Share market outlook of the week: Markets to consolidate with eyes on inflation print

- Nifty (down 0.5%) consolidated near life highs while Midcap and small cap indices (down 1.5%) were subject to profit taking after sharp rally.

- Most global indices inched up marginally to record new 52-week highs ahead of next week’s US inflation numbers.

- Nifty is undergoing a higher base formation near above 50-day ema over past four weeks that will set stage for next leg of up move towards 23,400.

- In the coming week, however, we expect extended consolidation with positive bias in the broad 21,400-22,000 range amid stock specific action, while earnings season concludes.

- Sectors in focus: BFSI, IT, Pharma, Oil&Gas, Metal.

- Strong domestic fund flow, firm global setups, steady oil prices and bond yields are likely to act as tailwind.

RBI Policy – Rate cut bar set higher

- MPC decided to keep the repo rate unchanged at 6.5% and retain stance at ‘withdrawal of accommodation’ with one external member voting for 25 bps rate cut.

- GDP growth forecast was revised to 7% for FY25 from 6.5% earlier, inflation forecast for FY25 was retained at 4.5%.

- It seems like RBI by stating about achieving the inflation target of 4% on a durable basis wants to keep the bar for rate cut higher and wants to keep the market rate cut expectations lower. However, overall the monetary policy does change the rate-cut expectation in August 2024.

- Since monetary policy was largely on expected lines, bond yields were largely unchanged (No change in 10-year yield).

- Equity markets (Nifty) was down by ~1% on the policy day. However the fall cannot be attributed to the monetary policy. The weakness in the market was driven by private sector banks which have been under pressure since last few days on the back of FPI selling. There seems to be some re-alignment in the overall banking allocation with concerns on growth and margins of few large private sector banks. Interest is higher in PSU banks and other PSEs. However given their lower weightages, the index movement is not reflective of their performance. Weak results from few large FMCG companies is also weighing on the market sentiment.

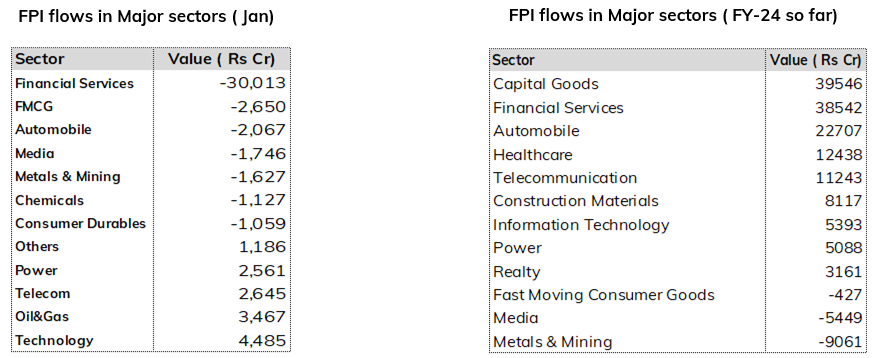

Pause in FPIs flows resulted in consolidation in Nifty

- Nifty move has been largely driven by FPI flows and with pause in flows during January, we have seen consolidation in Nifty for almost 1 and half months now. FIIs have pulled out nearly 26k crores from equities in January and weakness was primarily seen in Financial stocks only which saw Net outflows of nearly 31k crores suggesting no major impact in other sectors.

- During the period, we have seen inflows in Technology, Energy and Telecom space which were the major outperformers.

- So far in the current financial year (FY-24), FIIs have poured nearly 1.7 lakh crores in equities which is the highest ever flows ( excluding Covid times: 2.7 lakh crores ) helping Indian equities to continue their outperformance.

MF inflow at a new high

- Mutual Fund inflows came in significantly higher in the month of January at Rs 21,800 crore (Rs 17,000 crore in December). Ex-NFOs, Inflows were almost 2x at Rs 20,800 crore Vs Rs 10,700 crore in December.

- Inflows were higher MoM across category. Smallcap (3,200 in Jan vs 2,600 in Dec), Midcap (2,100 vs 1,400) continue with higher inflows. Largecap also saw higher inflows at Rs 1,300 crore vs outflows of Rs 300 crore.

- SIP inflows MoM rose by more than 1,200 crore at Rs 18,838 crore in Jan vs Rs 17,610 crore in Dec. SIP inflows are now almost touching Rs 20,000 crore per month.

