BLOG

PSUs on cusp of structural uptrend

What's Buzzing:

PSU companies, which have consolidated over a decade, have been in the limelight in CY23 with many stocks making way to new 52-week/multi year highs and relatively outperforming over the past couple of months. Is it just a short term phenomenon or a structural turnaround?

Context:

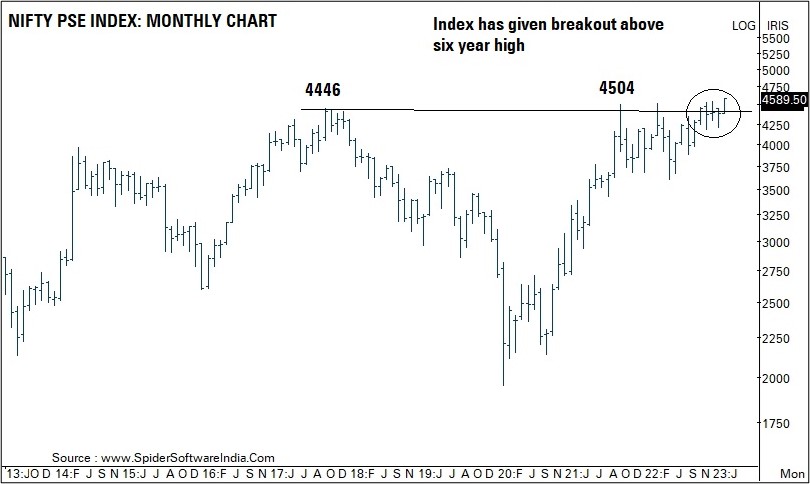

The Nifty PSE index has given a strong breakout from six year’s consolidation range signalling the beginning of a structural uptrend. The bulk of index constituents include old economy stocks from the oil & gas, power and capital goods space, many of which have consolidated for the past many years and are now witnessing multiyear/multi quarter breakouts.

Historically, breakouts post multiyear consolidation and resultant under ownership in such sectors lay the foundation for a new structural bull market that lasts for several quarters or even years and generates above normal returns for investors.

Noteworthy examples are that of the technology sector, wherein a breakout from the 2000-09 consolidation led the index to double over the next few years. More recently, the capital goods sector outperformed after breaking past the 2007-20 consolidation phase wherein some companies gave outsized returns even when benchmarks underwent a consolidation phase.

Our Perspective

The Nifty PSE index has just registered a breakout from the six-year consolidation phase and is placed on the cusp of a structural uptrend, backed by strong breadth. Post such breakouts, temporary phases of consolidation cannot be ruled out, which would offer an incremental buying opportunity. We expect the sector to outperform in coming years wherein companies like NTPC, ONGC, PFC, HAL, BEL, IOC, National Aluminium are expected to outperform and generate ~15-20% returns over the next few quarters.

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Related content

Blogs

Blogs

Articles - Stocks

Advantages and Disadvantages of NPS

It is a long established fact that a reader will be distracted by the readable content of a page when looking at it...

Articles - Stocks

Advantages and Disadvantages of NPS

It is a long established fact that a reader will be distracted by the readable content of a page when looking at it...

Articles - Stocks

Advantages and Disadvantages of NPS

It is a long established fact that a reader will be distracted by the readable content of a page when looking at it...

Video

Video

Video - Stocks

What is Book Value?

Book Value Explained – Find out what is book value in stocks in this video by ICICIdirect.com.

Video - Stocks

What is Book Value?

Book Value Explained – Find out what is book value in stocks in this video by ICICIdirect.com.

Video - Stocks

What is Book Value?

Book Value Explained – Find out what is book value in stocks in this video by ICICIdirect.com.

Podcasts

Podcasts

Top Mutual Funds

Top Mutual Funds