Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 6: Risk Reward Matrix for Investment

You must have heard the phrase – No risk, no reward!

No one took that quote more seriously than Amar. As he finally stood on the peak of Mount Everest, he truly understood the meaning of earning his reward. As the tears gushed down his cheeks, the 11 months of rigorous training and risk he took to train his body, flashed before his eyes. But as he absorbed the majestic view in front of him, he realized that his efforts and risks were not in vain.

The same applies to investing. Every investment comes with a certain degree of risk. While you cannot avoid the risk, you may be able to mitigate it by being financially aware and understanding your risk appetite.

Did you know?

Mark Zuckerberg had this to say about risks – “The biggest risk is not taking any risk.

The same applies to investing. Every investment comes with a certain degree of risk. While you cannot avoid the risk, you may be able to mitigate it by being financially aware and understanding your risk appetite.

So, if you have to reach your goals, you need to invest. But if no investment is truly risk-free, how can you reach your goals? Now that's a dilemma! But there's a way around it. You can look at ways of stepping up your reward potential by diversifying into the right assets to help mitigate market volatility and ensure that your financial goals are on course.

Risk reward matrix for investments

“I want to be a crorepati.”

“I wish I had a million dollars.”

Who hasn't wished for these? It's of course natural to wish for a lot of money, but unfortunately that doesn’t happen overnight.

Every investor looks for an investment avenue that would give them the best of returns and as soon as possible. But the key here is to remember that it’s better to go slow in the right direction than to go fast in the wrong direction.

And as they say – all good things take time. Similarly, investments too, take time to grow.

Now, concerning investments, an important factor to consider is the risk to reward ratio.

Are you wondering what’s risk/reward ratio?

Well, here’s an example –

Two friends, Anil and Sunil decide to indulge in an Instagram trend of ‘coin toss’. In this game, Anil suggests that both of them put in Rs. 500, making it a joint contribution of Rs. 1000. On tossing the coin, if it lands on heads, Anil will win the total amount. If it lands on tails, Sunil stands to win. Now, here the risk to reward ratio is 1:1, as both Anil and Sunil have a 50% chance of winning an amount equal to the amount they put in.

It doesn’t seem like an interesting offer, does it? Sunil felt the same and decided not to play.

On hearing this, Anil decided to raise the stakes. He tweaks the game and suggests that if Sunil contributes ₹500, Anil would place triple the amount, that is ₹1500 for the same deal. He then looks at Sunil, whose eyes suddenly light up at the prospect of winning a larger sum at the cost of a lower contribution.

Now this seems exciting, doesn't it? Sunil still has a 50% chance of winning. But if he wins, he stands to earn Rs. 1500, 3 times more than what he put in. So, the risk to reward ratio here is 1:3.

If you were to understand this in technical terms, the risk to reward ratio is a useful assessment that helps gauge the profit (reward) of an investment relative to its potential loss (risk).

Previously, we learned that every investment comes with a specific degree of risk.

In the investment world, “higher investment risk indicates an opportunity for higher returns on an investment.”

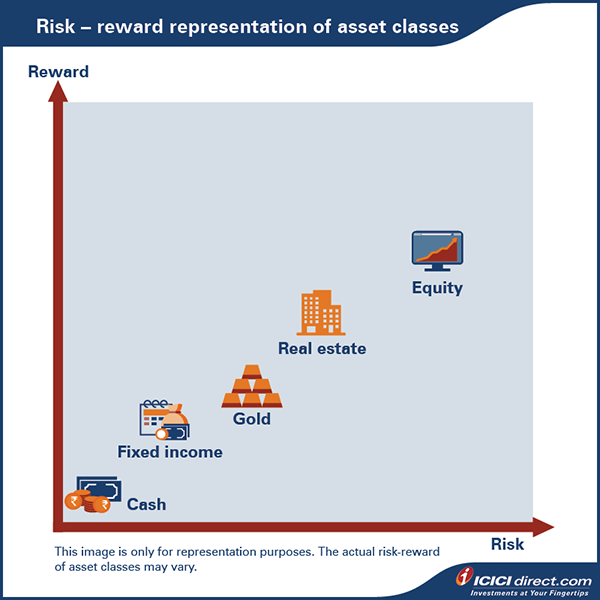

Here we look into popular assets and their risk-reward ratio to understand what you can expect from investing in them.

Equity

Shares and equities are highly volatile, which makes it the riskiest as compared to all other assets. However, it has the highest potential of earning you high return in the long run.

Debt/bonds

Debt securities are issued with the promise of payment of interest. Since the risk involved is less, the returns earned over time may not be significantly large as it is in the case of equities.

Real estate

The nature of the real estate market is unpredictable. Key risks depends on several factors like locations, demand, structural issues, lack of liquidity. Based on all these factors, the risks involved in investing in real estate lies plausibly between that of stocks and bonds.

Gold

When it comes to investment risks associated with gold, it may include the cost of storing and insuring the precious metal. But today, you also have options to invest in gold through Sovereign Gold Bonds (SGB), digital gold, Gold ETFs and gold mutual funds. Investing in gold gives you diversification power and a unique mix of reward features. However, the risks involved with commodities like gold would depend upon the demand and supply of the same in the market.

Here’s a recent study of the above mentioned asset returns over time

Investments in different assets will give you different growth rates.

Historically, assets falling in different risk categories have shown the following rate of returns:

|

Asset Class |

Return p.a. |

|

Equity 1 |

12.58% |

|

Debt/Bonds 2 |

7% |

|

Real Estate 3 |

5.59% |

|

Gold 4 |

7.62% |

- Sensex return for the period between 1 Jan2001 -1 Jan 2021, Source: bseindia.com

- Long duration, debt fund category returns for 10 years as on February 13,2021, Source: Morningstar.in

- NHB RESIDEX return for the period of Jun 2010 – June 2020 Source BIS: Real Residential Property Price Index

- Precious metals category returns for last 10 years as on February 13,2021, Source morningstar.in

Reading about all the varying degrees of risk that every investment carries, you may be wondering, what if you just keep the money at home? Wouldn’t that mean zero risk?

No, it won’t. For one, keeping cash at home may be risky. Or just keeping money in your savings bank account would subject it to inflation. This would mean the money will keep losing its value over time. And that’s an additional risk you would be taking.

Summary

- Consider diversifying into the right blend of assets to help cut market volatility and investment risks.

- Remember to look into investment risks before investing in any asset.

- Equity investments have historically provided exceptional returns in the long run.

- Investing in bonds offers benefits of stable returns and diversification.

- When considering investing in real estate, look into various risk factors and craft a sound exit strategy.

- Gold investments are popular thanks to their hedge over inflation and diversification power.

You now know the various investment options and the risks involved. Next, let’s figure out how to assess your risk tolerance and understand the different strategies that you can deploy to manage them.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)