Learning Modules Hide

Hide

- Chapter 1: Introduction to Equity Investments

- Chapter 2: Risk & Return on Equity Investment

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Valuation Terms Explained – Part 1

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 - How Foreign Investments Influence Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 13: IPO investment and FPO

Browsing through the news headlines, you come across this one which says -

“Swiggy files draft paper for Rs. 10,000 crore IPO”

It is safe to say you've heard about this company before. It's hard to overlook this major food delivery platform with such a large fleet on the road.

Say you realize buying the shares of this company may earn you good returns in time.

Well then, you obviously don’t want to miss out on the opportunity to grab the shares as early as possible.

And lucky for you, an IPO is as early as it can get!

But how to invest in an IPO?

How to invest in an IPO

To invest in IPO shares, you need a demat and trading account. In the previous chapters we seen the importance of holding a demat and their relevance in buying and holding in equity investments.

Your trading account will allow you to trade in the shares of your choice, while your demat account will hold your securities in electronic format.

Sounds like a lengthy process, doesn’t it?

Well, this is quite a lengthy process. But then SEBI introduced the ASBA (Applications Supported by Blocked Amount) to improve and speed up the IPO process.

With ASBA, when you apply for an ongoing IPO, the application amount gets blocked in your bank account directly.

Are you worried about what might happen if you are not allotted any shares?

Don’t worry. The amount is temporarily blocked and will only be debited once you are allotted the shares. If none or fewer shares are allotted to you, then the pending amount is unblocked.

Here's an example.

Let's say you applied for Supertronic Pharmaceutical shares worth Rs. 1.5 lakh through ASBA. You received an allotment for only Rs. 60,000. So, under the ASBA IPO, only Rs. 60,000 will get debited, and the restrain on the remaining amount is lifted from your bank account.

Did you know?

ASBA was introduced by the Securities and Exchange Board of India (SEBI) in September 2008.

So, here are the steps you will need to look into, to invest in an IPO:

- Choose the IPO to invest

- Arrange for funds

- Open a demat and trading account, if you don’t have

- Look into the ASBA application in your trading account

- Bid for at least minimum number of shares as specified in the company's prospectus

Now, you will need to wait until the book building process is completed and you are allotted the requisite shares.

On completing the allocation process, shares will be credited to your demat account. Following that, the shares will also be listed on the stock exchange. The whole process will take around 10-12 days.

As we saw earlier, the allotment of shares will depend on the demand for the IPO issue compared to the number of shares the issuer offers. So that means, if the demand has exceeded the number of shares offered, you are likely to get fewer shares than you had applied for.

In some cases, it is may so happen that you do not receive any shares due to an enormous over-subscription.

Now you know how a company can raise the capital via an IPO.

But what happens if a promoter of a company wants to sell their stake in the listed company?

Well, they can do that too via Offer for Sale (OFS).

What is OFS (Offer for Sale)?

In the case of a listed company, an Offer for Sale (OFS) can only be managed through the special window provided by the stock exchange. The company determines a floor price and accepts bids placed for that price or at a higher price.

However, as per SEBI guidelines, only the listed companies with a market capitalization of Rs. 1000 crore and above can use OFS to raise funds. However, in the case of non-listed companies, an IPO can also be in the form of OFS, where existing shareholders sell their stake instead of a company issuing new shares. In the case of OFS, the money raised would be used to pay back the promoters who sold their stake in the company.

Anyone except the seller can invest in OFS, including retail investors, enterprises, Foreign Institutional Investors (FIIs), and Qualified Institutional Buyers (QIBs). As per SEBI guidelines, a minimum 10% reservation is mandatory for retail investors, and as a retail investor, your bid should not exceed Rs. 2 lakh. Also, with OFS, there is no specific lot size required unless the promoter specifies them. This means you can even bid for just one share.

However, it is vital to know that the duration of the OFS would be as per the trading hours of the secondary market and will be open for two business days. Only Non-Retail Investors would be permitted to place their bids on the first day of the OFS, denoted as T day, and carry forward their bids to the next day. Whereas retail investors can start trading only from (T+1) day.

Now let’s look at another scenario. Let’s say a company is already listed in the stock exchange via IPO but their business requirement increases and now they need more money to expand. Could they have another IPO?

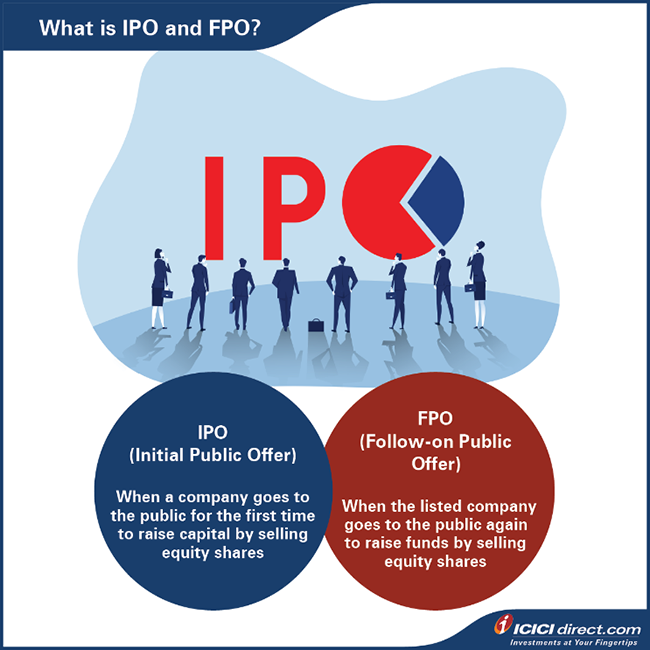

Well, this is the reason why Follow-on Public Offer (FPO) was introduced.

What is FPO?

See, the thing is that when a company is listing its shares on the stock market in an attempt to raise capital, it does not mean that all it will never need any more funds. On the contrary, the company might require more funds in the future to expand its brand, launch new products, build new business lines and more. So, in such an event, if the company is not interested in taking on debt, it opts for an FPO (Follow-on Public Offering).

Here, the company offers a price band within which bids must fit in — neither high nor low than the price mentioned in the price band. If the company decides to take the FPO route, it must issue a prospectus and go through the IPO process of filing the prospectus with SEBI and hiring managers who will take care of the sale.

Like every other form of investment that requires your due diligence, the same is advised before investing in an IPO. After all, when you decide to invest in an IPO, you do so to build your wealth.

Additional Read: How to track upcoming initial public offerings (IPOs)

Summary

- To invest in an IPO, you need a demat and trading account.

- The trading account will allow you to trade in the shares of your choice.

- The demat account holds your securities in electronic format.

- The allotment of shares will depend on the demand for the IPO issue compared to the number of shares the issuer offers.

- An OFS will help promoters of the company sell their shares and reduce their holdings.

- An FPO allows a company that is already listed in the stock exchanges to issue new shares to the public.

And finally, in the following chapter, let’s understand the advantages of investing in an IPO.

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. Please note, IPO related services are not Exchange traded products and I-Sec is acting as a distributor to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Please Enter Email

Thank you.

COMMENT (0)