Market Outlook of the week: Nifty breaks out of four-month consolidation, 21,400 in sight

ICICI Direct

18 Mins 01 Dec 2023

2 Comments

200 Likes

- Nifty reclaimed life highs as improving global set up and return of FII flows amid signs of interest rates peaking out. Nifty traded at 20,280, up 2.47% for the week while Nifty midcap and small cap indices gained 3% each.

- India outperformed global peers and Dow Jones and Dax gained 1.3%.

- Nifty posted a breakout from four-month consolidation (20,200-19,000) highlighting resumption of uptrend. We expect uptrend to accelerate and Nifty to head towards 21,400 in FY24 with strong support at 19,600 levels.

- Sectors to lead: BFSI, Auto, PSU, Power, Capital goods to outperform. Metals and large cap IT provide favourable risk-reward.

- Breadth thrust: Percentage of stocks above 50day ema jumped from 26% at end of October to ~70% in November indicating broad based participation in current breakout.

- Fund flow improves: FII turned net buyers for November after two-month hiatus. This would help accelerate rally along with already robust DII flows.

- Macros: Brent prices remained flattish despite Opec+ indicating extended output cut. Also decline in Dollar index to 103 is supportive of inflows to EM and India.

Q2 GDP surpasses expectation driven by investment growth

- Real GDP growth came at 7.6% in 2QFY24, higher than consensus, led by strong industrial growth while services sector witnessed moderation.

- Manufacturing sector grew 13.9%, driven by base effects, government focus on capex and better profitability aided by low input costs.

- Services sector growth witnessed moderation at 5.8% vs 9.4% in Q2FY23, owing to deceleration across hospitality and financial sectors.

- Agriculture sector remained on weak footing, as anticipated, growing at 1.2% vs 2.5% earlier.

- Cognizant of weakness in rural demand amid adverse rainfall, high frequency indicators continue to point to continued resilience in economic activity ahead.

Banking credit at 15.3%; in-line with estimate

- Banking credit growth came at 15.3% YoY as of October 2023, driven primarily by disbursement to NBFCs and retail segment.

- Agriculture segment witnessed improvement in growth from 13.8% to 17.5%, other segments saw some deceleration. Industry segment grew at 5.4% compared to 13.4%, led by moderation in credit to large (2.8% YoY compared to 10.7%) and medium industries (12.1% YoY vs 29.6%).

- Services segment continue to deliver steady growth at 20.1% YoY driven by continued traction in trade and NBFC sector, though HFCs witnessed slowdown in growth in recent months.

- Within retail segment (18% growth vs 20.5%), housing sector (which remains significant contributor) witnessed some moderation from 16.7% to 14.5%. momentum in credit cards continued to remain strong at 28% YoY, however, rising caution in personal loans led to some moderation in growth at 22.3% vs 25%.

- Despite deceleration, credit growth broadly remained within anticipated range of 14-16%. However, impact of recent hike on risk weight remains key watchful. In our view, credit off-take of banks should continue to remain in broad range of 14-16% in FY24E, though NBFCs could witness slight deceleration in momentum of advances.

Defence Sector: Proposals worth Rs 2.23 lakh crore approved by government

- Defence ministry has approved acquisition proposals worth Rs 2.23 lakh crore, which includes 97 LCA mark 1A fighter jets, 156 LCH Prachand choppers, upgrade of 84 Sukhoi-30 fighters, Towed Gun System (TGS) and Medium Range anti-ship missiles.

- Procurement process will start now which includes issuing of RFIs, tendering and negotiations. Hindustan Aeronautics (HAL) will be the primary beneficiary of contracts for LCA MK1a, LCH and Sukhoi-30 upgradation. As per the sources, these three proposals are worth Rs 1.6 lakh crore.

- Bharat Dynamics (BDL) is likely to participate in RFIs for medium range anti-ship missiles which is developed by DRDO and under trails. BDL will also benefit from additional requirements of missiles like Astra missiles (used in Tejas MK1A) and Helina (to be used in Prachand choppers).

- Bharat Electronics (BEL) will be involved in supplying electronic systems like Uttam radars, electronic warfare, communication systems etc. Private players like Data Patterns and Astra Microwave would also benefit in terms of supplying electronic sub-systems for these radars & electronic warfare.

