Yes Bank Saga: Will the past glory come back?

After being away from the limelight for three years, Yes Bank is back in the news. We thought of covering the Yes Bank Saga after covering the Paytm Saga earlier in the week. We hope you have already checked our writeup on Paytm. Then Yes Bank shares have been up nearly 30% this week. What is driving the rally, and what should investors expect? We try to answer these questions in this article.

Yes Bank's Recent Quarter Result

In the last week of January, Yes Bank reported its Q3FY24 numbers. The numbers were good, with profit increasing 4X to Rs 231 crore and Net Interest Income to Rs 2,016.8 crore. The Gross Non-Performing Assets (NPA) remained at 2% - the same as last year in the same quarter. The Net NPA came down marginally from a percent to 0.9%.

The Reason for the Recent Rally

The rally started with the news of HDFC Group increasing its stake in Yes Bank (please note that the stake increase is by HDFC Group and not the bank).

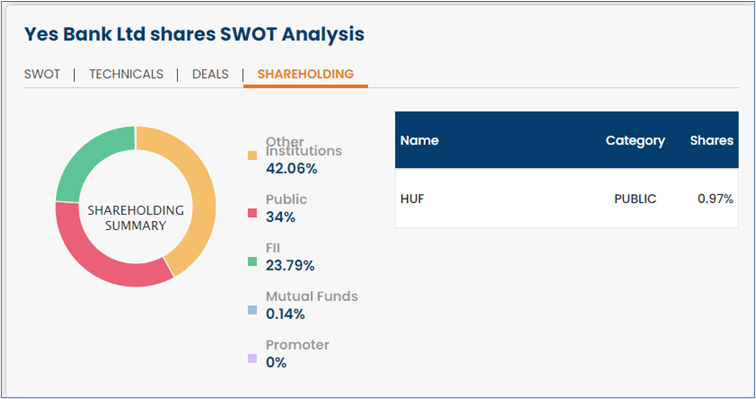

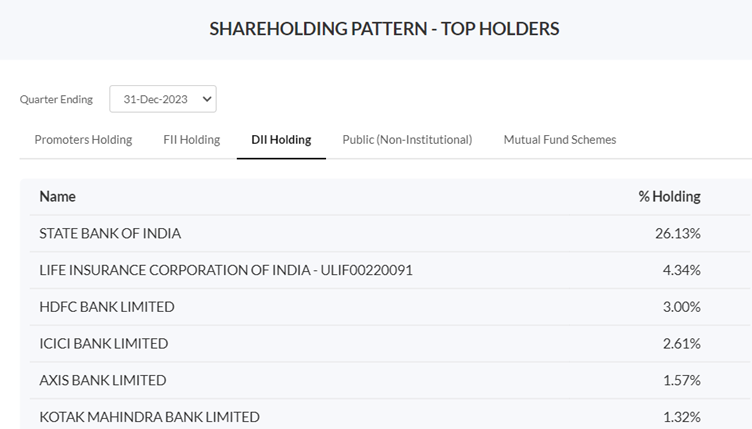

At the end of the December quarter, HDFC Group had a 3% stake in Yes Bank. You can see in the below image that other banks have holdings in Yes Bank. If you are wondering why so many banks, including SBI, are holding stakes in a bank, we will answer that in a while.

The news is that the Reserve Bank of India (RBI) has granted approval to HDFC Bank and its related entities to increase their stake in Yes Bank up to 9.5%. The approval is valid for a year. So, if HDFC is interested in increasing its stake in the bank, it needs to execute the trade within a year. If they fail to do it, the approval will be revoked.

The RBI has said that HDFC should acquire a stake as a paid-up share capital or aggregate holding of voting rights. The approval for acquiring the stakes is for investments by HDFC AMC, HDFC Ergo, and HDFC Life Insurance.

The roadblock to the share price increase came on 8th February with reports that SBI is likely to sell a stake in Yes Bank worth Rs 5,000 - Rs 7,000 Cr through a block deal. However, on 9th February, both SBI and Yes Bank confirmed that the news is speculative and that there is no plan for SBI's stake sale via the block deal. As a result, Yes Bank's share price jumped again on Friday.

The Fall of Yes Bank

Yes Bank was among the top private banks in India a decade ago. However, issues started coming in in 2017. The bank faced financial instability due to a combination of factors, including a high level of bad loans, governance issues, and regulatory concerns. The bank had substantial exposure to troubled sectors like real estate and infrastructure, leading to a deterioration in its asset quality.

Between 2018 and 2019, Yes Bank saw a series of resignations from its board of directors and top management. It raised concerns among investors and depositors about the bank's governance practices and its ability to manage its financial affairs effectively.

The Revival of Yes Bank

The Reserve Bank of India intervened to address the growing concerns about Yes Bank's financial stability. In March 2020, the RBI imposed a moratorium on Yes Bank, restricting withdrawals and imposing a temporary cap on deposit withdrawals to prevent a potential run on the bank.

To facilitate the restructuring and revival of Yes Bank, the RBI initiated a rescue plan that involved other banks and financial institutions stepping in to support the troubled lender. The State Bank of India (SBI) played a crucial role in leading the rescue efforts. And this is how it ended up having a high stake in the Yes Bank.

Following the intervention by SBI, LIC, and other investors, Yes Bank underwent a restructuring process to strengthen its balance sheet and improve its governance practices. It raised additional capital through a combination of equity infusions and bond issuances to shore up its capital reserves.

Over the last three years, the Yes Bank has been able to clean up its bad book. At one point, it had a Gross NPA of over 15% and a Net NPA of over 5%. As seen in the recent quarter result, the percentage has come down significantly.

The Future

In the last six months, the bank has surged by nearly 85%. How much more share will increase from here? The movement will be driven by several factors. Whatever the price increase, it won't be touching its lifetime high of nearly Rs 400 in the foreseeable future! Yes, despite the recent positive developments, it has been one of the biggest wealth destroyers.

In the short term, profit bookings can be seen. Long-term investors need to monitor the upcoming quarterly results (focusing on profitability and NPA) and the buying by HDFC Bank - how it turns out.

With the support of SBI, LIC, and other stakeholders, Yes Bank managed to stabilize its operations and gradually recovered from the crisis. It has been able to stand up on its feet with the support of others - it is time to climb the mountain, with or without support from peers.