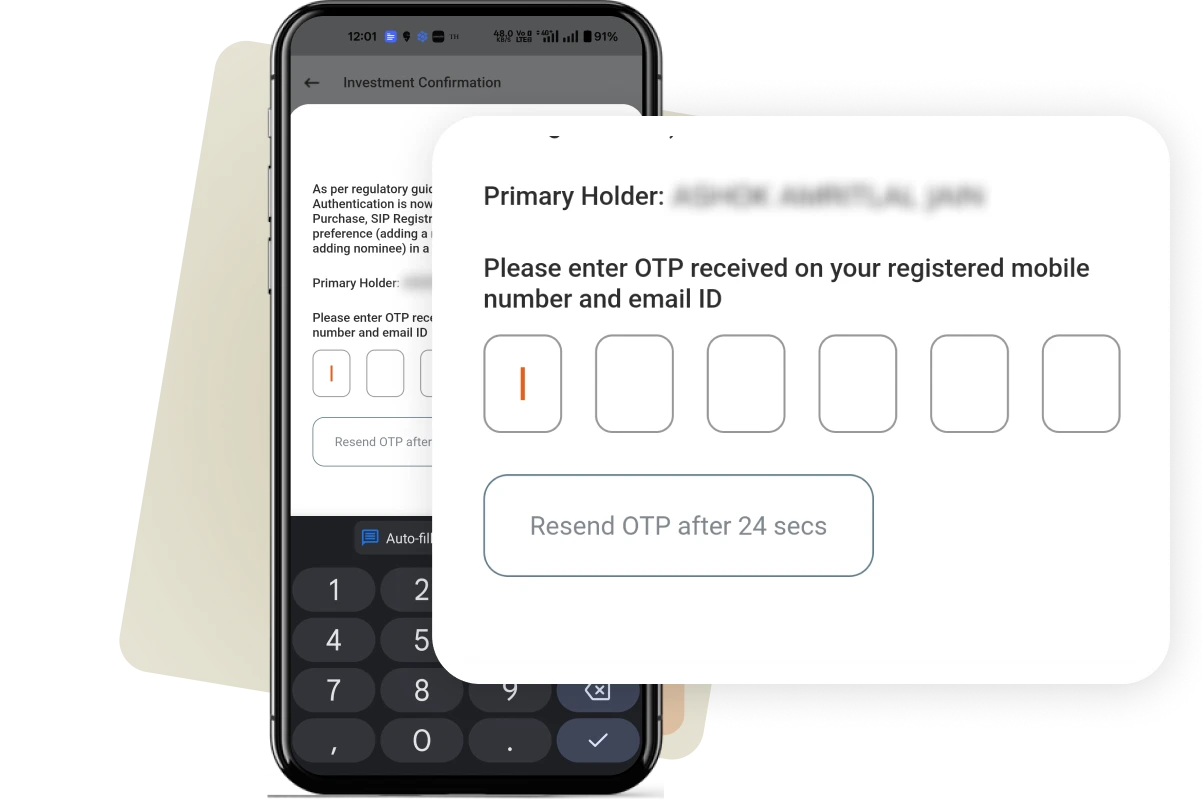

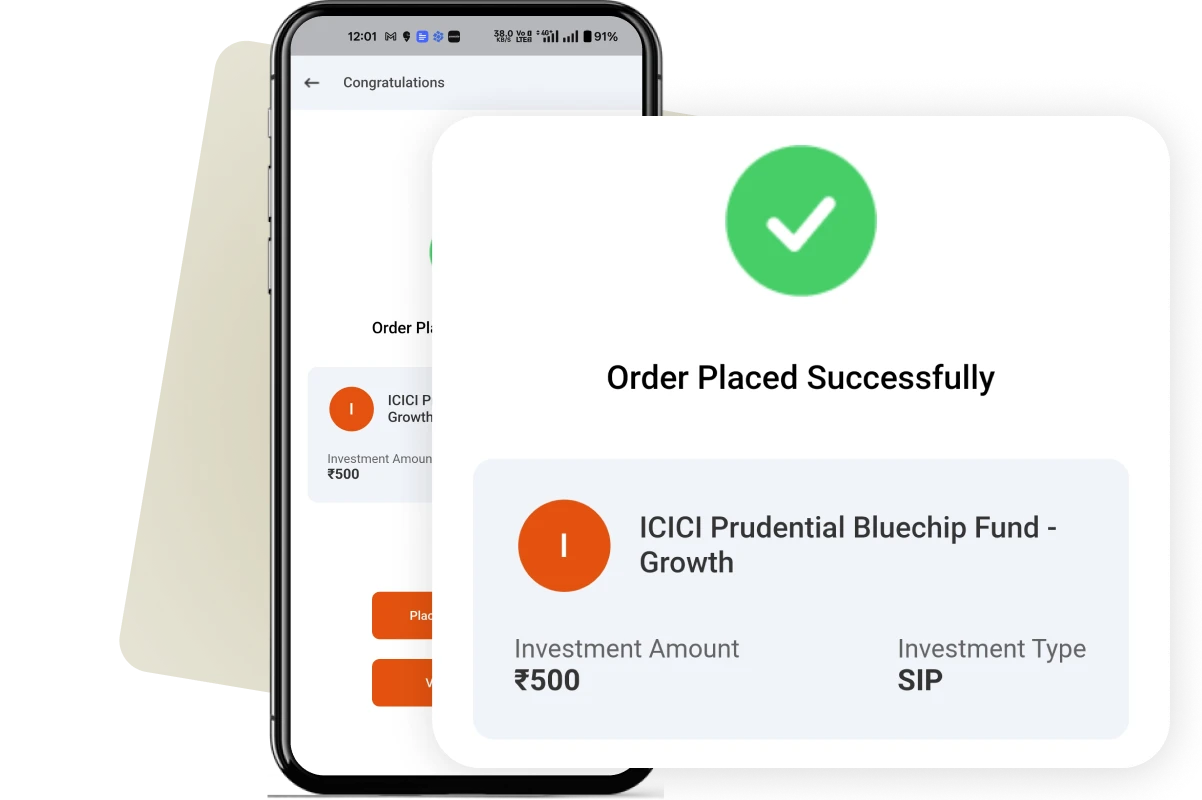

Start your SIP with top performing funds

View FundsGet your investments managed by experienced fund managers

Avail tax benefits with ELSS investments

Diversify investments across sectors & asset classes

Enjoy the liquidity of funds with no lock-in