- Midhani will be the main beneficiary in terms of supplying superalloys and titanium alloys for these platforms.

- Another key announcement was that, minimum 50% of indigenous content is required now onwards in all categories of procurement cases. Earlier it was 30% mandatory in case of buying from foreign OEMs. We believe that this is again a significant structural move as it will further push domestic manufacturing in defence and would benefit players across the manufacturing chain.

Cement: Industry consolidation continues

- UltraTech Cement will acquire the cement business of Kesoram Industries at a valuation of $91/ton. The company has a total capacity of 10.75 MT with two integrated units at Karnataka (9 MT) and Telangana (1.75 MT).

- This acquisition will enhance UltraTech cement's production capacity to 149 million tonnes and provide it the opportunity to extend its footprints in fast growing western and southern markets in the country.

- Valuation of $91/ton is much lower than the current replacement cost of ~ $130/ton but higher than the valuations of mid-sized companies like JK Lakshmi, Birla Corp and India Cement ($80-85/ton) and Orient Cement ($69/ton).

- We believe that cement industry will continue to see more consolidation. Larger players with better balance sheets would look for capacity expansion through inorganic opportunities in stressed assets at a reasonable cost.

- Consolidation in the sector is a win-win for both the acquirer and the target companies as large companies wouldn’t mind giving some premium to smaller companies in order to retain or increase market shares.

- Our top picks in cement are Sagar Cement & Birla Corp. Sagar Cement’s operational performance has improved significantly in Q2FY24 led by consolidation of additional volumes from recently acquired Andhra Cements and other subsidiary. Improvement in capacity utilization with lower energy cost led to sharp improvement in EBITDA/ton. Valuation at 9x EV/EBITDA or $55/ton looks attractive. Our target price is Rs 305 based on 10x EV/EBITDA on FY25E.

- Birla Corp is also expected to witness strong recovery in its margins and profitability during FY24-25E primarily led by healthy sales volume growth and operational efficiency measures. EBITDA/ton is expected to improve significantly from Rs 491/ton in FY23 to Rs 832/ton in FY24E and Rs 959/ton in FY25E. Valuation at 8x EV/EBITDA or $ 85/ton on FY25E basis looks attractive considering the multiple tailwinds. We value Birla Corp at Rs 1,540 i.e. 8.5x FY25E EV/EBITDA.

Bumper Listing for Tata Technologies: Gains for Tata Motors

- Tata motors subsidiary in the E&RD domain i.e., Tata Technologies listed amongst much fanfare at Rs 1,400/share vs. the IPO price of Rs 500/share; potentially tripling investors wealth in a week’s time.

- This was a big value unlocking event which we have been highlighting for long at Tata Motors. It divested 11.4% stake in Tata Technologies for Rs 2,314 crore via the present IPO route (@Rs 500/share).

- Tata Motors residual stake in Tata Technologies post recent transactions now stands at 53.4% which at the current price of Rs 1,350 is valued at Rs 29,000 crore.

- With ~Rs 4,000 crore as cash inflow into Tata Motors (via IPO and pre-IPO placement) and residual stake valued at Rs 29,000, we get further ~Rs 40/share upside to our target price.

- Our previous target price on Tata Motors was Rs 810 which potentially can be upgraded to Rs 850/share.

- With stock up 12% in the past month, we expect positive sentiments to weigh on Tata Motors stock price going forward.

Amara Raja Energy & Mobility (CMP: Rs 745; MCap: Rs 12,720 crore; Target price: Rs 900; Upside: 21%)

- Amara Raja Energy & Mobility (AREM, erstwhile Amara Raja Batteries) is a part of the duopolistic organised Indian lead acid battery market with a strong presence across Automotive (OEM & aftermarket) and Industrial battery space (UPS, Telecom, etc.). The company realises ~70% of sales from the automotive segment and rest ~30% from the industrial segment.

- In terms of geography mix, the company realises ~88% of its sales from the Domestic market with rest ~12% from Exports.

- In the automobile space Amara Raja is the leader in aftermarket space. Consequently, it has on consistent basis has reported better operating margins vs. its listed peer (last 10-year average EBITDA margins at Amara Raja stands at ~15% vs. its listed peer average of ~13%, a long-term outperformance of ~200 bps).

