What are the factors fueling the bull run in the market?

We are about to close 2023 on a super strong note. With two trading days left, NIFTY50 has delivered 19% returns in 2023. In December alone, the NIFTY50 has given nearly 9% returns (as of December 27th). After the 2017 rally, it is the second-best year for equity investors after 2021, when NIFTY50 gained over 24%. The rally in 2021 was for a different reason than the current rally.

Will the rally continue, or will the market fall from these levels? To know the answer to this question, you must understand the factors fueling the current bull run. In this article, we cover some reasons driving the market to new highs every week.

Factors fueling the bull run

Here are some factors that are fueling the recent bull runs:

Rate Cut Hope Strengths: Inflation in the United States has cooled off in recent months. It has increased the hopes of potential rate cuts by the Federal Reserve (US central bank). As per reports, the market is pricing 80% on the rate cut next year, with more than 150 basis points of easing. Similarly, in India, inflation has come below the threshold level of 6%, and the RBI may also cut the interest rate here. The question is: How does it impact the stock market?

When the interest rate comes down, it infuses more money into the financial system. For example, when rates are lower, companies can borrow money at more favorable terms, making it cheaper for them to invest in projects, expand operations, and pursue growth opportunities. It may reflect on their profits and, therefore, have a positive impact on the market.

Growth Outlook: As per the Fitch Rating, India's economic outlook is robust. The agency is predicting excellent GDP growth of 6.5% and a growth rate of 6.9% for FY24, and India will be the fastest-growing country globally. The Indian economy is poised for sustained growth after a 7.7% expansion from April to September this year. GDP growth is often associated with increased economic activity. It can boost corporate profits.

A higher GDP comes when businesses do well. As companies experience higher sales and revenues, their earnings tend to rise. Investors often value stocks based on earnings, so an environment of robust GDP growth can lead to higher stock prices.

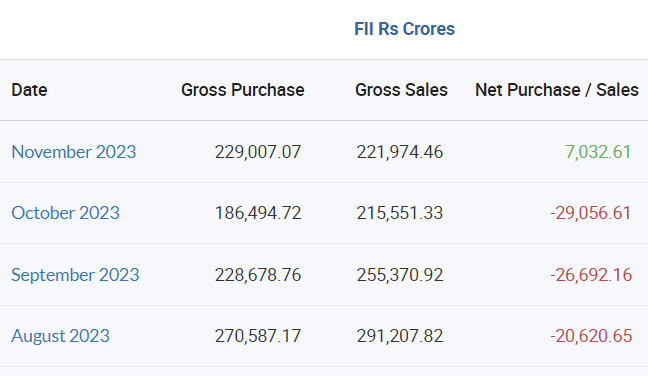

Strong FII Buying: Foreign Institutional Investors (FII) have been pouring money into the Indian stock market since November. In November, the net purchase by FII was Rs 7,032 crore. In December (till December 27), the net purchase by FII was nearly Rs 23,000 crore. It is supported by strong buying by DII - Rs 12400 crore nearly.

Why are FII buying after they were net sellers from August to October? This surge by foreign investors is driven by expectations of interest rate reductions, the decline in bond yields, and the US dollar, coupled with India's robust economic growth prospects.

Bond Yields: We have seen FII investing in the Indian market. Let us now look at one of the main reasons for it. In the below image, you can see that the 10-year yield increased until October. It started to decline starting November.

Source: Financial Times

The 10-year yield, which crossed 5% in October, has now come below 4%. How does the yield impact the market? Bond yields are closely tied to interest rates. Lowering the 10-year yield in the US can make US assets relatively less attractive for investors seeking yield. As a result, some investors may look for higher-yielding opportunities in other markets, including emerging markets like India. The same has happened recently, which has led to increased FII in the Indian stock market and caused a rally.

Decisive Election Results: In the recent state elections, the BJP won the elections in all major states. See, investors don't like uncertainty over anything, including elections. Now that the BJP has won state elections with a clear majority, it is expected that the BJP-led government will come after the general elections in May to form a stable government for the third term. A stable political environment boosts investors' confidence. That is what we have seen after the state election results.

Before you go

We are about to end the year, and without a doubt, it will be one of the best years for Indian equity investors. The confluence of favorable global conditions and strong domestic factors has created a favorable environment for Indian investors. However, investors should keep an eye on the valuations and certain geopolitical uncertainties, as a healthy correction may be around the corner.