Infrastructure Investment Trusts (InvIT): Know them before you invest in them

Next week, we will have Bharat Highways InvIT coming to the market for investors. But before we cover it next week, we thought that you understand InvIt as an investment option. In this article, we cover the basics of InvIT.

What are Infrastructure Investment Trusts or InvITs?

InvITs are infrastructure developers that own, operate, and invest in completed and also in under-constructed infrastructure projects. What kind of infra projects? It could be roads, highways, telecom towers, fiber optic networks, power distribution networks, and other similar projects. These are financial instruments that allow you to invest in such infrastructure projects.

To understand them, think of them as mutual funds. As you know, mutual funds pool money from different investors and invest in different stocks or bonds. InvITs invest in infrastructure projects by pooling money from retail and institutional investors. Just like mutual funds, there is a manager for InvIT.

Let us better understand them with an example. Assume there is a company that owns a portfolio of toll roads. They decide to create an InvIT to raise funds for further expansion. They contribute these toll roads to the InvIT, and the InvIT issues units to investors.

The company might initially offer 10 crore units at a price of Rs 10 each, raising Rs 100 crore. Investors buy these units, becoming unit holders of the InvIT. The toll roads generate income through toll collections as you know. Let us say that the income is Rs 20 crore annually. Obviously, there would be expenses for the company, so after deducting expenses and management fees, the net income available for distribution is Rs 15 crore.

The InvIT distributes this income among the unit holders, perhaps paying out Rs 10 crore in dividends. Investors receive dividends based on the number of units they hold. So, if you own 1,000 units, you might receive Rs 10,000 in dividends.

How to invest in InvIT?

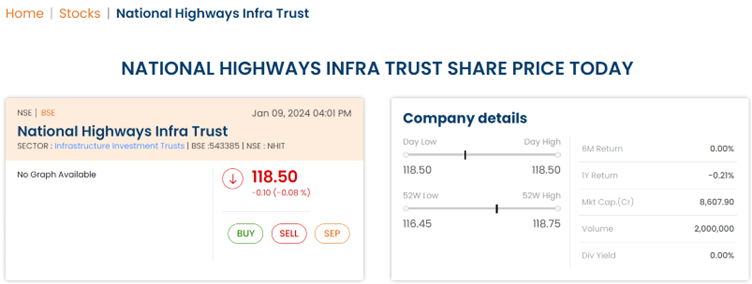

In the last section, we mentioned that investors can buy the units. But how? InvITs are exchange-traded investment options, which means that they are listed on NSE and BSE for you to buy and sell units during the trading window.

In India, InvITs have been around for a while - SEBI launched InvIT a decade back in 2014. However, as of December 2023, there are only 22 InvITs in India. You can check them here.

Here are the rules for companies coming with InvITs:

To safeguard investors' interest, SEBI mandated InvITs to invest at least 80% of their total assets in completed infrastructure projects that are capable of generating income. The balance of 20% can be invested in under-construction infrastructure projects.

The trust needs to distribute at least 90% of its income to the unit shareholders as dividends. So, in our example above, even though we said they would distribute 10 crores, they are mandated to distribute Rs 13.5 crore at least.

Why are InvITs created?

In our earlier example, we mentioned that the InvIT wanted to expand its business. For business expansion, one option is to take debt or loan. However, you would understand that the loan amount for infra projects is super high, and the recurring income is a small part of it and may take years for recovery. If the firm continues to take loans for every new project, they will soon find themselves in a debt trap.

For this reason, these companies come with InvITs. In our example, the company raised Rs 100 crore via InvIT. Once raised, it can use this money for its new projects or complete the existing ones - under construction projects.

Another reason is tax benefits. InvITs are not companies but trusts, and they get different tax benefits unavailable to corporations. These tax benefits can help the company grow its business further.

Advantages of InvITs

Here are a few advantages:

Stable Income: InvITs typically invest in stable, income-generating infrastructure assets such as toll roads, power transmission lines, or pipelines. It can provide you with a steady stream of income in the form of dividends as seen above.

Diversification: Investing in InvITs allows investors to diversify their portfolios. Instead of investing directly in a single infrastructure project, investors gain exposure to a portfolio of assets, reducing the risk associated with individual projects.

Liquidity: InvITs are listed on stock exchanges, which means investors can easily buy and sell units, providing liquidity compared to direct investments in infrastructure projects, which may lack liquidity.

Disadvantages of InvITs

Here are some disadvantages associated with them:

Market Risks: Like any investment in the stock market, InvITs are subject to market risks. The value of units can fluctuate based on market conditions, and investors may experience losses if the market performs poorly.

Dependency on Asset Performance: The performance of InvITs is directly linked to the performance of the underlying infrastructure assets. If the assets fail to generate expected income due to factors like lower-than-anticipated traffic on toll roads or regulatory issues, it can impact the returns for investors.

Interest Rate Sensitivity: Infrastructure assets often require significant financing, and InvITs may rely on debt to fund acquisitions or expansions. Changes in interest rates can affect the cost of debt, impacting the profitability of InvITs and their ability to generate returns for investors.

Before you go

InvITs provide you with an opportunity to invest in income-generating infrastructure assets, offering potential returns through regular income distributions and the potential for capital appreciation. However, you should evaluate the underlying asset and its income-generating capability before investing in InvIT.