Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 10: Understand Short Strangle Option Strategy in Detail

Simran was impressed with Abhinav’s suggestions for PQR Ltd. She then asks him to think of other strategies that might work too. Here’s what Abhinav shares with her.

What is Short Strangle

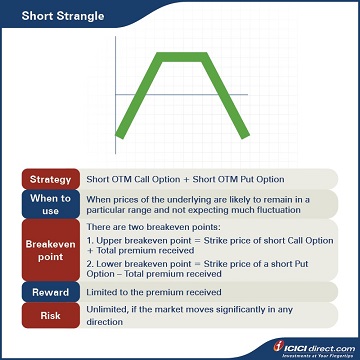

Abhinav suggests a Short Strangle as an alternative for PQR Ltd. A Short Strangle is a strategy that is similar to a Short Straddle, but is slightly less expensive. The Options that a trader sells are normally OTM which are cheaper than ATM Options.

He suggests selling OTM Call and Put Options. This is in keeping with Simran’s view that prices of the underlying will remain in a particular range and not expecting much fluctuation.

With this strategy, you can experience unlimited loss with rewards capped up to the premium received.

Strategy: Short OTM Call Option (Leg 1) + Short OTM Put Option (Leg 2)

When to use: When prices of the underlying are likely to remain in a particular range and not expecting much fluctuation

Breakeven: There are two breakeven points:

1. Upper breakeven point = Strike price of short Call Option + Total premium received

2. Lower breakeven point = Strike price of a short Put Option – Total premium received

Maximum profit: Limited to the premium received

Maximum risk: Unlimited, if the market moves significantly in any direction

Let’s understand a Short Strangle strategy with an example:

Assume that the spot price of PQR Ltd. is Rs. 1,000. Abhinav sells a PQR Ltd. OTM Call of strike price Rs. 1,200 at Rs. 40 and Put Option of strike price Rs. 800 at Rs. 30. He receives total premium of Rs. 40 + Rs. 30 = Rs. 70 and this will be the maximum profit. However, he will accrue unlimited losses if the stock moves more than 70 points in either direction i.e., above 1200 + 70 = Rs. 1,270 or below 800 – 70 = Rs. 730.

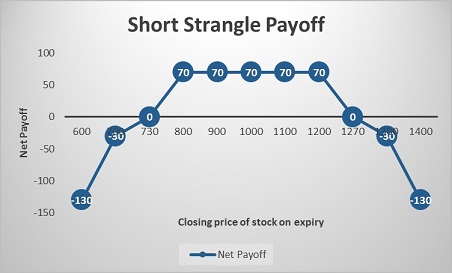

Let’s look at the cash flow in various scenarios:

|

Closing price of stock on expiry (Rs.) |

Payoff from OTM Call Option (A) (Rs.) |

Payoff from OTM Put Option (B) (Rs.) |

Net payoff (A+B) (Rs.) |

|

600 |

40 |

– 170 |

– 130 |

|

700 |

40 |

– 70 |

– 30 |

|

730 |

40 |

– 40 |

0 |

|

800 |

40 |

30 |

70 |

|

900 |

40 |

30 |

70 |

|

1000 |

40 |

30 |

70 |

|

1100 |

40 |

30 |

70 |

|

1200 |

40 |

30 |

70 |

|

1270 |

– 30 |

30 |

0 |

|

1300 |

– 60 |

30 |

– 30 |

|

1400 |

– 160 |

30 |

– 130 |

Let us understand the payoff in various scenarios. It will give you a fair idea of how we have arrived at the above values.

If Stock closes at Rs. 700 on expiry: Leg 1 expires OTM while leg 2 expires ITM

Leg 1: Premium received on the OTM Call Option of strike price Rs. 1200 = Rs. 40

Premium paid on OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (700 – 1200)} = Max (0, – 500) = 0

So, the payoff from the OTM Call Option = Premium received – Premium paid = 40 – 0 = Rs. 40

Leg 2: Premium received on the OTM Put Option of strike price Rs. 800 = Rs. 30

Premium paid on the OTM Put Option of strike price Rs. 800 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (800 – 700)} = Max (0, 100) = Rs. 100

So, the payoff from the OTM Put Option = Premium received – Premium paid = 30 – 100 = – Rs. 70

Net payoff = Payoff from OTM Call Option + Payoff from OTM Put Option = 40 + (– 70) = – Rs. 30

If the stock closes at 900 on expiry: Both the legs expire OTM

Leg 1: Premium received on the OTM Call Option of strike price Rs. 1200 = Rs. 40

Premium paid on the OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (900 – 1200)} = Max (0, – 300) = 0

So, the payoff from the OTM Call Option = Premium received – Premium paid = 40 – 0 = Rs. 40

Leg 2: Premium received on the OTM Put Option of strike price Rs. 800 = Rs. 30

Premium paid on OTM Put Option of strike price Rs. 800 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (800 – 900)} = Max (0, – 100) = 0

So, the payoff from the OTM Put Option = Premium received – Premium paid = 30 – 0 = Rs. 30

Net payoff = Payoff from OTM Call Option + Payoff from OTM Put Option = 40 + 30 = Rs. 70

If the stock closes at 1270 on expiry: Leg 1 expires ITM while leg 2 expires OTM

Leg 1: Premium received on the OTM Call Option of strike price Rs. 1200 = Rs. 40

Premium paid on the OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1270 – 1200)} = Max (0, 70) = Rs. 70

So, the payoff from the OTM Call Option = Premium received – Premium paid = 40 – 70 = – Rs. 30

Leg 2: Premium received on the OTM Put Option of strike price Rs. 800 = Rs. 30

Premium paid on OTM Put Option of strike price Rs. 800 at expiry = Max {0, (Strike price– Spot price)} = Max {0, (800 – 1270)} = Max (0, – 470) = 0

So, the payoff from the OTM Put Option = Premium received – Premium paid = 30 – 0 = Rs. 30

Net payoff = Payoff from OTM Call Option + Payoff from OTM Put Option = (– 30) + 30 = 0

Additional Read: Chapter 5: Options Trading – Short Call (Call Seller)

Summary

- A Short Strangle is a two-part Options strategy that involves one short Call with a higher strike price and one short Put with a lower strike price. They are both on the same underlying, with the same expiration date, but different strike prices.

- Breakeven: There are two breakeven points:

- Upper breakeven point = Strike price of short Call Option + Total premium received

- Lower breakeven point = Strike price of a short Put Option – Total premium received

- Maximum profit: Limited to the premium received

- Maximum risk: Unlimited, if the market moves significantly in any direction

In the next chapter, we will look at another Options strategy, Iron Condor, for a neutral view of the market.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)