Nifty earnings to gain traction, seen growing at a healthy 15% on y-o-y basis in q4fy23

Earnings season for Q4FY23 kicked off this week. Estimates for Nifty 50 stocks for the upcoming quarterly results indicate double digit growth on YoY basis.

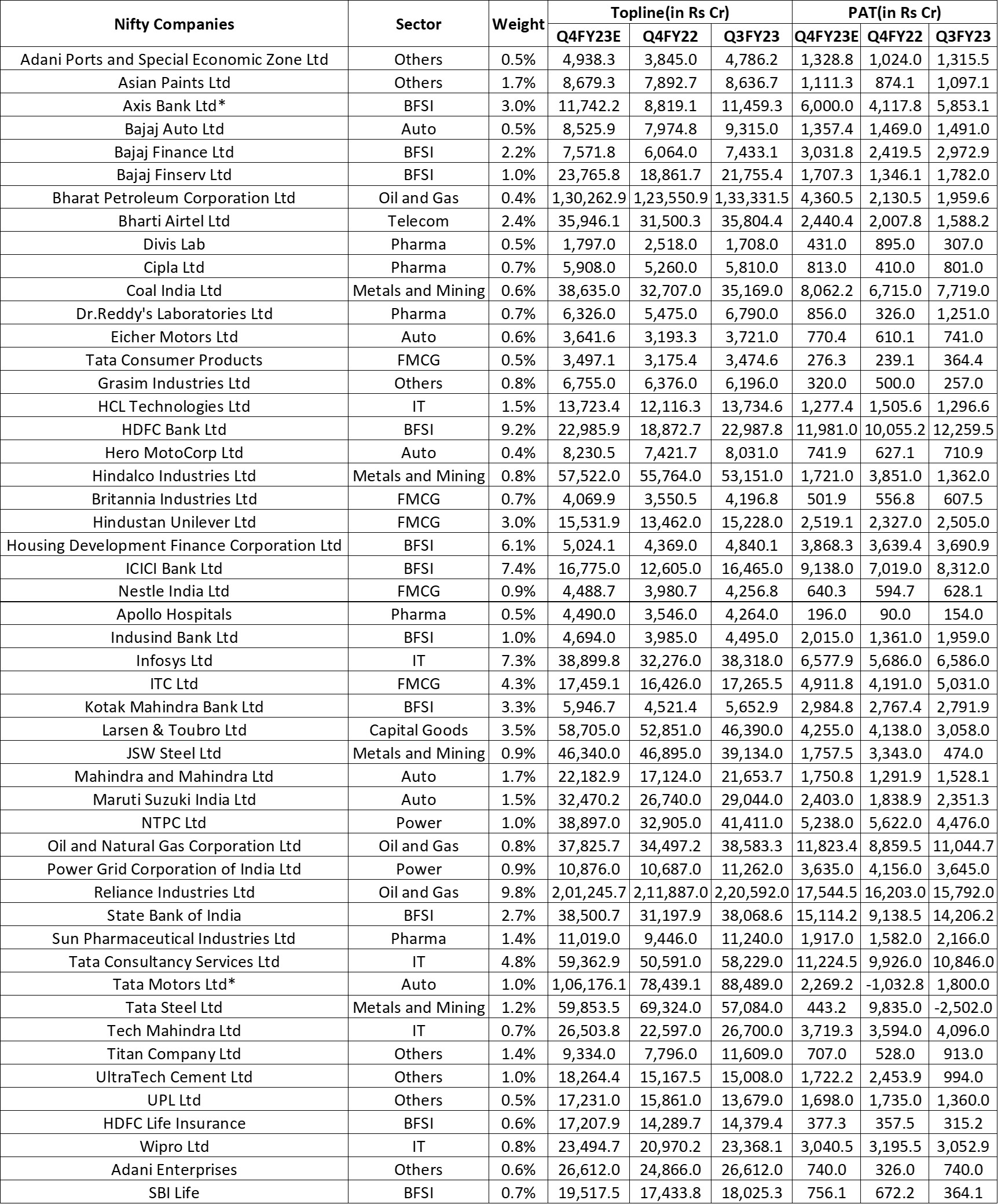

Nifty50 Stocks- Quarterly estimates for Q4FY23E

*Axis Bank and Tata Motors adjusted for one offs

TCS and Infosys have announced their numbers which were a bit disappointing on overall basis.

Infosys: Revenue and PAT stood at Rs 37,441 cr and Rs 6,128 cr respectively.

TCS: Revenue and PAT stood at Rs 59,162 cr and Rs 11,392 cr respectively.

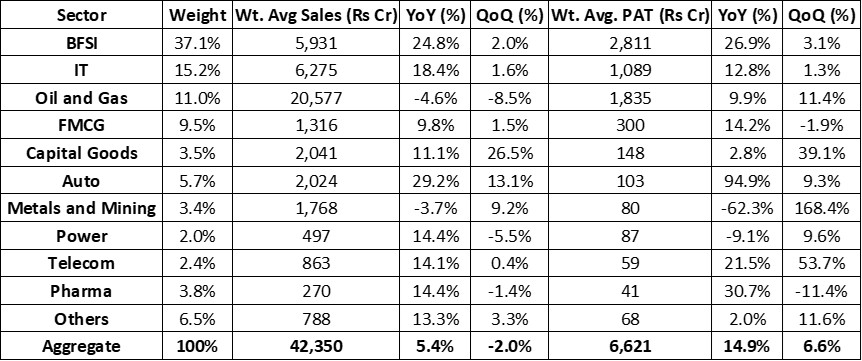

Nifty50 Sectors- Quarterly estimates for Q4FY23E

*Axis Bank and Tata Motors adjusted for one offs

- On weightage average Basis, Nifty Earnings in Q4FY23 is expected to be healthy double digit on YoY basis and high single digit on QoQ basis.

- On the topline front we expect we expect Nifty topline to grow 5.4% YoY with key drivers for topline growth being BFSI space (topline up 25% YoY amidst healthy credit growth), IT domain (up 18% YoY amid healthy order booking and INR depreciation benefits) and Auto Sector (up 29% YoY amid healthy volume prints at JLR). Topline growth is tad muted amidst deflationary scenario in commodity space namely the Oil & Gas (topline down 5% YoY) as well as Metals.

- On the bottom-line front, Nifty PAT is seen growing healthy 15% on YoY basis in Q4FY23. Bottomline growth for the Index will be driven by Auto Space (up 95% YoY amid growth in volumes primarily Tata Motos), BFSI (up 27% YoY amid elevated NIM’s and lower credit costs), Pharmaceuticals (up 31% YoY amid traction in branded generics and US speciality) and Telecom domain (up 22% YoY amid healthy ARPU growth)