What are FII and DII & how do they impact the stock market?

Think of the any marketplace as a stock market. People buying in small quantities are retail investors. Local bulk buyers are Domestic Institutional Investors or DII, and people from different countries are Foreign Institutional Investors or FIIs. Institutional investors like DII and FII play a significant role in the stock market. Therefore, in this article, we will cover: What are FII and DII in the stock market? Also, understand the difference between FII and DII.

Who are FIIs?

Foreign institutional investors or FIIs are those categories of investors that invest in the financial market of a foreign country. For example, if an investor (not retail, we will look later who) from the US invests in the Indian market, they will fall under the FII category. These FIIs bring in money from foreign countries and invest in the stock market, where they see growth possibilities.

FIIs are also known as Foreign Portfolio Investors (FPI). These are not individual investors. So, who are they? Let us look at their types:

- Foreign Mutual Funds: Investment funds that pool money from many investors to purchase a diversified portfolio of stocks fall in this category.

- Foreign Pension Funds: Institutions that manage funds on behalf of pension beneficiaries, investing in financial instruments to generate returns and fund future pension obligations.

- Foreign Insurance Companies: Companies that provide financial protection to individuals or entities, and often invest in various asset classes to grow their portfolios.

- Foreign Central Bank: A central bank from the US (Federal Reserve) or any other country's central bank can invest in the Indian stock market as FII.

List of FIIs in India

Let us now look at some of the top FIIs in India. You should be able to tell in which of the above four categories they fall in. Here are the top 10 foreign institutional investors in India:

|

Government of Singapore |

Government Pension Fund Global |

|

East Bridge Capital Master Fund Limited |

Nalanda India Fund Limited |

|

Small-cap World Fund |

New World Fund Inc |

|

Euro-pacific Growth Fund |

Vanguard Fund |

|

Amansa Holdings Private Ltd |

Elara India Opportunities Fund |

Who are DIIs

Based on the fruit marketplace example and FII discussion, DIIs should be easy to understand. However, we will explain DIIs in detail. Domestic Institutional Investors (DIIs) are institutional entities that invest in the financial markets of their own country. Unlike FIIs, which come from abroad, DIIs are local entities that manage and deploy funds within the domestic financial market. Their investments are directed toward local companies, government securities, and other domestic financial instruments. This local presence makes them integral to the stability and growth of the domestic financial market. Let us look at who falls under DIIs?

- Mutual Funds: Similar to foreign counterparts, domestic mutual funds pool money from local investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Insurance Companies: Domestic insurance companies invest the premiums they receive from policyholders in various financial instruments to generate returns and meet future claim obligations. LIC is a perfect example of it in India.

- Banks and Financial Institutions: These entities may invest in the financial markets as part of their overall investment strategy to manage their asset portfolios.

- Pension Funds: Institutions managing funds on behalf of local pension beneficiaries, investing in financial instruments to generate returns and fund future pension obligations. Your investment in NPS goes to the stock market via a pension fund.

List of DIIs in India

Here are the top 10 domestic institutional investors in India:

|

Mutual Funds |

Insurance Companies |

Banks & Financial Institutions |

Pension Funds |

|

HDFC Mutual Fund |

Life Insurance Corporation of India (LIC) |

State Bank of India (SBI) |

Employees' Provident Fund Organisation (EPFO) |

|

ICICI Prudential Mutual Fund |

HDFC Life Insurance |

ICICI Bank

|

National Pension System (NPS) Fund Managers |

|

SBI Mutual Fund |

ICICI Prudential Life Insurance |

HDFC Bank |

|

|

Nippon Mutual Fund |

SBI Life Insurance

|

Kotak Bank |

|

You can thank us for additional names (14 in total).

Difference between FII & DII

Here is the difference between the FII and DII:

|

Feature |

Foreign Institutional Investors (FIIs) |

Domestic Institutional Investors (DIIs) |

|

Origin |

From outside the country |

Based in the same country |

|

Types of Entities |

Hedge funds, mutual funds, pension funds, etc. |

Mutual funds, insurance companies, banks, etc. |

|

Primary Motivation |

Diversification, higher returns, global exposure |

Investment in the domestic market, stability |

|

Investment Horizon |

Short-term and long-term strategies |

Primarily long-term focus |

|

Source of Funds |

Funds originate from foreign countries |

Funds sourced domestically |

|

Regulatory Oversight |

Regulated by host country's financial authorities |

Regulated by domestic regulatory bodies |

|

Currency Impact |

Can impact local currency values |

Transactions are in the local currency |

|

Impact on Local Economy |

Inflow/outflow affects foreign exchange reserves |

Contributes to local economic growth and stability |

|

Role during Market Volatility |

May contribute to increased market volatility |

Often provides stability during market fluctuations |

How do FIIs and DIIs work?

Here is how FIIs and DIIs work:

FIIs and DIIs enter a market by registering with the regulatory authorities of the country. In India, they need to register with the Securities and Exchange Board of India (SEBI).

