Gold Outlook 2026

Gold emerged as one of the strongest performing assets in 2025, delivering an exceptional rally across global and domestic markets. Prices surged to record highs, supported by a rare alignment of macroeconomic uncertainty, central bank demand, geopolitical risks, and a weakening dollar. As markets enter 2026, the key question is whether gold can sustain these levels or whether the rally pauses after such a sharp rise.

The outlook for gold in 2026 points to moderation rather than a sharp reversal. While near term volatility and profit booking cannot be ruled out after a strong run, structural demand drivers remain firmly in place. Central bank buying, de-dollarisation, rising global debt, expectations of further United States Federal Reserve rate cuts, and continued investment demand are expected to limit the downside and keep gold well supported.

How Gold performed in 2025

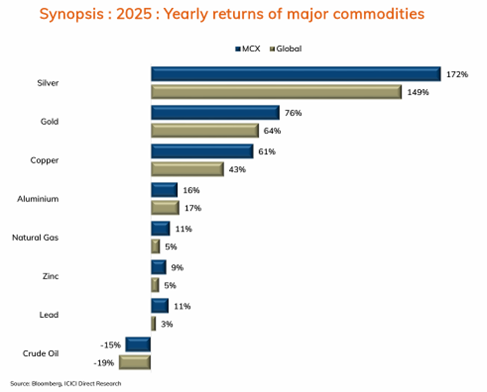

The year 2025 proved to be historic for precious metals. Gold prices rallied sharply and touched record highs on both global and Indian exchanges. On the global front, gold prices surged to an all-time high of around 4,550 dollars per ounce. In India, MCX gold delivered strong returns, outperforming most asset classes.

Gold was not alone in this rally. Silver delivered even stronger returns, while base metals such as copper also ended the year on a positive note. However, gold stood out due to its dual role as a hedge against uncertainty and a store of value.

What triggered the sharp surge in gold prices

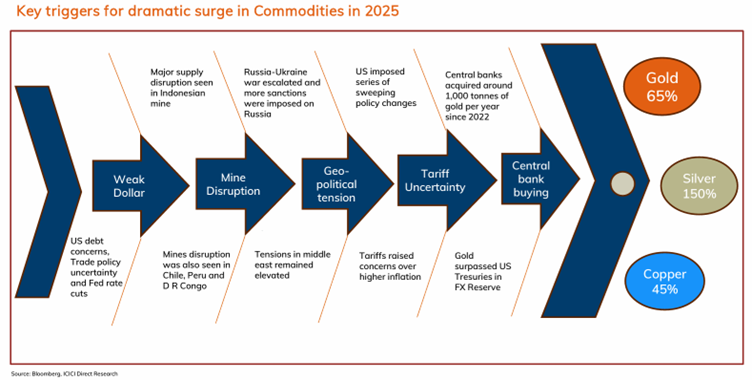

Key factors that supported gold prices in 2025 are:

• Rate cuts by the United States Federal Reserve

Expectations of monetary easing weighed on the dollar index. As the dollar weakened, gold became more attractive for global investors.

• Weakness in the United States dollar

Concerns around United States debt and trade policy uncertainty weighed on the dollar index. As the dollar weakened, gold became more attractive for global investors.

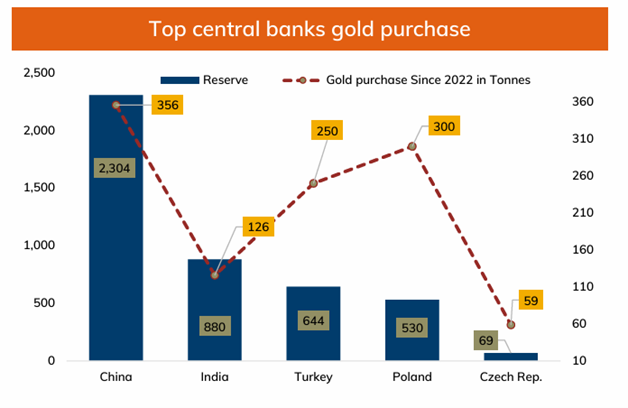

• Large scale central bank buying

Central banks emerged as a powerful source of demand. Since 2022, global central banks have been acquiring around 1,000 tonnes of gold per year. This structural shift reflects a strategic move to diversify reserves and reduce dependence on the United States dollar.

• Geopolitical tensions across multiple regions

Geopolitical risks remained elevated. Tensions in Eastern Europe and ongoing conflict in the Middle East increased demand for safe-haven assets.

• Uncertainty around trade policies

Uncertainty around global trade policies reinforced risk aversion and increased demand for safe-haven assets.

Factors likely to drive gold prices in 2026

As the market moves into 2026, several supportive factors for gold remain in place, even as some headwinds begin to emerge.

Central bank buying and de dollarisation

Central banks are expected to continue adding gold to their reserves in 2026. Gold holdings in global reserves have been rising steadily, and gold has now become the second largest reserve asset after the dollar.

Concerns over the long-term stability of fiat currencies, rising fiscal deficits, and geopolitical fragmentation have reinforced the appeal of gold as a reserve asset.

