More fintechs in trouble? RBI’s latest circular

After Paytm, more startups from the fintech space are under the central bank's radar. In a recent announcement, the Reserve Bank of India (RBI) asked the payment network to stop facilitating credit card insurance by fintech aggregators. At the outset, it may seem that the central bank is making fintechs' lives difficult in India. However, one should not draw conclusions when listening to one side of the story. You should also look at the other side. In this article, we cover the whole story with you.

Understanding credit card usage

Let us ask you a simple question: Can you use your credit card at any place? The short answer is NO. Basically, you can only use a credit card where the merchant has the terminal to accept the credit card. As a retail user, it does not make much difference to you, as you have UPI and Net Banking for your needs. So, let us shift focus to small businesses for better understanding.

For small businesses, credit is of utmost importance. Let us say a company designs, manufactures and sells artificial jewelry—AR Jewellers. They need raw materials from different vendors to create the jewelry. The vendor would like to have his payment as soon as the sale is complete - they deliver the raw material.

However, for AR Jewellers, the cycle of getting money from their customers is too long: manufacture, distribution, sales, and then only they will get their money back. In this case, AR Jewellers cannot swipe their credit card to pay the vendor. You may ask, Why? It is because the merchant (vendor) is not authorized to receive payments via credit card. In simple words, they don't have a Point of Sale (PoS) machine or payment gateway for their business to receive credit card payments.

Business Payment Service Provider

Now, let us bring BPSP to the table. A Business Payment Service Provider (BPSP) is a company that helps businesses handle their financial transactions. They offer services to facilitate payments between businesses and their customers, suppliers, or partners. In the above scenario, some fintechs came into the picture and provided help to companies like AR Jewellers - those who need small credit.

Another essential point to note is that these companies cannot go and take a loan from the banks - it will impact their margins significantly. So, what did these fintechs do? They started facilitating credit card transactions for companies like AR (small businesses) so that they could make payments to their vendors through the credit card. It made life super easy for everyone in the system.

But how exactly do these BPSPs do this? The AR takes the credit card from the bank. Now, they will use their credit line on BPSP, and BPSP will approve the transaction. Basically, they would receive the money from the bank after the settlement, but they were ready to pay the AR's vendor immediately through NEFT or RTGS. The vendor gets his payment on time, AR can use their credit line to make payment to the vendor, and BPSP gets business in this end-to-end transaction.

The RBI's problem

Now, if you are wondering, what is RBI's problem with this transaction? Let us walk you through it, though it is not difficult to understand if you have followed our discussion so far.

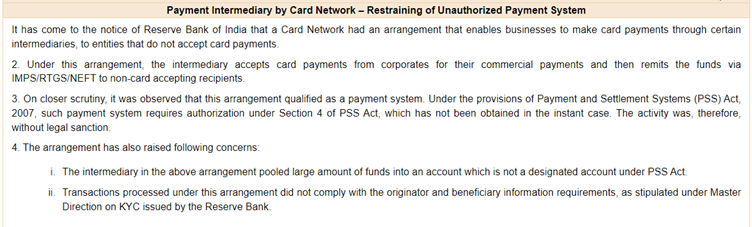

We already told you that these vendors are not authorized to accept payments via credit cards. Here, indirectly, they are receiving it, and RBI does not like it. For these types of payment systems, the company (vendor in our example) is required to have a license under the RBI's Payment and Settlement Systems Act of 2007. And no one has taken that license in this case. Also, this setup does not fulfill all the KYC norms.

Though the RBI has not said what impact it could have, but, as per industry experts, such a payment setup makes it difficult for the central bank to see the transaction trail from BPSP’s escrow account to the vendor’s bank account. Therefore, such a setup can lead to money laundering or round-tripping of funds (Round-tripping of funds refers to a deceptive practice where money is sent through a series of transactions or intermediaries to create the appearance of legitimate financial activity. In reality, the funds circle back to the original source, often resulting in inflated transaction volumes or revenues).

Before you go

Now that you know both sides of the story, you can form an opinion. Industry people are waiting for more updates and clarity from the RBI in this matter. What fintech industry people hope is that RBI's decision will not lead to the complete shutdown of such businesses as it would hurt both the investors' and entrepreneurs' sentiments and the overall startup ecosystem. People are expecting guidelines for BPSP to continue their operation. We will keep you posted on all the developments.