They raise funds from investors, including pension funds, hedge funds, and other institutional investors. These funds are then deployed in the financial markets.

Institutional investors employ various investment strategies, including short-term (mostly FIIs) and long-term approaches. Some may engage in active trading to capitalize on short-term market movements, while others take a strategic approach with a focus on long-term investments.

Let us share two main differences on how FIIs and DIIs are different compared to retail investors. It will help you understand the working easily:

- Extensive research

- Bulk purchases

FIIs and DIIs' Impact on Stock Markets in India

You now have a fair understanding of what is FIIs and DIIs. We can move to the most crucial section of the article - their impact on the Indian stock market. We will look at the combined impact first:

- Market Momentum: Sustained inflows from both FIIs and DIIs can contribute to positive market momentum, attracting more investors and driving stock prices higher.

- Market Corrections: The combined actions of FIIs and DIIs can influence the severity of market corrections. If both groups are actively participating, corrections may be less severe as DIIs may see market downturns as opportunities to accumulate stocks.

- Overall Economic Impact: The activities of FIIs and DIIs are closely monitored by policymakers and economists as they have broader implications for the Indian economy. Strong FII and DII participation can be indicative of a robust and growing economy.

FII Impact on the Indian stock market

FII activities often influence market sentiment. Positive FII inflows are generally viewed as a sign of confidence in the Indian economy, leading to a bullish market sentiment. FIIs were net buyers in November 2023 and we have seen an exceptional rally in the market. Also, FIIs can contribute to market volatility, especially during periods of global uncertainty or when there are abrupt changes in their investment strategies. Sudden sell-offs or purchases by FIIs can lead to price fluctuations.

DIIs Impact on the Indian stock market

DIIs, with their long-term investment focus, contribute to market stability. Their consistent participation and steady investment approach provide a counterbalance to the potentially volatile actions of FIIs. During FII outflow phases, DIIs may continue to invest or stabilize the market through their long-term investment strategies. This can mitigate the impact of abrupt changes in FII sentiment.

History of FII and DII Flows and their impact on the Indian Stock market

Since 1992, FIIs have been net buyers for 5 straight years when they were allowed to invest in Indian stock markets. The amount of FIIs inflows has increased over the years. To give you some numbers:

- 2013: Rs 1,13,134 crore

- 2017: Rs 51,252 crore

- 2018: Rs -33,014 crore

- 2020: Rs 1,70,262 crore

- 2021: Rs -1,21,439 crore

To sum up, the historical data will suggest that whenever there’s a big crisis at a global level, FIIs mostly rush out of Indian markets. Here are some examples: the 1998-99 Asian currency crisis, the Lehman Brothers havoc in 2008-09, and most recently Covid pandemic. During the Lehman crisis, FIIs were the main culprits behind making things look ugly for the Indian stock market. During that time, they pulled out Rs 47,706 crore from the Indian market.

The recent change: As mentioned above, whenever there was a crisis, FII used to sell from the Indian market. More often than not, it led to the Indian stock market falling like a flash of cards. However, in recent years, things have changed. The major changes had come with the Covid (though the trend started before it). Here are two crucial numbers to look at, after the March 2020 crash (the start of the pandemic):

- The number of new DEMAT accounts grew exponentially

- People had high savings since they mostly stayed at home, so they started investing in the market

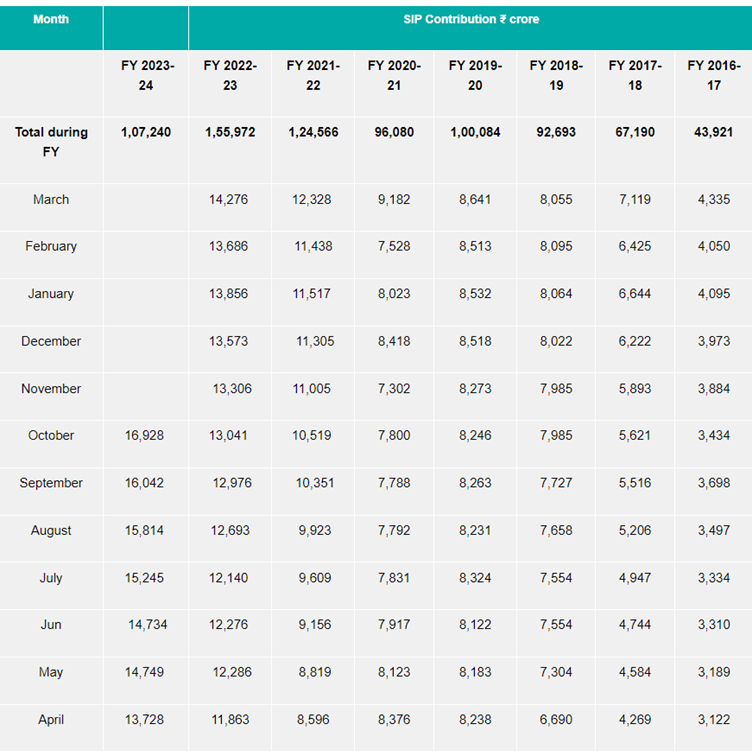

Since retail participation has increased, mutual funds can support the Indian market even when FIIs are selling. You can see that for October 2023, the SIP amount is 5.5 times more than what it was in FY17 for the same month.

