Understand India's Gold Industry in Detail

Gold has exhibited exceptional momentum in 2025, reaching 13 new highs and surpassing the critical $3,000/oz mark. This strong performance mirrored across major currencies, is driven by economic trends and sustained investor interest. Key factors such as geopolitical and economic uncertainty, a weaker US dollar, falling interest rates, and inflation concerns continue to fuel demand and shape price movements. Given all the positive sentiments around gold and its price, we thought to cover the Indian gold industry in detail.

India & Gold Industry

Gold holds deep cultural and religious significance in India, making it one of the largest consumers of gold globally. According to the World Gold Council, India accounts for approximately 25% of global gold demand, primarily driven by weddings and festivals. Despite limited domestic production, the country’s jewelry industry remains robust, with gems and jewelry exports surpassing $22 billion in 2020-2021.

To manage gold imports, India increased import duties to 12.5% in 2022. However, in a key policy shift, the last Union Budget announced a reduction in import duties on gold, silver, and platinum, bringing the total duty down to 6% from the previous 15%. This move is expected to stimulate retail demand, curb gold smuggling, and support the domestic jewelry industry. While higher imports may widen the current account deficit (CAD), India's overall economic performance, including a narrowing merchandise trade deficit and a strong services trade surplus, has helped reduce the CAD to a seven-year low of $23.2 billion in FY24 from $67 billion in FY23.

India has also taken steps to reduce its reliance on gold imports through initiatives like the Gold Monetization Scheme (GMS). By mobilizing idle gold, GMS aims to promote financial inclusion, encourage capital formation, and strengthen the gold refining industry. As per the annual report of the Finance Ministry for 2023-24, approximately 30.15 tonnes of gold were mobilized under GMS till March 2024 with 10 participating banks and 5,193 depositors. Additionally, by reducing the need for new mining, GMS offers environmental benefits, contributing to sustainable gold consumption.

Gold has historically served as a store of value during times of economic uncertainty. Global investment in gold-backed ETFs reached record highs in 2022 due to financial volatility. In India, gold loans remain a crucial financing tool, with outstanding loans exceeding Rs5.5 lakh crore. However, competition from gold loan companies and fintech firms, along with rising gold prices affecting purchasing power, has led to a moderation in the growth of gold loan portfolios, slowing to 15% in February 2024 from a peak of 26% in June 2023.

Government policies, such as import duties and monetization schemes, continue to shape gold demand and its role in the economy. While gold remains an inflation hedge and a key asset for Indian households, balancing import dependency with financial reforms will be crucial in managing its long-term impact on trade and economic stability.

Why is the Gold Price Rising in India?

Here are the key points explaining the recent trends in gold prices and its performance in India in 2025:

- Global Gold Price Surge: The LBMA (London Bullion Market Association) gold price in USD has risen by $330/oz (12%) since the start of 2025, reaching $3000/oz. A significant portion of this increase, over 4%, occurred in the first half of March.

- Domestic Gold Prices in India: In India, the domestic landed gold price has followed the global trend, rising 17% to hit a record Rs 90,750 per 10 grams. However, the increase is more pronounced due to the depreciation of the Indian Rupee (INR) against the US Dollar (USD) by 1.3% year-to-date.

- Impact of Weak Demand: Despite rising prices, gold demand, particularly for jewelry, remains weak. As a result, the domestic gold price is trading at a discount compared to the landed price.

- Narrowing Price Discount: The price difference (spread) between the local market price and the imported landed price averaged $12/oz in the first half of March, a slight improvement from the $17/oz spread in February.

- Gold as a Top-Performing Asset: In 2025, gold delivered year-to-date (YTD) gains of 13%, making it the best-performing asset class in India. This is in stark contrast to the negative returns from domestic equities and significantly outperforming fixed-income assets such as bonds and bank deposits.

- Strategic Investment Importance: The strong performance of gold highlights its importance in investor portfolios, particularly in times of market volatility and economic uncertainty.

India's Gold Import

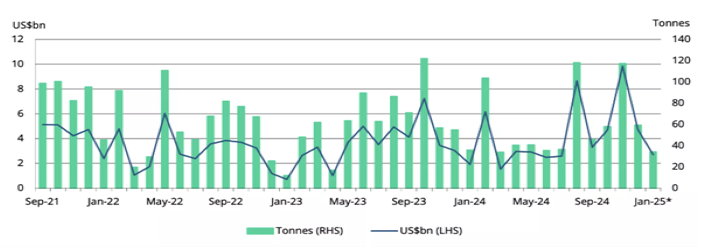

Gold imports in India continued their downward trend in February 2025, reaching their lowest levels since March 2024. This marks the third consecutive month of decline, following a steep drop from the highs recorded in November 2024. The decline in imports is primarily attributed to weak consumer demand, as persistently high gold prices deter buyers, particularly in the jewelry segment.

According to data from the Ministry of Commerce, India's gold import bill for February stood at $2.3 billion, representing a 14% month-on-month (m/m) decline and a significant 63% year-on-year (y/y) drop. This sharp contraction in imports reflects cautious consumer sentiment, with many buyers either postponing purchases or shifting towards lighter jewelry designs and alternative investment options.

Based on estimates, gold import volumes for February ranged between 25 to 30 tonnes, significantly lower than historical averages. The high cost of gold, coupled with rupee depreciation and import duties, has made bullion purchases less attractive, further dampening import demand.

The ongoing decline in gold imports has broader implications for India's current account balance. While lower imports help contain the trade deficit, they also signal muted jewelry demand and a possible slowdown in retail consumption, which could impact the overall economy.

Market analysts are closely monitoring whether upcoming festivals and wedding seasons will provide any relief to the sluggish demand. Additionally, the recent import duty cut announced in July 2024 may help improve affordability and support a rebound in gold imports in the coming months.

Industry Risks and Challenges

India's gold industry faces significant challenges due to the absence of a well-defined and cohesive gold policy. Without a unified vision or clear objectives, industry stakeholders lack proper guidance, making it difficult to align efforts toward long-term strategic growth. This policy vacuum hinders effective planning and creates uncertainty for businesses operating in the gold sector.

The regulatory framework governing India's gold industry is highly fragmented, involving multiple authorities such as the Reserve Bank of India (RBI), Ministry of Finance, Ministry of Commerce, Directorate General of Foreign Trade (DGFT), and Customs. Each entity issues circulars and notifications, resulting in a complex and often confusing compliance environment. This lack of coordination increases inefficiencies, making it challenging for businesses to navigate the legal and procedural landscape.

Another critical issue is India's tendency to replicate international gold policies without adapting them to the country’s unique market conditions. While adopting global best practices can be beneficial, merely copying foreign models without customization may prevent India from leveraging its technological strengths and domestic market potential. A more tailored approach is necessary to ensure that regulatory frameworks and industry initiatives align with India’s economic and cultural realities.

Before you go

India’s gold industry is at a critical juncture, balancing traditional consumer demand with modern financial strategies. As urbanization increases and disposable incomes rise, the demand for gold jewelry is expected to remain strong. However, a noticeable shift towards digital and paper gold investments reflects a growing trend of financial inclusion and portfolio diversification.

Government initiatives play a crucial role in encouraging non-physical gold investments. These measures aim to reduce the country's reliance on imported physical gold, thereby helping to lower the current account deficit (CAD). A well-structured policy framework, coupled with a modernized regulatory environment, will be essential in unlocking the full potential of India's gold industry while ensuring its long-term sustainability and economic contribution.