Nifty recovery may accelerate if nifty sustains above 17,800 levels

- Nifty traded volatile in 17,200-18,000 band in budget week as index continued to face selling pressure

- In coming week, we expect index to trade in the 17,200-18,000 range amid stock specific action. Key monitorable will be that Nifty and Bank Nifty both holding their 52-week EMA (17,300 and 39,200 respectively)

- While Adani Group stocks have led the declines but index heavyweights from Technology and FMCG space held the Nifty near 17,600 levels. Expect IT, Auto, Infra to relatively outperform in coming week

- From the volatility perspective, post budget Indian VIX has declined considerable to near 15 levels despite large index moves. Since most of the results from index heavyweights is over along with the crucial events, markets are likely to stabilize near current levels

- Going ahead, while we are witnessing signs of support at lower levels near 17,500, but we believe that a move above 17,800 may expedite the recovery considering huge short positions prevailing in Index.

- Nasdaq gained 5% (S&P 500 2.7%) to settle at 5-month high post US Fed raised rates by 25 bps

Union Budget: Govt is banking upon its time-tested template of driving growth though higher capex

Major growth pointers

- GDP growth assumed of 11 % to 303 lakh crores

- Direct Taxes: 10.5%

- GST: 12%, GST monthly collection is assumed at Rs 1.59 lakh crore. We currently have a run-rate above 1.5 lakh crore. So indirect taxes also have upside potential

- Gross Tax Revenue: 10.4%

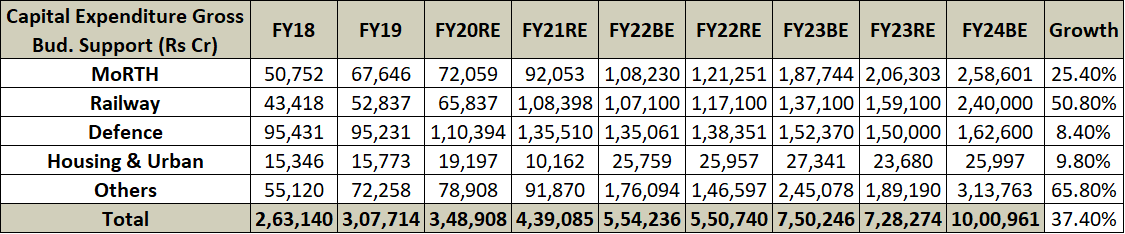

- Capex: 37%

- Disinvestment target for FY23RE revised downward to Rs 50,000 crore (Rs 65,000 crore). For FY24E it is pegged at Rs 51,000 crore

- Glide path on reducing Deficit has been complied with Deficit likely to go down to 5.9% in FY24 vs. revised estimates of 6.4% of FY23. Long term target of 4.5% Fiscal deficit by FY26 is on track.

- No Negative Surprise on LTCG, to be taken as sign of stability & positive by the market

Growth to be driven by - Capex led Growth with focus on lowering logistics cost

- The capex focus has been continued with Capex allocation increased by 33% to Rs 10 lac crore or 3.3% of GDP. This will boost the overall segments such as Railways, Roads, Urban Infra and will also crowd in more private investments

- Railway Capex at 2.4 lakh crore

- 1.3 lakh crore interest free loan to states for undertaking capex, increased from 1 lakh crore given last year

- State are allowed a higher fiscal GDP of 0.5% for undertaking power sector reforms

- Measures for green capex – 19,700 cr for green hydrogen: 5MT by 2030, 27,000cr for 13GW of Ladakh project, 200 compressed bio gas plants with an investment of 10,000 cr

- PM Awas Yojna allocation increased from Rs 48,000 crore to Rs 79,590 crore

- Jal Jeevan has increased from Rs 60,000 crore to Rs 70,000 crore

- Metro Projects has been hiked from ~Rs 15,500 crore to Rs 19,500 crore

- To enhance measures for lab grown diamond and reduce import dependency

- Modification to gold monetization scheme. Capital gains not applicable for gold converted from physical to digital format

- Relief on customs duty on import of mobile components like cameras, batteries, etc. and concession on lithium-ion batteries for one more year. Reduction on customs duty on open cells used in production of televisions to 2.5%.