In Auto Space, OEMs continue to report healthy performance, margins surprise on the positive side

Tata Motors: Reports healthy performance in Q3FY24, cash flow targets kept unchanged for FY24E

- Consolidated topline in Q3FY24 came in at Rs 1.16 lakh crore (up 25% YoY) with EBITDA at ~Rs 18,074 crore and EBITDA margins at 16.3%, up 80 bps QoQ (driven by outperformance at JLR).

- PAT in Q3FY24 came in at Rs 7,025 crore (highest in its history, also supported by lower effective tax rate) vs. profit of Rs 3,764 crore in Q2FY24.

- JLR reported EBITDA & EBIT margins of 16.2% (up 130 bps QoQ) & 8.7% respectively primarily driven by better product mix and controlled VME. JLR generated FCF of 626 million pounds for Q3FY24.

- Indian CV business EBITDA margins came in at 11.1% (by 70 bps QoQ) while India PV business EBITDA margins came in at 6.6% (up 10 bps QoQ).

- At JLR the broader guidance on cash flow remains unchanged with FCF expected at over £2bn in FY24 with net debt reducing to less than £1bn by the end of FY24.

- Demand outlook on the JLR front was stable however high base coupled with election activity is likely to keep volume growth under check for company’s India business (both PV & CV).

- With much of the positives in the numbers including impending IPO of Tata Technologies, the element of positive surprise is limited for Tata Motors which caps the potential upside in our opinion.

- With stupendous run up in Tata Motors stock price (>2x in last 1 year) and having captured much of the up move, we now assign HOLD rating to the stock, thereby valuing it at Rs 1,000 on SOTP basis (10x, 2.2x FY26E EV/EBITDA to India, JLR; Rs 230 value to Indian E-PV & stake in Tata Tech).

Ashok Leyland: Margins continue to surprise on the positive side in Q3FY24

- Standalone operating income for Q3FY24 came in at Rs 9,273 crore, up 2.7% YoY amid 1% de-growth in volumes to 47,241 units and share of M&HCV in total volume mix at 62.4% vs. 64.4% in Q2FY24.

- EBITDA came in at Rs 1,114 crore with margins at 12%, up 80 bps QoQ. Consequent PAT in Q3FY24 came in at Rs 580 crore (up 61% YoY, 3% QoQ).

- Net realisation for the quarter came in higher than anticipated at Rs 19.6 lakh/unit (up 1.5% QoQ). Gross margins expanded 130 bps on QoQ basis, the gains however limited by higher other expenses.

- The company in the recent past has won impressive orders on the Bus segment for both ICE & EV buses and now trades at reasonable valuation of ~9x EV/EBITDA on FY26E with 25% return ratios profile.

- We assign BUY rating on the stock tracking industry wide pricing discipline aiding double digit margin trajectory and company’s midterm target of mid teen levels coupled with its step-up play in the EV domain (Buses, Trucks and LCV’s). Incorporating FY26E, we now value Ashok Leyland at SOTP based target price of Rs 225 (10x core FY26E EV/EBITDA, 2x P/B for investments).

SBI (CMP - Rs 697, MCap - Rs 6,22,402 crore, Target - Rs 800, BUY)

- SBI reported healthy performance in Q3FY24, while optically earnings were marred by one-time provisions during the quarter. Business growth remained healthy both on advances (+14.4% YoY) and deposits (+13.02% YoY) with continued focus on retail loans and term deposits.

- Slippages came higher sequentially at ~67 bps, however, steady trajectory with below 1% accretion provides comfort. GNPA witnessed continued decline at 2.42% (-13 bps QoQ).

- Margins declined ~9 bps QoQ at 3.34%, resulting in 4.6% YoY growth in NII. Earnings declined 36% YoY to Rs 9,164 crore, owing to one-time expense of Rs 7,100 crore (Rs 1,700 related to dearness allowance and Rs 5,400 crore on account of uniform pension liability) and additional provision for wage revision at Rs 6,313 crore.

- Earnings impacted due to one-time expense; excluding the same RoA would be at 1.06% (reported RoA at 0.8%). Management has indicated growth to remain healthy. Margins seen to remain steady with maximum decline of 2-3 bps in Q4FY24. Additional provision related to wage revision expected in Q4FY24.

- Management remains confident on growth, maintenance of margins and improvement in RoA ahead. With normalization in staff cost, expect RoA to remain at ~1% in FY25-26E. Gains on treasury and recovery from existing stressed book could act as positive surprise. Thus, we value the bank at ~1.3x FY26E ABV and subsidiaries at ~Rs 179/share to arrive at a revised target price of Rs 800.

