Impact of geo-political crisis in Bangladesh on Indian Textile Industry

Bangladesh is facing its worst political crisis since its 53 years of independence. Does the political crisis in Bangladesh affect India? It does in more than one way.

First, we share boundaries with Bangladesh, and any conflict in neighbouring country could have political impact on India. Second, it poses concerns for India's textile and apparel sector. Our focus in this article will be on the second point. Let us understand the details.

About Indian Textile Industry

You would be happy to know India is among the world's largest textiles and apparel producers. It is one of the biggest industries in India. The sector contributes 2.3% of its Gross Domestic Product (GDP). Also, 12% to exports and 13% to industrial production. India has a 4% share of the global trade in textiles and apparel.

The textile industry is projected to grow at a CAGR of 10% from FY20 to reach $190 billion by FY26 and $350 billion by FY30. The total exports will be over $65 billion by FY26 (India is the third largest exporter).

The textiles and apparel industry is the 2nd largest employer in the country, providing direct employment to 45 million people and 100 million in allied industries.

Dependency of Indian Textile Houses on Bangladesh

Bangladesh is a key partner for India's textile industry. It serves as a crucial market for Indian textile exports and a significant manufacturing base for garments that are exported globally. Here are the dependencies of Indian Textile houses in Bangladesh:

- Raw Material Supply: India is a significant exporter of cotton and synthetic fibers to Bangladesh, serving as a crucial raw material supplier for the country's textile industry.

- Low Labor Costs: Bangladesh offers lower labor costs compared to India. This cost advantage makes it an attractive destination for Indian textile houses looking to reduce manufacturing expenses.

- High Production Volume: Bangladesh has established itself as a global leader in garment manufacturing with a high production capacity. It enables Indian textile houses to meet large orders and scale production efficiently.

- Machinery and Technology: Indian textile machinery manufacturers have a strong presence in Bangladesh, providing essential equipment for India's textile mills.

The current situation in Bangladesh is causing significant concern within the Indian textile sector. The industry hopes for a fast return to normalcy to ensure uninterrupted trade and production.

Impact on the Indian Textile Market

According to the National Organization for the Textile Industry, any interruption in the supply chain in Bangladesh will immediately influence the supply chain and may affect the delivery and production schedules of Indian companies.

Indian companies with manufacturing operations in the country will face challenges in maintaining their production flow, leading to delays and potential shortages in the market. This disruption could affect the availability of products and might force companies to seek alternatives.

“While we are concerned about the impact on the supply chain and the potential delays and disruptions it might cause, we are hopeful that the situation will improve soon,” Chandrima Chatterjee, Secretary General, Confederation of Indian Textile Industry (CITI) said.

As per CITI, Indian enterprises engaged in manufacturing within the nation may encounter difficulties in sustaining their production flow, hence resulting in market delays and possible scarcities. The product supply may be impacted by this disruption, and businesses may be forced to look for alternate manufacturing options to lessen the effects.

Global Apparel Market and India's Share In It

The global apparel market is a behemoth, driven by ever-changing fashion trends, consumer preferences, and economic conditions. It is a highly competitive landscape with significant opportunities and challenges.

While India is among the world's largest producers of textiles and apparel, its global apparel market share is around 4-5%. It puts it behind giants like the United States and China, which hold a significantly larger market share. The US, with apparel revenue of 351.35 billion, and China, with 313.82 billion in revenue, hold the first and second positions, respectively.

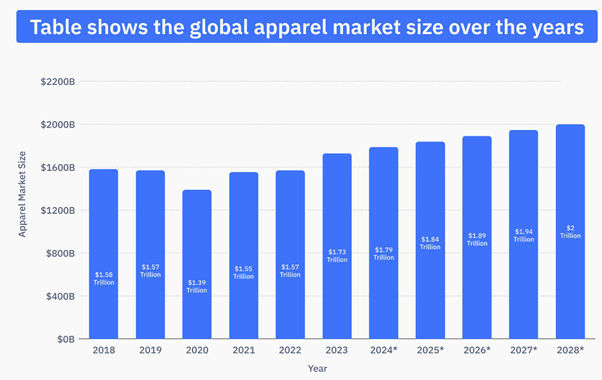

The apparel market is estimated to be valued at $1.79 trillion in 2024, accounting for 1.63% of the global gross domestic product. The apparel market is projected to grow at a CAGR of 2.81% between 2024 and 2028. The Apparel market accounts for 1.63% of the world’s GDP.

Bangladesh's Textile Industry

Bangladesh's textile industry is a cornerstone of its economy. It is one of the world's largest apparel exporters, second only to China. Here are a few things to know about its textile industry:

- Massive Employment: The sector employs millions, primarily women, making it a significant contributor to the country's social and economic development.

- Export Dominance: Ready-made garments (RMG) account for the vast majority of Bangladesh's export earnings, making it heavily reliant on global fashion trends and consumer demand.

- Rapid Growth: The industry has experienced rapid growth in recent decades, driven by factors such as low labor costs, a favorable business climate, and increasing global demand for affordable clothing

Future of the Indian Textile Market

In yarn and fabric exports, with Bangladesh being a major buyer of Indian cotton yarn and fabrics, the spinning sector may face short-term issues. A swift recovery in Bangladesh is crucial for these two sectors.

Once the businesses resume production, which can happen in a week, demand for yarn and fabric may rebound strongly to manage the Shortages created by the disruption in their spinning sector.

Apparel imports from Bangladesh have declined over the past few months, and a further drastic reduction in imports is expected. Consequently, goods may not arrive in time for India’s upcoming festival season. It will help Indian manufacturers to get more orders from domestic retailers.

Bangladesh is the biggest customer for yarn exports as of now, with around 25% to 30% of exports going to Bangladesh. Any disruption over there will create issues here as well. However, this situation is relatively minor and has not yet impacted demand. But unless it is resolved or continues for a long period. Then, there could be a concern. But as of now, there does not seem to be an issue.

Conclusion

In the short term, there is a definitive impact of the Bangladesh crisis on the Indian textile industry. However, not everything is gloomy, as there are companies from the textile and spinning industries that are likely to benefit from the crises.