- Energy security – promoting green capex on hydrogen

Promoting make in India through Import substitution or higher levels of indigenization

Boosting Consumption

Direct Taxation

Ease to middle class tax payers (welcome change after a long time) under new tax regime (To boost overall consumption). A person earning 15.5 lakh would be able to save Rs 525,00 amount of taxes

Sector to benefit

Banks, Cement, Steel, Infra & Capital goods and Logistics

Capex spending remains the key area of focus with government capex allocation growth at 33% YoY in FY24BE to Rs 10 lakh crore led by sectors like railways, roads, defence, housing, water (Jal Jeevan) and metro projects. The capex to GDP is pegged at all-time high of 3.3%. Among sectors banks, Cement, Steel, Infra & Capital goods and Logistics to benefit. Stock wise, the key beneficiaries of the above are L&T ( overall beneficiary ), Siemens ( strong product portfolio on railways and automation), SKF India and Timken India (Leaders in Industrial bearings and dominating share in railway bearing market), KEC international (Power T&D and Railway electrification/EPC), Action Construction (market leader in pick and carry cranes) and Anup Engineering ( strong player on the heat exchangers)

Consumption - Auto, Consumer Durables, Tourism

Tax exemptions under the new tax regime and higher capex to drive demand for domestic commercial vehicle space and more so for Medium and Heavy Commercial Vehicle (M&HCV) domain. Positive for Tata Motors and Ashok Leyland

The government has increased allocation to FAME-II scheme for FY24E at Rs 5,172 crore, up 78% YoY. This is largely on expected lines and is positive for domestic EV space with key beneficiaries being Tata Motors in the OEM space and Gabriel India, Motherson Sumi Wiring India in the ancillary domain

The tourism sector has received a healthy boost in the Budget with "Dekho Apna Desh" getting a well-deserved spotlight. Under this, 50 tourist destinations will be selected on a mission mode to be developed as a whole package for domestic and international tourism

Sectors adversely impacted

Insurance

Govt lifts tax exemption on traditional insurance policies with a premium of over 5 lakh (other than Ulip). This is likely to reduce the demand to buy high value traditional policies bought by HNIs

Cigarettes

Net tax on cigarette would increase by Rs 0.07 / stick to Rs 0.12/stick, which would require 1-3% price hike for cigarette in difference category. The hike in taxes is not very high & would be easily passed on by small increase (1-3%) in prices.

Auto Nos January 2023 - PV, tractor segments outshine for the month

At the OEM level, out-performance for the month was led by Maruti Suzuki in the PV space and M&M in the Tractor space.

- In PV space, volumes at Maruti Suzuki grew 22.3% at 1.7 lakh units with UV volumes coming at all time high at ~35k units. Volumes at Tata Motors were up 19.5% MoM at ~48k units i.e. highest ever monthly volumes. M&M's volumes were also up healthy 16.2% MoM at 33,040 units. Overall YTD figures depicts healthy double-digit growth for all players for FY23E.

- In CV segment, some moderation was witnessed on a high base (Dec’22) largely led by MoM decline in M&HCV segment. Ashok Leyland posted 5.2% de-growth in total volumes to 17,200 units. With robust allocation of Rs 10 lakh crore (up 33% YoY) as capex spend by government in FY24E, we expect CV space to grow healthy double digit (>20%) over FY22-25E.

- In the 2-W pack numbers came in mixed with premium segment reporting healthy volume prints (Royal Enfield volumes up 9% MoM at 75k units) with commuter segment led by Hero still not out of the woods.

- In Tractor space, M&M's tractor sales were up 27.5% YoY at 28,926 units. Both the players reported healthy monthly tractor volumes despite seasonally weak month. Domestic tractor industry is well poised to make a new high of >9 lakh units in FY23E (up double digit in YTDFY23)

We remain positive on auto space given the expectation of double-digit volume growth amidst healthy demand prospects particularly in the PV & CV space coupled with margin expansion given benign RM prices. Our top bets in the OEM space are Maruti Suzuki (target price: Rs 11,200), M&M (target price: Rs 1,590), Tata Motors (target price: Rs 530) and Ashok Leyland (target price: Rs 185)

Major results this week

HDFC Ltd – merger in focus (CMP – Rs 2,654, Target – Rs 2,850, BUY)

- HDFC Ltd posted modest performance with advance growth a tad lower at 11.8% YoY, though improvement in operational numbers led by uptick in margins

- Individual book (comprising 82% of book) grew at healthy pace of 18%, aided by both volume accretion and increase in ticket size

- Profitability increased 13.2% YoY, led by 10 bps improvement in margins and 21.8% QoQ decline in credit cost (at ~22 bps of AUM).

