Wockhardt Limited announces 3:10 rights issue at Rs. 225 per share for Rs 748 Crores

What is a rights Issue?

Issue of Shares to an existing shareholder as on record date is called a Rights Issue.The rights are offered in a ratio to the number of shares or convertible securities held by the shareholder as on the record date.

Wockhardt Ltd comes with rights issue of 748 Crores & the issue of up to 3.32 Crores rights equity shares at Rs. 225 per share. The company in the ratio of 3 rights equity shares for every 10 fully paid-up equity shares held by the eligible equity shareholders on the record date, that is on Wednesday, March 9, 2022.

Brief information about Wockhardt Ltd: -

It is in the pharmaceuticals sector with the Market Capitalization worth of Rs. 3,238.60 Crores as on 17 March 2022. It was incorporated in the 1960s. It has reported consolidated sales of Rs. 853.89 Cores in December 2021. The company is also listed in the Bombay Stock Exchange (BSE) with the code 532300 and listed in the National Stock Exchange (NSE) with the code WOCKPHARMA.

Wockhardt is a global biotechnology and pharmaceuticals company with its headquarters based in Mumbai. Wockhardt is engaged in producing biopharmaceuticals, nutrition products, vaccines, formulations, and active pharmaceuticals ingredients (APIs). The company has various manufacturing plants in India and the USA. Notably, more than half of its revenue is generated in Europe. It has a market presence in many countries around the globe, such as India, the USA, UK, Brazil, Russia, Mexico, Kenya, Ghana, etc. Wockhardt Hospitals, a subsidiary of Wockhardt ltd is a healthcare network of tertiary care and super specialty healthcare services in India. These hospitals offer services in the fields of Cardiology, Orthopedics, Neurology, Gastroenterology, Urology, etc. The promoters of the company own 69.68% of the stake in the company, Foreign Institutional Investors (FII) own 2.73%, Domestic Institutional Investors (DII) own 0.09% of the stake, and others (such as public & retail investors) hold the balance of 27.50%.

Price performance of Wockhardt: -

Source: - ICICIdirect.com

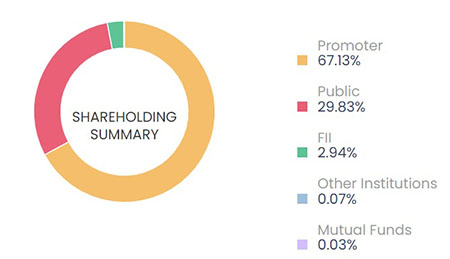

What is share holding pattern in Wockhardt Ltd?

Source: - ICICIdirect.com

What are the Objectives of rights Issue by the company ?

The company aims to utilize the proceed from the right issue for the following purposes;

- To make repayment of subordinated debt and company's borrowings including interest partially or fully allocated amount shall be 590 crores.

- General corporate purposes allocated amount shall be 152 crores.

When is Wockhardt Rights Issue?

The Wockhardt Rights Issue opens on Mar 15, 2022, and closes on Mar 22, 2022.

Wockhardt Rights Issue Schedule?

|

Last Date for credit of Rights Entitlements |

Mar 11, 2022 |

|

Last Date for renunciation of Rights Entitlements |

Mar 16, 2022 |

|

Issue Opening Date |

Mar 15, 2022 |

|

Issue Closing Date |

Mar 22, 2022 |

|

Date of Allotment (on or about) |

Mar 30, 2022 |

|

Date of Credit (on or about) |

Apr 1, 2022 |

|

Date of Listing (on or about) |

Apr 4, 2022 |

What is the issue price for Wockhardt Rights Issue?

Wockhardt Rights Issue price is set at ₹225 per share per equity share.

In what ratio is the Wockhardt Rights Issue offered?

The eligible shareholders are being offered 3 shares for every 10 fully paid-up shares held on the record date (Mar 9, 2022).

What is the record date for Wockhardt Rights Issue?

The record date for the Wockhardt Rights Issue is Mar 9, 2022.

What is the issue size of Wockhardt Rights Issue?

The issue size of Wockhardt Rights Issue is of 3.32 Crores equity shares at ₹225 per share aggregating up to ₹748.00 Crores of equity shares of face value of ₹5 each.

Where can I get the Letter of Offer for Wockhardt Rights Issue?

The Letter of Offer for Wockhardt Rights Issue can be download here.

What is Rights Entitlement (RE)?

Rights Entitlement (RE) is the rights issued by the company to the existing shareholders to

subscribe to the new shares that the shareholder of a company is eligible to apply for under the rights offer.

