Silver Outlook 2026

Silver emerged as one of the most powerful performers in the global commodity complex in 2025. Prices surged sharply across domestic and global markets, supported by a rare combination of macroeconomic uncertainty, supply disruptions, strong investment flows, and industrial demand. After such an exceptional run, the key question for investors as markets move into 2026 is whether silver can sustain its momentum or whether returns are likely to moderate.

The outlook for silver in 2026 points towards moderation rather than a sharp reversal. While near term volatility and profit booking cannot be ruled out after a steep rally, the broader structural factors that supported prices remain largely intact. At the same time, elevated price levels bring in mean reversion risks, making the risk reward equation more balanced than it was earlier in the cycle.

How Silver Performed in 2025

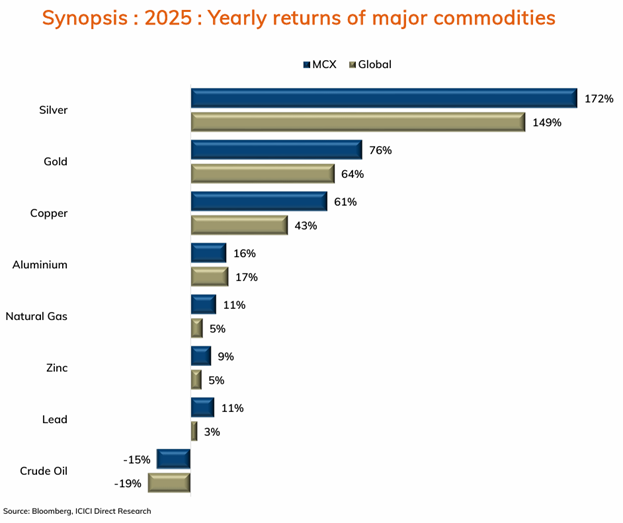

The year 2025 proved to be historic for silver. Among major commodities, silver delivered the strongest returns.

On the domestic front, MCX silver prices rose by around 172 percent, while global silver prices gained close to 149 percent. This performance significantly outpaced gold, copper, and most base metals. The rally reflected silver’s dual nature as both a precious metal and an industrial commodity.

What Triggered the Sharp Surge in Silver Prices

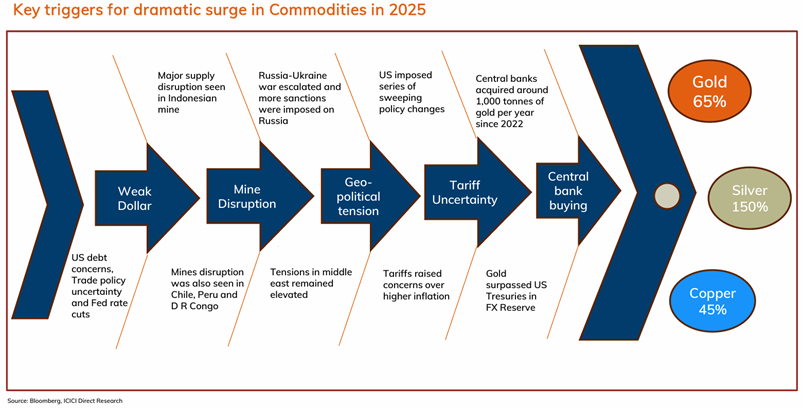

The surge in silver prices during 2025 was driven by multiple factors reinforcing each other.

- Weakness in the United States Dollar

Concerns around United States debt levels, trade policy uncertainty, and expectations of rate cuts weighed on the dollar. As the dollar weakened, silver became more attractive for global investors.

- Elevated Geopolitical Tensions

Geopolitical risks remained high throughout the year. The escalation of the Russia Ukraine conflict, continued tensions in the Middle East, and sanctions on Russia increased safe haven demand for precious metals, including silver.

- Tariff Uncertainty

Uncertainty around tariffs and trade policies added to inflation concerns and supply chain stress. This environment supported higher commodity prices, including silver.

- Strong Investment Demand

Investment demand played a crucial role in silver’s rally. Exchange traded fund inflows remained strong, and flows of silver into the United States increased amid tariff related concerns.

Factors Likely to Drive Silver Prices in 2026

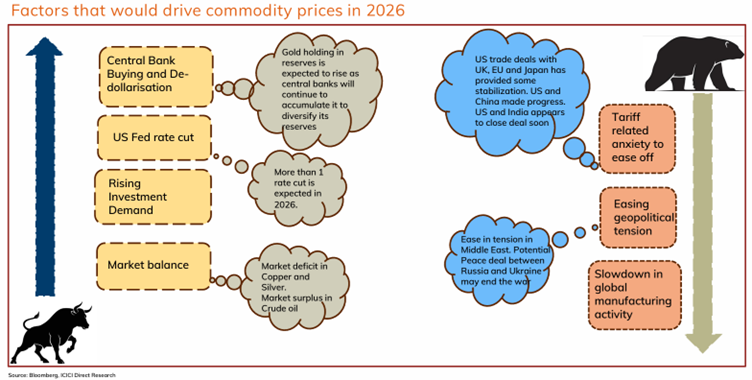

As markets move into 2026, several supportive factors remain in place for silver, even as certain headwinds begin to emerge.