Lupin Q3FY24 numbers- Upbeat numbers with significant margins improvement

- Revenues grew ~20% YoY to Rs 5,080 crore driven by the US, India and Europe, Middle East and Africa (EMEA) markets.

- EBITDA grew almost 2x YoY to Rs 1,022 crore and EBITDA margins stood at ~20% (800 bps improvement) mainly on the back of strong GPMs (66% vs 60%) which improved due to better product mix.

- US sales grew ~24% YoY to Rs 1,885 crore on the back of recently launched respiratory products and market share gains in existing products.

- India sales grew ~13% to Rs 1,735 crore driven by new launches and strong performance in therapies such as Respiratory, Gynaecology, Gastroenterology and diabetology and growth in in-licensed products.

View: After a gap of almost 9 quarters, the EBITDA margins have hit the 20% threshold mainly driven by strong GPM performance. This suggests that the product mix for the company has improved significantly with strong India performance and recently launched complex respiratory products in the US.

Going ahead the sustainability of this performance especially on the margins front would be the key determinant besides launches in US and India.

Apollo Hospitals Q3FY24 Results- good all-round performance

- Revenues grew 14% YoY to Rs 4,851 crore, mainly supported by hospitals as well as Pharmacy (Apollo HealthCo) businesses. EBITDA grew 21% to Rs 614 crore and EBITDA Margins grew 90 bps to 12.7%, positive delta was attributable to reduction in losses of Apollo online pharmacy distribution and Apollo 24x7.

- Healthcare services division (Hospitals) revenues grew 12% YoY to Rs 2,464 crore on the back of growth from both new as well as existing hospitals. EBITDA grew 8% to Rs 586 crore and margins stood at 23.8%. ARPOB grew 10% YoY to Rs 56,368.

- Apollo HealthCo (Digital Healthcare and Omni-channel Pharmacy platform) grew 17% YoY to Rs 2,049 crore to Rs 2,049 crore. Revenue from digital platforms came at Rs 225 crore whereas Offline pharmacy reported revenue of Rs 1,834 crore. EBITDA margins before 24x7 and ESOP charges stood at 7.7%. AHLL revenues stood at Rs 338 crore up 8% YoY and EBITDA margins stood at 8%.

View:The hospitals business has maintained strong profitability with optimum case mix and payor mix. The ROCE of hospitals business (ex-WIP) already trending at a strong ~26%. The next capex cycle will add 2,860 beds with a capex of Rs 3,400 crore over the next 4 years across India. However, we do not expect much of a balance sheet stress with strong base already in place.

- Apollo HealthCo post 24x7 and ESOP charges turned EBITDA positive during the quarter. We expect profitability improve gradually on the back of improving profitability of omni-channel pharmacies and improving Gross Merchandise Value for digital platform which is growing at 20% p.a.

Hidden Gem

Birla Corporation: Target: Rs 1,880

- Birla Corporation’s operational performance has improved substantially on YoY basis led by strong volume growth, reduction in power & fuel cost and positive operating leverage.

- Revenue growth in Q3FY24 was at 14.7% YoY led by volume growth of 13.5% YoY. Volume growth was mainly driven by recent commissioning of 3.9 mtpa cement capacity in Maharashtra and it has been much better than the industry average of 3-4% YoY. Volume growth for 9MFY24 also stands at 13.5%.

- EBITDA/ton stood at Rs 901/ton in Q3FY24 as against Rs 390/ton in Q3FY23. The sharp YoY improvement is primarily led by decline in power & fuel cost and positive operating leverage. For 9MFY24, EBITDA/ton stands at Rs 755/ton (vs Rs 442/ton in 9MFY23).

- With further ramp-up of new capacity, company’s capacity utilization and cement volumes to pick-up further in coming period. We estimate volume CAGR of 7.3% (FY23-26E).

- Operational efficiency measures (in terms of raw material sourcing and increasing usage of captive coal & power) and increasing share of premium products, we believe that company’s margins to improve significantly over FY24-26E. We estimate blended EBITDA/ton to improve to Rs 993/ton by FY26E (from Rs 491/ton in FY23), implies EBITDA CAGR of ~36%.

- In terms of next phase of expansion, company targets to increase its cement capacity from 20 mtpa at present to 30 mtpa by 2030.

- Valuation of 8x EV/EBITDA on FY26E basis looks attractive given the significant growth in coming years. There is still some gap in valuation as compared to other mid-sized peers.