- Given the growing impetus on EV transition the growth prospects of lead acid battery business is a bit cloudy. However, given the present population of vehicles on Indian roads and healthy OEM sales volumes post Covid (FY22-24) coupled with company’s efforts to augment exports, we believe this segment can grow higher single digit going forward. Company is itself targeting sales growth of 11-12% in this space going forward.

- Amara Raja has lagged competition in terms of commitment and actions towards the new energy space i.e., Li-On battery domain and hence the underperformance in stock price. However, in the recent past it has made a big announcement wherein it has entered into MoU with Govt. of Telangana for setting up of Li-Ion Battery Gigafactory. The said facility is expected to have cell manufacturing capacity of up-to 16GwH & assembly capacity of up to 5 GWh with overall investment pegged at ~Rs 9,500 crores over next 10 years. In the first phase, it is setting up a Li-On cell plant of 2GwH capacity at a capex outlay of ~Rs 1,200 crore and will be operational in next 2-3 years.

- With capex under execution and plans for sizeable foray in the new energy space, long term prospects at AREM are promising.

- With Healthy net cash positive B/S (Rs 100 crore + as of FY23) & capital efficient business model (core RoIC’s at ~20%) and Inexpensive valuations (trades at ~15x PE on FY25E) we have a positive view on the stock.

We assign BUY rating to Amara Raja Energy & Mobility with a target price of Rs 900, thereby valuing it at 17x PE on combined PAT on FY25E basis.

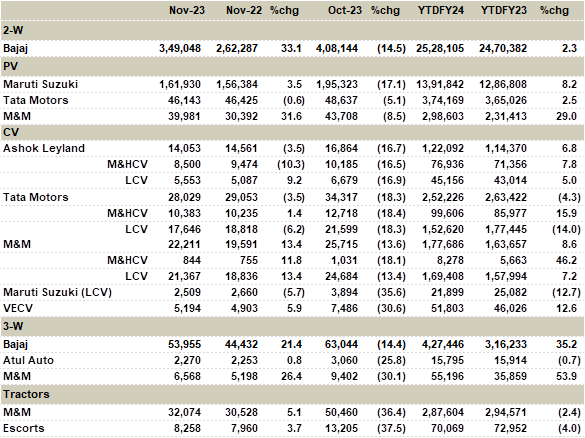

Auto: With festive season behind us, OEMs focus shifts from Wholesales to Retails

- Auto volumes across the OEM’s declined healthy double digit on MoM basis primarily led be pre festive inventory built up by OEMs in the previous months.

- On YoY basis, volume performance was company specific with no clear industry level signals.

- In the 2-W space, Bajaj Auto volumes grew 33% YoY amid chip supplies issue faced by the company in base quarter. Exports are yet to meaningfully recover at the company.

- In the PV space, volumes were healthy at M&M and were up 32% YoY amid increase in production and robust orderbook. The growth was flattish at Maruti as well as Tata Motors.

- In the CV space, VECV arm at Eicher Motors outperformed with 6% YoY growth while the same was negative single digit at both Tata Motors and Ashok Leyland.

- In the tractor domain, volumes grew low single digit on YoY basis with industry expected to close the fiscal year flat on YoY basis, albeit on a high base.

Retail Snapshot: Double digit retail sales during the festive period 2023

- As per press release issued by FADA, total vehicle sales during the 42-day festive period (from 1st day of Navratri and ends 15 days post Dhanteras) stood at 38 lakh units, a growth of 19% on YoY basis.

- Sales volume in the 2-W front came in healthy at 29 lakh units (up 21% YoY), 3-W stood at 1.4 lakh units (up 41% YoY), CV stood at 1.24 lakh unit (up 8% YoY), Tractor stood at 0.9 lakh units (flat YoY) while stood at 5.5 lakh units in the PV space (a growth of 10% on YoY basis).

- Healthy 2-W sales were supported by rebound in rural demand.

- Double digit volume growth during the festive period is in-line with management commentary with most of the OEM’s indicating rural demand growth better than the urban counterpart.

Source: ICICIdirect Research