Nifty surpassed budget day high and reclaimed 18,000 mark suggesting the end of 10-week corrective phase

- Indian equity benchmarks have been in a corrective phase over two months since recording lifetime highs of 18,800

- Indian equities to catch up global markets: Global setup has been positive since beginning of CY23. Some European indices have hit new lifetime highs while US indices are consolidating after a sharp up move in January. Expect India to catch up

- Market breadth has improved: Advance/ Decline ratio has improved to 1.2 over past few sessions against 0.9 in January indicating improving midcap/small cap participation

- FII selling abating: FIIs turned buyers along with the market recovery. FIIs turned net buyers last week with more than 5,500 crores in the secondary markets. We believe that the selling pressure seen in the early part of Feb was primarily due to stock specific reasons (Adani). Considering fresh flows coming into emerging markets, we expect India will also benefit from it in the days to come.

- Multi sector participation: Sectors like Auto, Oil &Gas, Infra and IT which have remained out of favour over past ~15 months have exhibited strength. The broad based participation along with Banking and Capital gods

- Index heavyweights like Reliance, HDFC twins, Bajaj twins, TCS, Infosys, ITC, Tata Motors, Maruti, L&T amongst others are witnessing improvement either in terms of falling channel breakouts or bullish reversals at key supports.

Gold prices are up 13% in last 4 months. Should one increase weightage to gold?

Gold prices are up 13% in last 4 months, both globally as well as in India). Domestically, it is up 28% in last 2 years (13% CAGR) and 78% in last 4 years (15.5% CAGR). The historical long-term return of Indian gold is around 9% per annum (9% CAGR since 1970). This uptrend since November 2022 is amid moderating US retail inflation numbers and anticipation of a less aggressive US Federal Reserve. Buying by global central banks and anticipated gold demand given the opening of Chinese markets.

Suggested Allocation:

Whenever any asset class has done well (higher return than long term average), it is generally not a time to be overweight. One can be either underweight or equal weight. Generally, we recommend 5%-15% as the normal range of allocation to gold. So, investors may maintain around 10% allocation to gold. Sovereign Gold Bonds (SGBs) remain the best way to take exposure to gold (2.5% p.a. additional interest + No capital gains tax).

Key Q3 results takeaways - Margin recovery was the key highlight

- Nifty operating margins (ex-financials rose) 230 bps QoQ to 17% primarily led by savings realised from lower raw material costs.

- This is post eight quarterly lowest margins witnessed in last quarter i.e., Q2FY23 at 14.7%

- On aggregate basis, Nifty topline for Q3FY23 was largely flat on QoQ basis at Rs 13.4 lakh crore with EBITDA up 16% QoQ at Rs 2.3 lakh crore and PAT by 16.6% QoQ at Rs 1.1 lakh crore.

- Including banks, aggregate Nifty earnings painted a similar picture with topline up 1.6% QoQ and PAT up 13.8% QoQ.

- Nifty EPS for the quarter came in at Rs 205/share vs. our expectation of Rs 195/share, an outperformance of ~5%.

- Outperformance was witnessed across Auto, Capital Goods, FMCG and Pharmaceuticals space while Metals and Oil & Gas space underperformed.

- Auto sector led the margin recovery from the front with key earning surprise from Tata Motors which posted healthy positive PAT after 7 quarters (at ~Rs 3,000 crore).

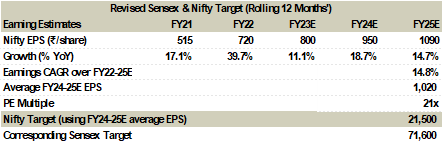

Post Q3FY23 earnings our Nifty EPS does not undergo any major change. We still expect Nifty earnings to grow at a CAGR of 15% over FY22-25 with our fair value for Nifty placed at 21,500 i.e., 21x PE on FY24-25E average Nifty EPS, offering a healthy 20% potential upside. The corresponding Sensex target is placed at 71,600. These are our 12-month rolling index targets.

IT sector has outperformed in 2023 so far. How do you see it performing and top picks in the sector?

