Vodafone Idea FPO: India's largest FPO

The India's biggest Follow-on Public Offer is going live on 18 April 2024. It will surpass Yes Bank's FPO of Rs 15,000 crore which came in July 2020. In this article, we will cover everything you need to know related to Vodafone Idea FPO.

Vodafone Idea FPO: Key Details

Below are the key details related to the VI FPO:

- Issue Window: 18 April to 22 April

- Issue Size: Rs 18,000 crore

- Price Band: Rs 10 - Rs 11

- Lot Size: 1,298 Shares

- Issue Details: Fresh Issue

- Minimum Investment: Rs 14,278

What is FPO?

First things first, what is an FPO? Before we get into Vi's FPO details, let us understand FPO and how is it different from IPO. A Follow-on Public Offer (FPO), also known as a secondary offering, is a process that allows a company already listed on a stock exchange to issue new shares to the public to raise additional capital. It is essentially a way for the company to go back to the public market and ask for more money after its initial public offering (IPO).

|

Feature |

Follow-on Public Offering (FPO) |

Initial Public Offering (IPO) |

|

Definition |

Issuance of additional shares by a publicly traded company after its initial public offering (IPO). |

First time a company offers its shares to the public for investment. |

|

Timing |

Occurs after a company has already conducted an IPO. |

Occurs when a company decides to go public for the first time. |

|

Purpose |

Typically used by a company to raise additional capital for expansion, debt reduction, or other corporate purposes. |

Used by a private company to raise capital for growth, expansion, or other strategic initiatives. |

|

Shareholders |

Existing shareholders can participate in the FPO by purchasing additional shares. |

Initial shareholders, founders, and early investors sell their shares to the public. |

|

Dilution |

Existing shareholders may experience dilution of their ownership stake if new shares are issued at a lower price than their original purchase price. |

Founders and early investors may experience dilution of their ownership stake as new shares are issued to the public. |

|

Allocation |

Allocation of shares may prioritize existing shareholders, institutional investors, or retail investors, depending on the company's strategy and market demand. |

Allocation of shares is typically managed by underwriters and may involve institutional investors, high-net-worth individuals, and retail investors. |

|

Pricing Mechanism |

Shares may be priced based on prevailing market conditions, company performance, and investor demand. |

Pricing is determined through a combination of factors, including company valuation, market conditions, and investor demand. |

Vi's FPO: Company Details

Vi is the 3rd largest telecommunications service provider in India based on subscriber base. The company is the 6th largest cellular operator globally in terms of number of subscribers in a single country of operations. They offer voice, data, enterprise, and other value-added services, including short messaging services and digital services across 2G, 3G, and 4G technologies. The company also offers connectivity services to enterprise customers.

It holds active licenses for national long-distance, international long-distance, and internet service providers, and registration for infrastructure provider services. The company has obtained 326 trademark registrations for its brands and has also applied for two additional trademark registrations.

Vi’s mobile network reach is across 4,87,000+ towns and villages in India, with broadband services in 3,42,200+ towns and villages, each as of December 31, 2023. As of December 31, 2023, the company’s sales & distribution network included over 10,000 distributors, 7,87,000 multi-brand retailers, 2,400 franchise outlets, and 20,000 sales promoters strategically positioned across urban and rural markets.

Vi's FPO: Issue Objective

Of the total FPO proceeds, the company proposes:

- To use Rs 12,750 crore for the purchase of equipment for the expansion of its network infrastructure by setting up new 4G sites; expanding the capacity of existing 4G sites, and setting up new 5G sites.

- Of the remaining, Rs 2,175.31 crore from the FPO proceeds has been set aside for deferred payments for spectrum to the Department of Telecom and the GST.

- The remaining funds will be used for general corporate purposes.

Vi's FPO: Financials

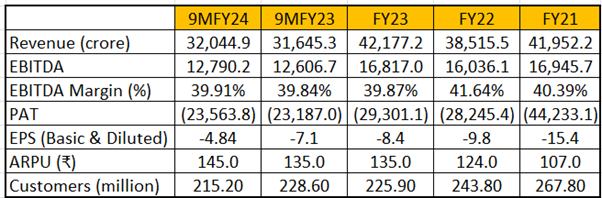

Here are the financial numbers of Vi from recent financial years.

- The company has not seen any growth in its topline. For FY21, the revenue was Rs 41,952.2 crore, which has increased marginally to Rs 42,177.2 crore after a decline in FY22. In 9MFY24, the revenue reported was Rs 32,044.90 crore.

- The EBITDA has remained at the same levels without any growth in it. In FY21, the EBITDA was Rs 16,945.7 crore, and it reduced to Rs 16,817 crore in FY23.

- The same holds for EBITDA margins - they have declined from 40.39% in FY21 to 39.87% in FY23. In 9MFY24, the margins were 39.91%.

- They have continuously reported losses since FY21 and they reported a loss of Rs 23,564 crore for the nine months ended December 31, 2023.

- The Average Revenue Per Issue (ARPU) has increased from Rs 107 in FY21 to Rs 145 in FY23.

- The number of customers has continuously declined.

Vi's FPO: Risks

- They require significant capital to fund their capital expenditure and working capital requirements and if they are unable to raise additional capital, the business, results of operations, financial condition, and cash flows could be adversely affected.

- Vi has incurred significant indebtedness and has not complied with certain covenants under its financing agreements. Their inability to meet its obligations, including financial and other covenants, under their debt financing arrangements could affect the business, financial condition, and cash flows.

- Their telecommunication licenses and spectrum allocations are subject to terms and conditions, ongoing review, and varying interpretations, each of which may result in modification, suspension, early termination, expiry on completion of the term, or additional payment.

- They face intense competition that may have an impact on their market share and profitability.