- Continued healthy growth coupled with relatively better efficiency should keep RoA at 2%. However, merger to remain in focus in near term (Management has indicated completion in June/July 2023). We maintain our SOTP target of Rs 2,850 and await clarity on matters related to merger

Titan Q3FY23 - Steady performance; upbeat outlook on jewellery segment (TP: Rs 3,030, upsides: 27%)

- As guided by the management in its pre-quarterly update, the jewellery division (excluding gold bullion sale in both the quarters) reported steady growth of 13% YoY. Prima facie, the growth trajectory appears to have moderated, however we believe the growth rate should be viewed in the context of a very strong base of Q3FY22 (the division had recorded 37% YoY growth). On three-year CAGR basis, revenue growth continues to be impressive at 21%.

- The management indicated that the jewellery sales were healthy in January 2023 (3-year CAGR 20%+) despite sharp surge in gold prices.

- Management reiterated its stance of maintaining 12-13% margins going forward with primary focus on market share gains.

- We build in revenue CAGR of 22% in FY22-25 with EBITDA margins in the range of 12.5%. Robust business model (30%+ RoCE) and strong earnings visibility will enable Titan to sustain its premium valuations going forward.

Major results next week

Tata Steel Preview - After a relative muted Q3, performance to improve in Q4FY23 aided by uptick in steel prices).

- For Q3FY23E, EBITDA/tonne of Tata Steel (Standalone operations) is expected to come in at Rs 12,500/tonne (Rs 10,177/tonne in Q2FY23). For Tata Steel Standalone operations, while on a QoQ basis blended steel realisations are expected to decline by ~ Rs 2,000/tonne, the sequential improvement in EBITDA/tonne is primarily on account of lower coking coal consumption costs which is expected to decline by ~ US$ 80/tonne in Q3FY23E when compared with Q2FY23. Going forward, in Q4FY23E Tata Steel Indian operations is likely to benefit with uptick in Domestic HRC prices. Indian HRC prices are currently hovering at ~Rs 58,500/tonne, a 6 -month high.

Bharti Airtel Preview – Margins to expand led by lower Spectrum Usage charges (SUC)

- The reported ARPU is likely to be up 2% QoQ at | 194 with benefit of subscriber mix during the quarter. We expect modest addition of ~1 mn subs with SIM consolidation restricting subscriber addition.

- Indian wireless revenues are expected to see 2.1% QoQ growth at Rs 19,359 crore. India non-wireless revenues traction are expected to remain robust especially broadband and enterprise.

- We expect India EBITDA margins at 52.5%, up 70 bps QoQ, aided by residual benefit of lower SUC, despite higher network opex on 5G rollout. Overall consolidated margins are expected at 51.3%, up 30 bps QoQ. We expect PAT at Rs 2,712 crore.

Hidden Gems

L&T: Best Play on Capex Cycle (CMP: Rs 2,160, Target: Rs 2,795, Upside: 30%)

Larsen & Toubro (L&T) is India’s largest engineering & construction (E&C) company, with interest in EPC projects, hi-tech manufacturing and services. The company primarily operates in infrastructure, heavy engineering, defence engineering, power, hydrocarbon, services business segments.

L&T has targeted revenues and order inflow CAGR of 15% and 14%, respectively. L&T will focus on emerging portfolios like green EPC, manufacturing of electrolysers, battery & cell manufacturing, data centres and platforms in the next five years. The company will invest Rs 1,500 crore in Electrolyser capacity (green hydrogen) in FY24 which will commence operations from FY25-FY26.

Focus on asset monetisation to further strengthen the balance sheet and improve return ratios. It is targeting ROE of 18% over FY21-26 driven by controlled working capital and strong cash generation.

In Q3FY23, management commentary was strong on the business prospects across all its business segments. The company also reported a strong order inflow growth of 21% in Q3FY23 where domestic order inflows are up 53% YoY. The improvement in ordering to tendering ratio at 52% in 9MFY23 vs. 48% 9MFY22 suggests that the pickup in capex cycle is on a strong footing coupled with all time high allocation in recent Budget to capex/infra segments Rs 10 lakh crore.

L&T is the best proxy play (strong execution skills and multisectoral exposure) on India overt the next 3-5 years. Our 12 month target on the stock is Rs 2,795, offering 30% potential upside

Conclusion

Since most of the results from index heavyweights is over along with the crucial events, markets are likely to stabilize near current levels

Source: ICICIdirect Research

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.