- United States Federal Reserve Rate Cuts

More than one rate cut is expected in 2026. Lower interest rates reduce the opportunity cost of holding non-interest-bearing assets such as silver. Expectations of monetary easing in the United States and China remain supportive for investment demand.

- Market Balance

The silver market is expected to remain in deficit for the sixth consecutive year in 2026. Market deficit for 2025 was estimated at around 118 million ounces. This structural deficit continues to provide long term support to prices.

- Investment Demand

Silver investment demand is expected to remain stable. Exchange traded fund holdings have shown a rising trend over the years, reflecting sustained investor interest.

Mean Reversion Risk and Why Returns May Cool in 2026

After rallying sharply in 2025, silver prices are now vulnerable to mean reversion.

Silver is known for its high volatility and sharp price swings. After an extraordinary rally of around 140 percent in 2025, returns in 2026 are expected to be more moderate. Current levels are less favourable for fresh aggressive investments from a risk reward perspective.

Higher margin requirements at major exchanges could force traders to cut positions. In addition, COMEX inventories remain comfortable, signalling no immediate supply stress.

However, primary structural factors remain intact, and data continues to indicate potential further upside over the medium term.

Demand Trends and Industrial Use of Silver

Moderating Industrial Demand in the Near Term

Demand for silver in the industrial segment is expected to flatten in 2026 after making a series of record highs in the past four years. Global economic uncertainty and potential thrifting due to high silver prices may cap near term demand growth.

Silver jewellery and silverware demand are expected to decline by 6 percent and 15 percent, respectively. Bar and coin demand is forecast to decline by around 4 percent.

Long Term Industrial Demand Remains Supportive

Despite near term moderation, long term fundamentals remain constructive.

Silver demand is expected to rise steadily in the coming years due to its use in:

- Solar installations

- Automotive applications

- Power grid investments

- Consumer electronics

- Artificial intelligence chips

- Data centre cooling

- Power distribution

Silver Investment Demand and ETF Flows

Silver investment demand is expected to remain stable in 2026.

Silver exchange traded fund holdings have shown a steady rise over time. In addition, tariff uncertainty has led to a significant flow of silver from London to the United States, triggering a historic squeeze and reducing available stocks in London.

Stockpiles in Shanghai hit their lowest levels in nearly a decade in 2025. Concerns remain around the risk of tariffs on silver following its inclusion in the United States Geological Survey list of critical minerals.

China has also announced restrictions on silver exports from 2026, requiring companies to obtain export licences. This move could disrupt supply chains and support prices.

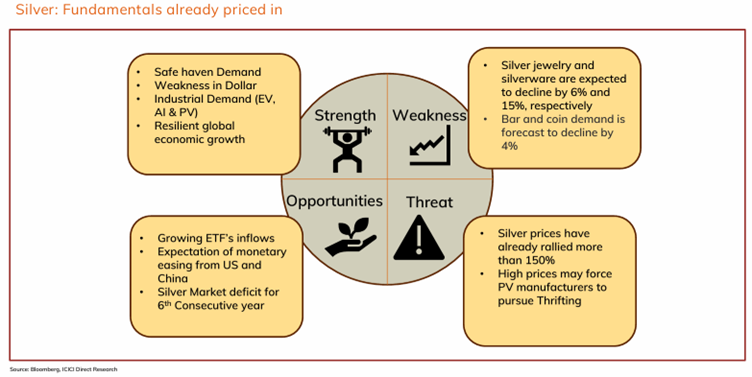

Strengths, Risks, Opportunities, and Threats for Silver

Strengths

- Safe haven demand

- Weakness in the dollar

- Industrial demand from emerging technologies

- Resilient global economic growth

Weakness

- High prices discouraging physical consumption

Opportunities

- Growing exchange traded fund inflows

- Expectations of monetary easing from the United States and China

- Market deficit for the sixth consecutive year

Threats

- Prices have already rallied more than 150 percent

- High prices may force thrifting in photovoltaic manufacturing

What History Suggests About Silver Bull Markets

Historical data shows that sharp rallies in silver are often followed by periods of consolidation rather than immediate reversals. Past episodes driven by monetary easing, industrial demand, and supply disruptions have seen cooling phases before the broader trend resumes.

The current cycle shares similarities with earlier periods where strong investment demand and supply constraints played a central role.

Summary of Silver Outlook 2026

Silver enters 2026 after one of its strongest rallies in decades. While returns are likely to moderate compared with 2025, the broader structural backdrop remains supportive.

Market deficits, stable investment demand, expectations of rate cuts, and long term industrial usage continue to provide a strong base for prices. At the same time, high volatility and elevated price levels call for a more measured approach.

For investors, silver continues to remain an important asset that offers exposure to both precious metal safety and industrial growth themes, even as the global macro environment remains uncertain.

Read the full report here - https://www.icicidirect.com/mailcontent/idirect_commodityyearly.pdf