What is in their favour

Going forward, IT stocks are expected to gain from

- Continued client spending on cloud transformation journey (multiyear opportunity)

- Clients are looking to use outcomes (or savings) from cost optimization deals to fund cloud transformation journey

- As a thumb rule, US$100 were dollar spent on cloud transformation (before macro concerns known) , US$85-90 are still being spent on cloud transformation, suggesting a criticality of continuation of cloud transformation for clients

- Deal TCV is still strong and not seeing any sign of stress despite companies talked about some pockets of weakness in BFSI, Retail, Telecom, Hi-Tech etc

- Ease of supply pressure helping margin improvement

- Top 5 players likely beneficiaries of vendor consolidation opportunity

- Continued adoption of few technologies across industries e.g AI (Global market to reach US$1394bn by 2029 (CAGR of 20.1%), blockchain, 5G, Low code applications etc.

What can go wrong

- Slower decision making may push Pipeline to TCV conversion which may impact future revenues

- Attrition for niche skills is still high and incremental adoption of these skills may derail attrition downtrend

Top pick: Coforge Ltd Looking for mid-teen growth in FY24 (CMP: Rs 4,213, TP: Rs 4,870, Upside: 16%)

- On the basis of continued strong order booking (YTD order book of US$964mn), the company is looking to end FY23 at 22% CC revenue growth (guidance)

- The company is looking at mid-teen revenue growth in FY24 as they see continued healthy pipeline in the medium term and not seeing any pressure on pipeline to TCV conversion

- LTM Attrition continue to be lowest in the industry at 15.8%

- Travel vertical (20% of the mix) revenue is already above pre-covid level and the company is seeing 25% revenue growth in this vertical in FY24.

- Insurance vertical (22% of the mix) was performing below company’s expectations and there has been a leadership change to drive future growth in this vertical

- We expect the company’s revenues/EBITDA/PAT growth of 17.6%/21.2%/22.3% over FY22-25E

- We value Coforge at 25x FY25EPS to arrive at target price of Rs 4,870

Power sector has been under-performing. Would these sectors see better days ahead and top picks

The power sector has been a decadal (2011-2021) laggard on account of

- Uneconomical thermal projects in 2008 taken by private players,

- Inefficiency of SEB operations which impacted the entire power value chain and

- Transition from fossil energy to renewables.

Going into CY2023, things are looking up for the power sector on account of

- Significant focus of Government to repair the SEB’s via initiatives like smart metering, linking state fiscal deficit in conjunction with reforms in their respective power sector,

- Massive renewable capacity addition coupled with project and tariff economics in place which has further lead to reduce dependence on the coal projects.

Going ahead, we believe integrated incumbent players who have decent coal projects base, strong balance sheet and project execution strength are rapidly diversifying into the alternate energy value chain be it renewables, green hydrogen and nuclear will be future winners. Basis above factors NTPC is our top pick in the power space.

NTPC (CMP: Rs 169, Target: Rs 204, Mcap: Rs 1,63,000 crore, Potential Upside: 23%)

NTPC is India’s largest power generation company with a total installed capacity of ~70,500 MW at the group level. NTPC has 17% of total installed capacity in India with 24% generation share. The company’s vision is to become a 130 GW+ company by 2032 of which 60 GW would be contributed by renewable energy. It was the only company which has added capacity in the coal side over the last 5 years and given strong demand for power (expected to grow 8% over next 5 years) will lead to higher PLF’s and higher incentives for plants crossing 85% PLF. With strong focus on alternate energy spectrum, we believe NTPC may be able to break the underperformance of the last decade and witness a rerating coupled with monetisation of the renewable energy arm in FY23E and strong capacity addition in excess of 3,000 MW on the renewable side. We expect NTPC to have capacity in excess of solar capacity 6,000-7,000 MW by FY25E. The company has also ventured into the green hydrogen projects with projects on pilot basis and has created a JV with NPCIL for developing nuclear power assets. We value the stock at 1.4x P/BV and arrive at a fair value of Rs 204/share.

Oil & Gas sector has been a neglected sector but now silver linings visible for companies in FY24

Upstream companies: Volume growth on the horizon

- Key highlight in this sector would be the commencement in production from KG Basin. Reliance's MJ field is likely to be commissioned in Q4FY23 and would increase the volumes from ~19 mmscmd to ~30 mmscmd by FY24. ONGC's KG-98/2 field is expected to produce its first oil in May/June 2023. Peak oil and gas volume is estimated at 45,000 bpd and 11 mmscmd, respectively.

