Data Patterns is a vertically integrated Defense and Aerospace solutions provider. It was incorporated in 1998 in Bangalore, Karnataka, as a Private Limited Company. The company’s standalone net sales for the quarter ended March 2022 stood at Rs. 170.54 crore. It was up 8.58% Y-o-Y. On 15 June 2022, the company’s market capitalisation stood at Rs. 3,643 crore.

Data Patterns’ share is listed on the Bombay Stock Exchange with the code 543428, and on the National Stock Exchange with the code DATAPATTNS.

The company was formerly registered as Indus Teqsite Private Limited. It became Data Patterns (India) Private Limited in August 2021. In September 2021, the company went public. It caters to the industry of indigenously developed defence products. Its product range includes COTS Boards, ATE & Test Systems, Electronic Warfare, Space Systems, Power Supply, Naval Systems, and Launch and Fire Control Systems, among others.

Data Pattern’s balance sheet recorded total assets worth Rs. 328.39 crore for the FY 2020 - 2021. The current assets were worth Rs. 261.33 crore, and the non-current assets worth Rs. 67.06 crore. The total shares outstanding were 0.93 crore.

The top management of the company includes Mr Srinivasgopalan Rangarajan as Managing Director. The directors on the board committee are Ms Rekha Murthy Rangarajan, Mr Mathew Cyriac, Ms Sabitha Rao, Mr Venkata Subramanian Venkatachalam, Mr Sowmyan Ramakrishnan, Mr Prasad Raghava Menon, and others. The auditors of the company are RGN Price & Co.

As of 31 March 2022, 45.62% of the company’s shares belonged to the promoters, while 44.89% belonged to the public.

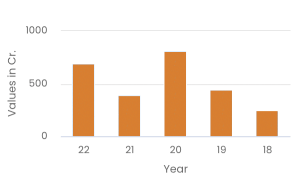

Data Patterns’ share price on NSE was trending at Rs. 702.50 on 15 June 2022. On BSE, Data Patterns Ltd.’s share price was trending at Rs. 700. The 52-week high for Data Patterns’ share price was Rs. 935.15, and the 52-week low for Data Patterns’ share price was Rs. 575.00.

Disclaimer- ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Data Patterns (India) share price as on 18 May 2024 is Rs. 3188.8. Over the past 6 months, the Data Patterns (India) share price has increased by 71.79% and in the last one year, it has increased by 107.57%. The 52-week low for Data Patterns (India) share price was Rs. 1564.95 and 52-week high was Rs. 3208.95.

Invest

Invest