(1) (1) (1) (1) (1) (1) (1)-202303171748024788608.png)

The Cola War is back & its impact on Varun Beverages

The Cola War is back. Campa Cola is coming back - you may not know the brand, but you can check with your parents if they had tasted this drink in the 80s. Reliance Consumer is reviving Campa Cola and launching it at a discounted price compared to market leaders - Coca-Cola and Pepsi. Will they succeed - only time will tell. Let us see the reason behind the move, the threats to Varun beverages, and other details.

The back story - Rise and Fall of Campa

In history, there are rare instances where the reason behind the rise and fall of something is the same. In our story, Campa Cola rose because of Coca-Cola and Pepsi (exit and entry) and went south for the same reason.

The story goes something like this - Until 1977, Coca-Cola and Pepsi dominated the entire Indian Cola market. As per the provisions of the Foreign Exchange Regulation Act under the Morarji Desai government, Coca-Cola was required to reduce its ownership stake in its Indian operations. Secondly, it also had to share the secret formula of its concentrate with Indian stakeholders. For these two reasons (majorly the second one), the company chose to leave India rather than operate under the new laws. Pepsi also exited the market around the same time because of poor sales.

It was a perfect time for a company like Pure Drinks to launch its own cola brand. Pure Drinks is the company that launched Coca-Cola in 1949 and manufactured and distributed it until 1977. The promoters took advantage of the situation and launched Campa Cola. For the next one and a half decades, the company ruled the Indian beverage market.

A series of events turned disastrous for the monopoly business. Parle Group launched Thumbs Up, and Pepsi made a comeback to the Indian market in 1989. In 1990, the liberalization of the Indian Economy happened. Under this, foreign companies were given incentives and had fewer regulations. No point in guessing, Coca-Cola found it a perfect opportunity to enter the Indian market. With Coca-Cola's heavy pockets and excellent marketing strategies, it was tough for Campa Cola to survive for a long. By the end of the decade, Campa Cola became history.

The Revival - Why Reliance bought Campa?

In August 2022, Campa Cola was acquired by Reliance Industries for Rs 22 crore. On March 9, 2023, Reliance Consumer, a subsidiary of Reliance Retail Ventures, announced the relaunch of the Campa in three flavors - cola, lemon & orange in the AP and Telangana markets.

Below are some possible reasons why Reliance acquired Campa Cola:

- For Indian Market, the revenue of the Carbonated Soft Drinks segment amounts to $2.11 billion in 2023. The market is expected to grow annually by 4.50% between 2023 and 2027 (Statista)

- Starting a new brand under any category in retail is a huge task and expensive.

- They saved time, effort, and money by reviving the old company, as they did not have to spend on R&D and work on patents.

- The company gets free marketing with its 'Make in India' push by reviving the old Indian brand.

Can Reliance & Campa disrupt the space?

The essential question is - can the relaunch of the iconic drink from the 1980s threaten current established players like Varun Beverages (one of the largest franchisees of PepsiCo in the world)? Let us try to find a logical answer to the question. To scale an FMCG brand in India, one needs to focus on five key levers:

- Price

- Taste

- Manufacturing

- Distribution and

- Brand

Let us look at the price factor in detail first. If you are a Shark Tank viewer, you would have known after watching Season 2 that new players in an existing market need to be competitive with their prices. The product has to be cheaper with the established players. Recently, Nestle saw a decline in Maggi sales when it increased the price of the 'Chotu' pack by Rs 2 in November 2022. Campa wins in this aspect, as its offerings are 16% to 33% cheaper than Coca Cola depending on the bottle size.

Here is our take on it:

Aggressive pricing may help initially, but we believe Campa Cola will find it tough to scale for the following reasons:

- No brand connects with a young audience (<40 yrs)

- The company will need multiple pan-India manufacturing plants

- Limited benefit from Reliance's distribution - Modern trade and e-commerce formats, which Reliance brings, account for < 10% of beverage industry revenues. Also, larger SKUs (600 mL and higher) account for ~40% of the beverage industry. The price differential is lower here, and this segment is less price sensitive.

To sum up, we can say that the impact of the lower price of Campa on Varun Beverages is LOW.

The challenge for Campa - Manufacturing, Distribution & Brand

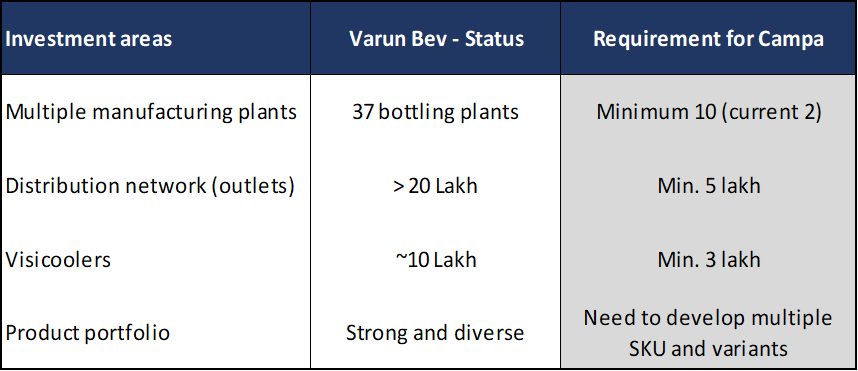

Campa will need to invest in multiple manufacturing plants. As beverages are ‘low-value high volume products, the overhead costs, such as freight and transportation, need to be optimized. Campa will have to set up a distribution network of at least 5 Lakh outlets to compete. A key differentiator for Varun is its 10 lakh Visicoolers at every nook and corner of the country, which cost Rs 20K-40K per piece.

Another challenge for Campa will be building brand awareness. Campa is well known only to consumers 40 years and above - only 30-35% of India’s population. Those less than 30 years have no connection with Campa. The maximum soft drinks consumption is by individuals below 30 years, who have grown up watching the ads of their favorite movie stars drinking Coca-Cola and Pepsi - it would be difficult for Reliance and Camp to bring about the change.

Conclusion

The revival of Campa is great for the Indian business ecosystem and allows Reliance to do well in the retail sector too. However, we see a low-real impact for Varun Beverages with the relaunch of Campa. Before we leave, we would like you to note some risks:

- Need to monitor a price war in higher price SKUs.

- A material increase in production capacities by Campa in a short timeframe.

- Delays in launch/failure of new products & geographies.