Source: AMFI

Not only that, insurance and pension funds are managing over Rs 25 lakh crore in assets, and this steady domestic demand from the realization of equities has provided the Indian stock market with a solid foundation.

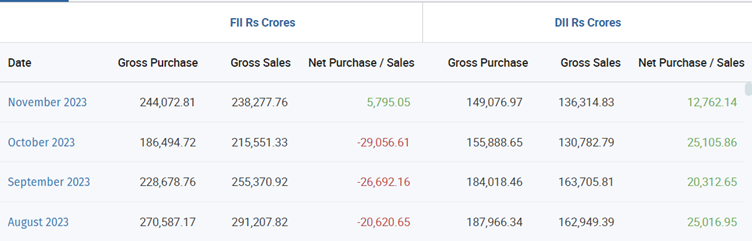

Here are some numbers from the recent month, where FIIs continuously pulled money from the Indian market, but we have not seen a major crash happening, which used to happen until a few years back.

Source: Moneycontrol

It won't be wrong to conclude that FII's impact on the Indian market has come down significantly, and we have become a mature economy.

How to find a FII / DII investment in stocks?

By now, you would have concluded that if FIIs and DIIs are investing in a stock, the company is worth considering (not always, as they may also go wrong). And that would have triggered the question of how to find FII and DII investment in a stock. We will take a couple of examples to guide you through the process.

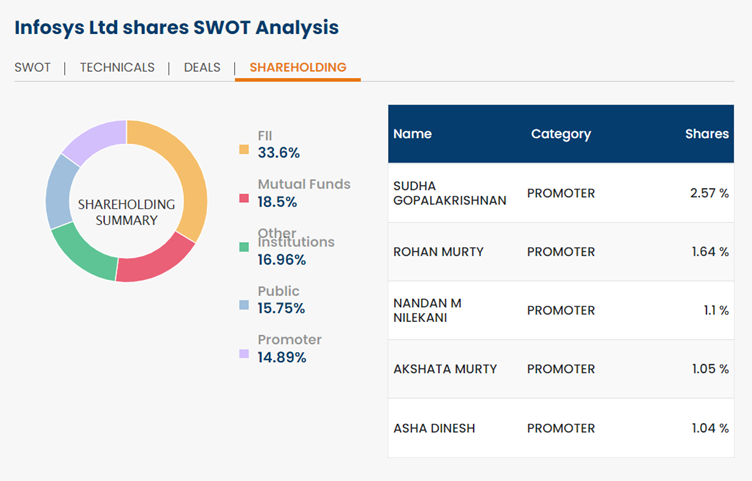

Let us say you want to find the DII and FII investment in Infosys Limited. You can go to ICICI Direct and find the company/stock page. This is Infosys' page - https://www.icicidirect.com/stocks/infosys-ltd-share-price

Scroll down, and under the SWOT analysis, click on the Shareholding tab. You can see that FII holds 33.6% of the company, while domestic mutual funds (DII) and other institutions (also DII) hold 18.5% and 16.96%, respectively.

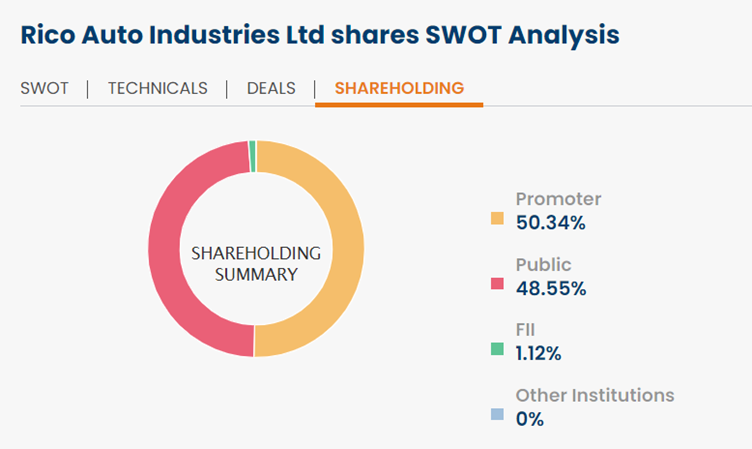

Here is a shareholding pattern of a small-cap company - Rico Auto. You can see that FII holds a small, 1.12% in the company, while DIIs have no investment in the company.

Before you go

The dynamics of FII and DII play a pivotal role in shaping the landscape of stock markets. Understanding their roles, motivations, and the impact of their actions is crucial for investors like you. A balanced interplay between these institutional investors can contribute to the stability, liquidity, and overall resilience of the Indian stock market, fostering a conducive environment for sustainable economic growth. As you navigate the complexities of global financial markets, staying informed about FII and DII trends becomes essential for making well-informed investment decisions.