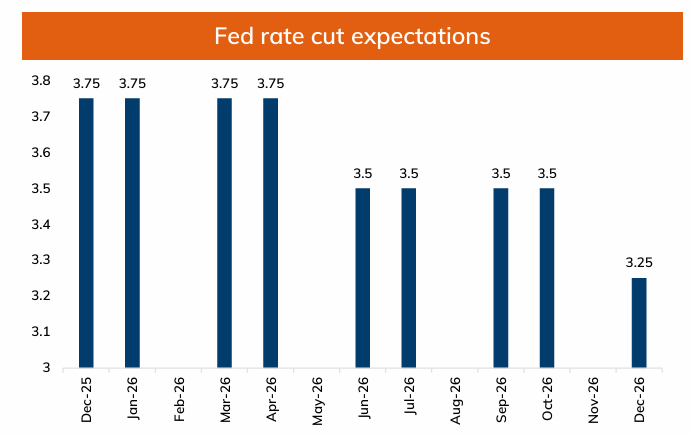

United States Federal Reserve rate cuts

The United States Federal Reserve is expected to cut interest rates more than once in 2026. Lower interest rates reduce the opportunity cost of holding non-interest-bearing assets such as gold.

In addition, concerns around Federal Reserve independence and the upcoming change in leadership have increased uncertainty around future monetary policy. Such uncertainty tends to support gold prices.

Rising global debt and inflation concerns

Global debt levels have reached record highs. Persistent concerns around fiscal sustainability and inflation continue to make gold attractive as a hedge.

Even though inflation has moderated compared with previous years, it remains above long-term comfort levels in several economies. Gold continues to be viewed as a store of value in such an environment.

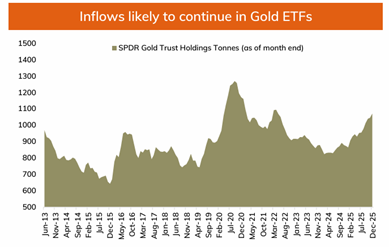

Investment demand and gold ETFs

Investment demand for gold remains strong. Global gold exchange traded funds have recorded consistent inflows, reflecting renewed investor interest.

In 2025, physically backed gold exchange traded funds registered multiple months of inflows. Holdings are expected to rise further in 2026 as investors seek stability amid ongoing uncertainty.

Why moderation in gold prices is likely in 2026

Despite the strong structural support, gold prices may see periods of consolidation in 2026.

After rallying more than 60 percent in 2025, gold is vulnerable to profit booking. Current price levels are less favourable for fresh aggressive investments from a risk reward perspective.

In addition, any meaningful progress toward easing geopolitical tensions, including a potential peace deal between Russia and Ukraine or reduced tensions in the Middle East, could lower risk premiums in gold prices.

Similarly, improvement in trade relations between major economies may reduce safe-haven demand in the near term.

Key support levels and price outlook

While short term corrections cannot be ruled out, ICICI Direct Research team expects structural demand to prevent a major crash in gold prices.

On the global front

• In case of any meaningful correction, gold prices are expected to find support near 3,500 $ to 3,600 $ per ounce

• On the higher side, prices may move toward the 4,800 $ to 5,000 $ range per ounce

On the domestic front

• MCX gold support lies near 1,05,000 ₹ to 1,12,000 ₹

• On the higher side, prices may move towards 1,55,000 ₹ to 1,60,000 ₹

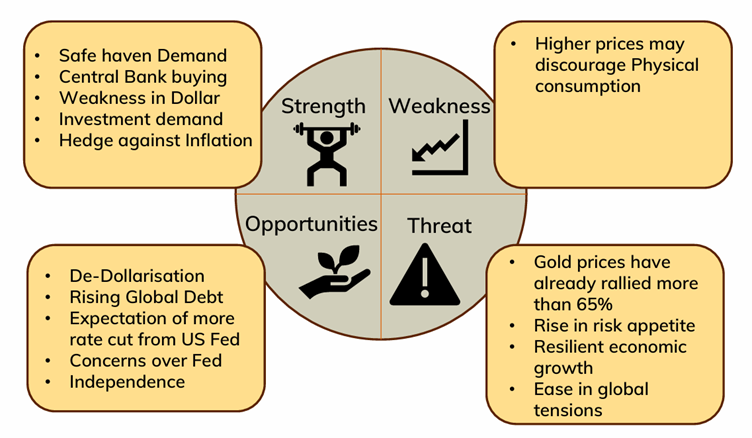

Strengths, risks, and opportunities for gold

Gold enters 2026 with a strong structural foundation, but investors should also be aware of the risks.

Strength

- Safe haven demand

- Central bank buying

- Weakness in the dollar

- Investment demand

- Hedge against inflation

Weakness

- Higher prices may discourage physical consumption

Opportunities

- De-dollarisation

- Rising global debt

- Expectation of more rate cuts from the US Fed

- Concerns over Fed independence

Threat

- Gold prices have already rallied more than 65%

- Rise in risk appetite

- Resilient economic growth

- Ease in global tensions

What history suggests about gold bull markets

Historical data shows that gold bull markets often pause for breath rather than reverse sharply. Past rallies driven by inflation, debt crises, or geopolitical risks have typically seen periods of consolidation before resuming higher.

The current rally shares similarities with earlier phases where central bank actions, currency weakness, and macro uncertainty played a key role.

Summary of Gold outlook in 2026

Gold is likely to remain well supported in 2026, even if the pace of gains slows compared with 2025. Structural demand from central banks, continued investment flows, rising global debt, and expectations of further rate cuts create a strong floor for prices.

At the same time, investors should be mindful of near-term volatility and the possibility of consolidation after a strong rally. Any meaningful correction may offer opportunities rather than signalling a breakdown of the long-term trend.

For investors, gold continues to play an important role as a hedge against uncertainty and a diversifier within portfolios as the global macro environment remains complex.

Read the full report here - https://www.icicidirect.com/mailcontent/idirect_commodityyearly.pdf