BLOG

Nifty to challenge life time high!

What's Buzzing

The domestic markets have corrected 9% over past three months in the backdrop of resurfaced anxiety around aggressive Fed rate hike. At the current juncture, many participants are puzzled with the question of what lies ahead? Will Nifty retest life time highs?

Context:

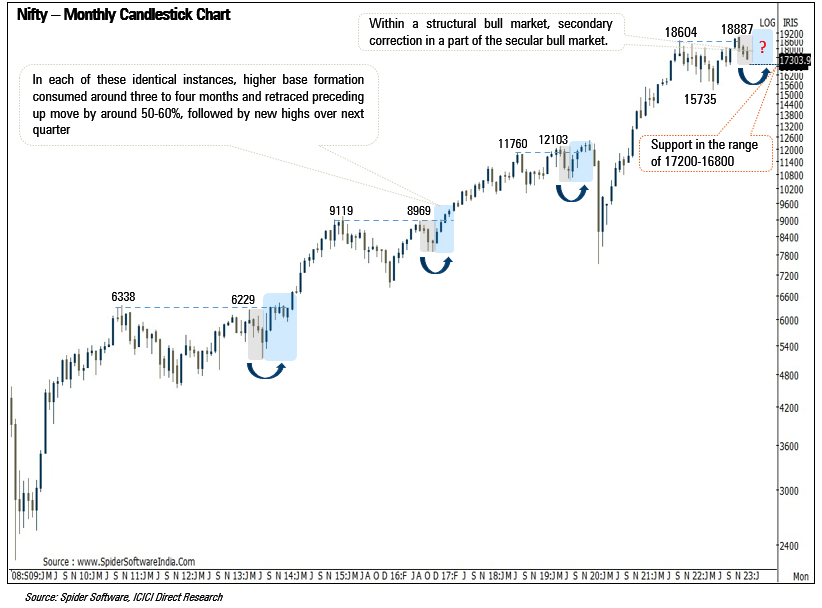

In a secular bull market, a secondary correction is an integral part of the primary bull trend. We believe Indian benchmarks are undergoing higher base formation over the past three months after reversing CY22 decline of 18% and recording new highs in December 2022. While the index has factored in various headwinds in the process, the current context is very similar to that of CY13, CY16 and CY18 phase. In each of these identical instances, higher base formation consumed around three to four months and retraced preceding up move by around 50-60%, then followed by index challenging the new highs over the next quarter.

Our Perspective:

In the current scenario, the index has already retraced 44% of prior up (15183-18887) move over three-month period and is approaching price/time wise maturity of correction. We expect the index to form a major bottom in the range of 17200-16800 and head towards lifetime highs over the next three to four months. However, the move towards lifetime high would not be in a linear manner. Thus, dips from here on should be capitalised on to accumulate quality stocks to ride the next leg of the up move. Sectorally, we expect BFSI, IT, Capital Goods, Auto, PSU to lead the index higher.

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Related content

Blogs

Blogs

Articles - Stocks

Advantages and Disadvantages of NPS

It is a long established fact that a reader will be distracted by the readable content of a page when looking at it...

Articles - Stocks

Advantages and Disadvantages of NPS

It is a long established fact that a reader will be distracted by the readable content of a page when looking at it...

Articles - Stocks

Advantages and Disadvantages of NPS

It is a long established fact that a reader will be distracted by the readable content of a page when looking at it...

Video

Video

Video - Stocks

What is Book Value?

Book Value Explained – Find out what is book value in stocks in this video by ICICIdirect.com.

Video - Stocks

What is Book Value?

Book Value Explained – Find out what is book value in stocks in this video by ICICIdirect.com.

Video - Stocks

What is Book Value?

Book Value Explained – Find out what is book value in stocks in this video by ICICIdirect.com.

Podcasts

Podcasts

Top Mutual Funds

Top Mutual Funds