- Net oil realisation would remain capped at around US$75/bbl in the near to medium term. Going ahead, even if APM gas prices get capped at US$6.5/mmbtu post Kirit Parikh committee recommendations, realisations would still continue to remain relatively high when compared to historical prices.

- We maintain our BUY rating on Reliance with a target price of Rs 3050 based on SoTP method. For ONGC, we revise our rating from HOLD to BUY with a target price of Rs 180 (Rs 150 for core oil & gas business and Rs 30 for subsidiaries and other investments)

Midstream companies: Volume growth coupled with better tariffs to play out well for GAIL, GSPL

- As per Indian Prime Minister, Indias gas pipeline network will expand to 35,000 kms from current 22,000 kms in next 4-5 years. Also, the amendments made to the pipeline tariff structure would help the pipeline companies to realise better tariff charges.

- In the near to medium term, with LNG prices (both spot and long term) declining, gas is likely to become more feasible than alternate fuels. Gail is also in talks with Russia's Novatec and UAE's ADNOC for long term supplies. This would lift the transmission and trading volumes

- We have a BUY rating on both the stocks (Gail and GSPL) with TP of Rs 115 (SoTP) and Rs 360 (SOTP) respectively

Downstream companies: Fortunes changing for CGD landscape

- Lowering input cost of gas (APM expected to be revised via Kirit Parekh recommendations and Lower LNG prices), is making the CGD companies a viable and preferred choice to alternate fuels. This would help IGL and MGL improve their volumes and maintain their margins going ahead.

- Owing to these reasons, we have changed our rating for IGL and MGL from HOLD to BUY with a target price of Rs 490 (17x P/E on FY25E) and Rs 1,000 (12x P/E) respectively. The difference in the valuation largely reflects the long-term volume growth play evident in IGL (each year 1 mmscmd vol addition i.e., 10% CAGR for next 3-5 years) from newer geographies such as Kanpur, Ajmer, Karnal, Kaithal, Muzzafarnagar etc vs 5% volume growth for MGL in next 3-5 years

Hidden Gems

Bosch Ltd (CMP: Rs 17,950; MCap: Rs 53,000 crore, Rating: Buy, Target Price: Rs 20,000)

- Bosch Ltd (Bosch) is a technology leader providing solutions in automotive, industrial technology, consumer goods, energy & building technology. Mobility solutions (automotive products) comprised ~85% of FY22 sales with share of Business Beyond Mobility pegged at ~15%. Within mobility, it has large presence in diesel-dependent vehicles (SUV’s, CV’s) & Tractors.

- We like Bosch given its Leadership positioning in powertrain technology with parent supported ready solutions for Flex Fuel, BS VI phase II transition, EVs and hybrids. The company stands to benefit from industry tailwinds in the form of healthy volume growth, diesel powertrain gaining traction domestically and incremental role to play amidst more stringent emission control norms (BS-VI phase 2 and beyond).

- Amid strong focus on increasing domestic sales with underlying focus on exports (~9-12% of sales), we build in 18.2% sales CAGR over FY22-24E. Operating leverage gains and localisation push is seen aiding margin improvement to 14.5% by FY24E with consequent PAT growth pegged at 23.1% over FY22-24E. With Cash positive B/S and Capital efficient business model, we have a BUY rating on the stock, valuing it at Rs 20,000 i.e. 32x PE on FY24E EPS of Rs 625/share.

- The company is a key beneficiary of rise in commercial vehicle sales consequent to robust capex spend by government for FY24E (at Rs 10 lakh crore, up 33% YoY) as well as rise in tractor sales amidst upbeat farm income.

- In the recent AMFI reclassification based on market cap, Bosch was also reclassified as a Large Cap from mid-cap earlier and hence could also see more institutional participation and fund buying.

Conclusion

Expect India to catch up on Improving market breadth, revival in sector lagging in participation, receding global recession fears on strong US jobs data despite sticky inflation and FII turning net buyers.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.