NSE to Launch Futures & Options for Nifty Midcap Select Index from 24th Jan'22

F&O Trading has evolved in India with F&O volumes now contributing to more than 95% of overall NSE volumes. F&O volumes in NSE have nearly doubled in FY 22 compared to FY 21 same time.

You can trade in F&O in Nifty, Bank Nifty and over 170 stocks. Nifty and Bank Nifty Accounts to nearly 33% of NSE volumes in FY22 in Overall Futures and nearly 80% of Options Premium turnover

Index F&O contracts which is blend of multiple stocks offers better diversification to customers.

With effect from 24th Jan 2022, NSE will be introducing the Nifty Mid-Cap Select Index to enable investors and traders participate in the Mid-cap growth story.

Mid Cap Index Returns

Mid-Cap index for over last 10 years has moved from nearly 6500 levels in 2012 to nearly 31,000 levels delivering a CAGR returns of nearly 17%. Midcap stocks contribute about 17% of the market capitalization of India

What are the constituents of the Nifty Midcap Select Index?

Stocks which form the part of Nifty Midcap Select Index include below. Tata Power, SRF, Zee, Voltas, Bharat Electronics account for nearly 30% of the weight of the Index. The top stocks include

|

Top constituents by weightage |

Weight % |

|

Tata Power Co. Ltd. |

7.52 |

|

SRF Ltd. |

7.07 |

|

Zee Entertainment Enterprises Ltd. |

5.95 |

|

Voltas Ltd. |

5.68 |

|

Bharat Electronics Ltd. |

5.04 |

|

Shriram Transport Finance Co. Ltd. |

4.9 |

|

Trent Ltd. |

4.79 |

|

Page Industries Ltd. |

4.71 |

|

AU Small Finance Bank Ltd. |

4.58 |

|

Godrej Properties Ltd. |

4.39 |

These stocks are selected from Nifty midcap 150 index based on trading availability, market cap and average daily turnover.

What is the sector wise break up and which is the dominant sector?

Financial Services followed by Automobile, Manufacturing, Power and Chemicals account ~ 53% of the Index

|

Sector Representation |

Sector Weight(%) |

|

FINANCIAL SERVICES |

26.63 |

|

AUTOMOBILE |

13.21 |

|

INDUSTRIAL MANUFACTURING |

8.63 |

|

POWER |

7.52 |

|

CHEMICALS |

7.07 |

|

MEDIA, ENTERTAINMENT |

5.95 |

|

CONSUMER GOODS |

5.68 |

|

OIL & GAS |

5.46 |

|

CONSUMER SERVICES |

4.79 |

|

TEXTILES |

4.71 |

|

CONSTRUCTION |

4.39 |

|

SERVICES |

3.39 |

|

CEMENT & CEMENT PRODUCTS |

2.57 |

How has the Nifty Midcap Index Performed, how is it co-related to Nifty and what is it’s volatility?

Below table depicts the returns of the index across multiple time frames.

|

Index Returns(%) |

QTD |

YTD |

1 Year |

5 Years |

Since Inception |

|

Price Return |

-0.23 |

37.36 |

37.36 |

17.86 |

13.06 |

|

Total Return |

-0.01 |

38.73 |

38.73 |

19.04 |

14.54 |

Nifty Mid-cap index has 0.84 co-relation with Nifty over last 5 years and Beta which is 1.03 in last 5 years. Beta is a measure of a stock's volatility in relation to the overall market. If a stock moves less than the market, the stock's beta is less than 1.0. High-beta stocks are supposed to be riskier but provide higher return potential; low-beta stocks pose less risk but also lower returns.

Standard deviation, which is the statistical measure of market volatility, measuring how widely prices are dispersed from the average price stands at 22.59 for the Index. If prices trade in a narrow trading range, the standard deviation will return a low value that indicates low volatility. Conversely, if prices swing wildly up and down, then standard deviation returns a high value that indicates high volatility.

|

Statistics |

1 Year |

5 Years |

Since Inception |

|

Std. Deviation |

22.43 |

22.59 |

27.05 |

|

Beta (NIFTY 50) |

1.1 |

1.03 |

1.02 |

|

Correlation (NIFTY 50) |

0.76 |

0.83 |

0.84 |

How does the fundamental of the new Index Stack up?

Price to earning which is the ratio for valuation that measures its current share price relative to its earning per share (EPS) of the Nifty Mid-cap select Index stands at 26.8.

Price-to-book value (P/B) which is the ratio of the market value of a company's shares (share price) over its book value of equity stands at 3.21

Dividend yield stands at 0.94.

|

P/E |

P/B |

Dividend Yield |

|

26.8 |

3.21 |

0.94 |

What is the Lot size, maximum order quantity, contract value and Margins required?

The lot size is 75. These contracts will have Weekly expires on Tuesdays. The contract value quantity freeze for trading in any single order is set to be 5500. Margins will depend upon the Span Based Margining system.

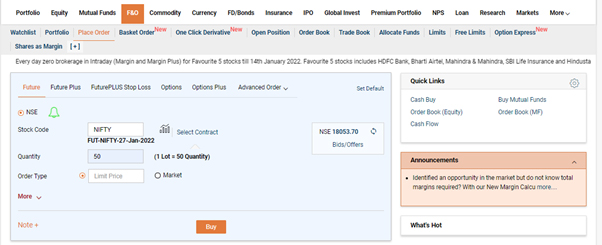

How can you Trade on ICICIdirect in Nifty Midcap Select Index

You can simply login to ICICIdirect and like normal Future and Options trade, enter Stock MIDCPNIFTY in the drop down select Nifty Mid-cap Index to get started.

Disclaimer:-

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Invest

Invest

COMMENT (0)