Defence company DCX Systems announced Q4FY24 & FY24 results:

Q4FY24 Financial Highlights:

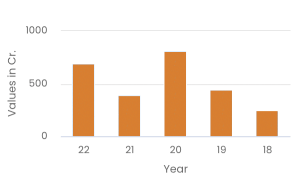

- Revenue stood at Rs 746.20 crore in Q4FY24 as compared to Rs 510.55 crore in Q4FY23.

- EBIT stood at Rs 51.91 crore in Q4FY24, vis-à-vis Rs 55.16 crore in Q4FY23.

- EBIT margin stood at 6.96% in Q4FY24 as compared to 10.80% in Q4FY23.

- Profit after Tax (PAT) stood at Rs 32.95 crore in Q4FY24 as compared to Rs 41.13 crore in Q4FY23.

FY24 Financial Highlights:

- Operational Revenue stood at Rs 1423.58 crore in FY24 from Rs 1253.30 crore in FY23.

- EBIT stood at Rs 124.41 crore in FY24, up from Rs 111.40 crore in FY23.

- EBIT Margin for the full year stood at 8.74%in FY 24, as compared to 8.89% in FY23.

- Profit After Tax (PAT) for the full year is Rs 75.78 crore in FY 24 as compared to Rs 71.68 in FY 23.

- Order Book as on 31st March 2024, is over Rs 801.16 crore.

Commenting on the company’s performance, Dr. H.S. Raghavendra Rao, Chairman & Managing Director, DCX Systems, said, “DCX Systems continued to navigate the turbulent global markets successfully during this quarter. Despite macro-economic headwinds and geo-political tensions, we were able to maintain healthy growth and profit margins.

In FY24, our consolidated revenues stood at Rs 1424 crore, while EBIT and PAT were Rs 124.41 crore and Rs 75.78 crore, respectively. This year we clocked the highest turnover in the history of DCX, with our continuous efforts we were able to boost operational efficiency and supply chain measures helped to improve the revenues and margins.

We recently raised funds to the tune of approximately Rs 500 crore through QIP. The proceeds out of fund raised through QIP would be utilized towards investment in NIART Systems, our JV agreement with ELTA Systems, we shall be developing and supplying obstacle detection solutions based on radar and optics technologies for the railway industry and also Invest in Opportunities through JV/Subsidiaries catering to Defence and Aerospace Sector through Transfer of Technology from Original Equipment Manufacturers (OEMs).

Our backward integration strategy through our 100% subsidiary M/s. Raneal Advanced Systems Private Limited started Commercial production from September 2023 and has been the driving force in controlling the supply chain.

Our focus remains on penetrating in new geographies, focusing on Make in India initiative and establishing DCX as a Product manufacturing company through Transfer of Technology (ToT) and securing raw materials supply to support the anticipated growth with better margins and rationalizing expenses to improve operational efficiencies.

I thank the entire team of DCX and all our stakeholders for your faith and support which helps us set and achieve new benchmarks.”

Invest

Invest