Construction & Engineering company Reliance Industrial InfraStructure announced consolidated Q4FY24 & FY24 results:

Q4FY24 Financial Highlights:

- Total Income for Q4FY24 stood at Rs 2,070.05 lakh, decrease of 1% from Rs 2,080.83 lakh reported in Q4FY23.

- Profit Before Tax (PBDIT) for the same period was reported at Rs 530.00 lakh, compared to Rs 565.80 lakh.

- During Q4FY24, the company acknowledged a share of Rs 81.85 lakh in profits from its associate.

- Net Profit, excluding exceptional items, reached Rs 369.24 lakh in Q4FY24, an increase of 2% compared to Rs 362.30 lakh in Q4FY23.

- Earnings per Share (EPS) for Q4, before exceptional items, was Rs 2.45, indicating an improvement from Rs 2.40 in the previous year.

FY24 Financial Highlights:

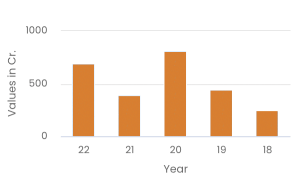

- For FY24, total income increased by 2% from Rs 8,093.57 lakh in FY23 to Rs 8,269.81 lakh in FY24.

- Net Profit for FY24 stood at Rs 1,331.84 lakh, a rise of 38% over the last year.

Dividend:

- The Board has recommended a dividend of Rs 3.50 per share for FY24, amounting to a total of Rs 528.50 lakh.

Invest

Invest