How many shares can clients apply for Wockhardt Rights Issue?

The number of Rights Entitlement (RE) are credited in demat account.

Can clients apply for additional shares in the rights issue apart from entitlement?

Yes, client can apply for any number of additional shares but the allotment of the same will

depend on shares available for apportionment and will also be in proportion to holding,

irrespective of additional shares applied by client.

Can clients apply online through ICICIdirect.com?

No, client can apply for Wockhardt Rights Issue through Registrar's Website (R-WAP Facility)

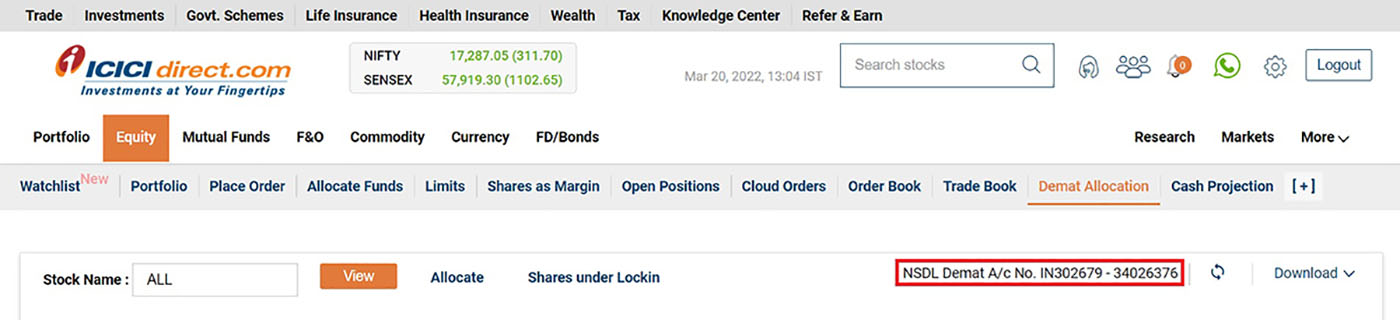

Where can clients get demat account number from ICICIdirect?

Login in to ICICIdirect.com & go to equity> Demat Allocation> you can see demat account number (it can be NSDL or CDSL).

Who is registrar for Wockhardt Rights Issue?

Link Intime India Private Ltd.

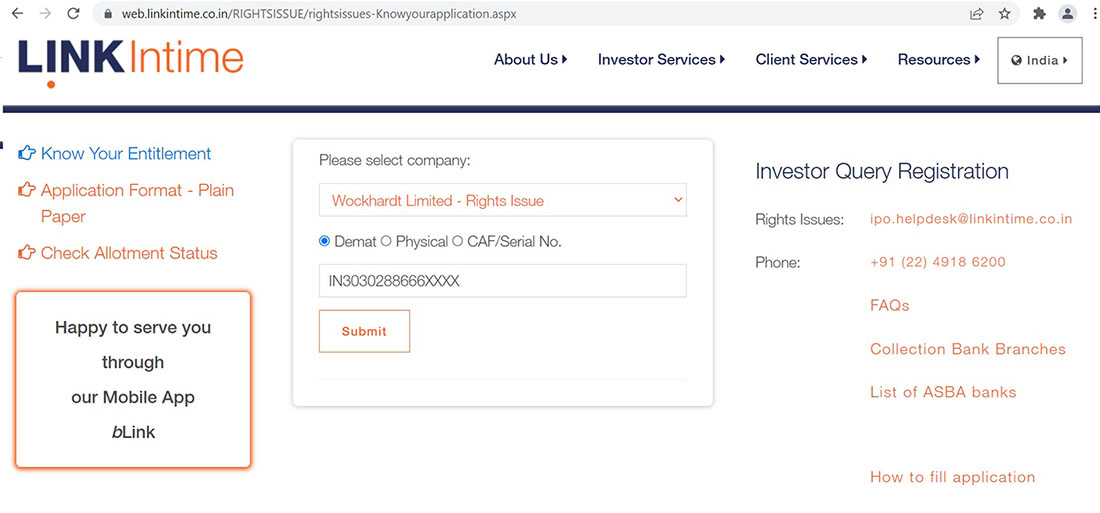

What are the steps to apply for Wockhardt Rights Issue using Registrar's website (R-WAP)?

Visit registrar's website: - https://linkintime.co.in/

Go to the 'Rights Issue' section in the Investor service tab

Select Wockhardt Rights Issue from the dropdown of select company

Enter Demat Account Number & click on submit

Fill the online application form.

Validate and submit the application.

Disclaimer:

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning, Investment Advisory etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)