Bharat Bond ETF- Safe long term tax efficient debt option

The Government of India has come out with the another tranche of its flagship Bharat Bond ETF. The new ETF is a 11-year product maturing in April 2033 and referred to as Bharat Bond ETF - April 2033.

The underlying index consists of AAA-rated public sector undertakings with an indicative yield of 7.5%, maturity date of April 18, 2033 and a modified duration of 6.66 years. The bond ETF will enjoy tax advantage in the form of indexation benefit similar to debt mutual funds (20% with indexation). While the actual tax implication depends on future inflation index, indicative after tax yield could be ~6.9%.

Bharat bond ETFs provide higher degree of certainty of returns (if held-to maturity) with a higher safety of capital as it invests in government owned AAA rated public sector bonds. With the current prevailing low interest rate regime, which is likely to continue, some allocation could be considered by investors looking to lock in safe and predictable returns and not concerned about intermittent interest rate volatility.

One of the major risk factors for taking exposure to long duration debt products like this is interim mark to market losses in case interest rate rises sharply, going forward. However, globally as well as in India, interest rate hike is nearing maturity with RBI now expected to further hike rates by just once or twice. The total rate hike expectation is of around 60bps with terminal Repo rate at 6.5% from current 5.9%. However, debt market has already discounted this last leg of rate hike accordingly yields are unlikely to rise significantly from hereon.

Currently, the yield curve is flat with very little difference between yields of papers maturing between 3/4 years to 10/11 years. However, since we are at the last leg of the interest rate hike cycle, possibility of capital loss on higher duration/maturity funds has reduced significantly. Investors may allocate some portion of their fixed income allocation to Bharat Bond ETF – 2033.

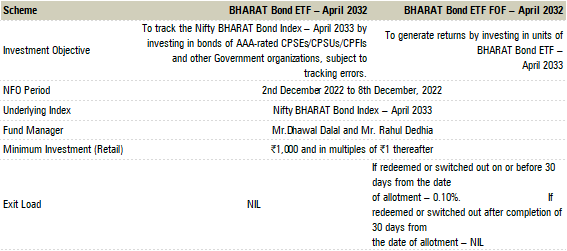

Edelweiss AMC is managing the Bharat Bond ETF. The funds raised through the debt ETF helps in smoothening borrowing plans of the participating CPSEs or public sector banks. It also helps them in meeting their capital expenditure needs. The Bharat Bond ETF is a target-maturity bond ETF, which has defined fixed maturity, investing in bonds with similar maturity. It will track the newly introduced Nifty BHARAT Bond Index April 2032. Edelweiss has also launched a ‘fund of fund’ (FoF) for this ETF to facilitate retail investors to buy/sell like a normal mutual fund. For retail investors, this Bharat Bond FoF is better suited in terms of convenience and liquidity.

The Bharat Bond ETF has been a huge success among investors. The AUM of earlier tranches with varying maturity is over Rs. 50,000 crore.

Investment rationale

- Higher return: Gross yield at 7.5% and tentative net of tax yield at around 6.9%.

- Stability, Predictability, Safety: A ETF/MF like structure with fixed maturity issued by AAA-rated public sector companies provides predictable and stable returns with low credit risk.

- Liquidity: Buy/sell on exchange any time or through AMC in specific basket size. Edelweiss has also come out with a Bharat Bond FoF. It enables retail investors to enter and exit just like mutual funds The Bharat Bond ETF offers a reliable and tax efficient debt investment option for long term investors.

- Tax efficient: Tax efficient compared to traditional investment avenues. Taxed at only 20% with indexation benefit, excluding surcharge

- Low cost: The expense ratio of the ETF is minimal at 0.0005%

Fund Feature of Bharat Bond ETF and FoF

Source: Scheme Information Document, Bharat Bond ETF

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism.The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.