Yearly Technical outlook for CY24

ICICI Direct

13 Mins 26 Dec 2023

2 Comments

200 Likes

FPI Flows to lift Nifty towards 24,200

Capital flows

- FPIs flows to increase further in CY 24

- US Rate cuts should induce flows

Volatility

- Domestic flows to rein in Volatility

- Stable currency to aid sentiments

Preferred sectors

- Banking: Largest headroom to absorb FPI inflows

- Infrastructure: Should remain firm

- Metals: Outperformance likely in CY24

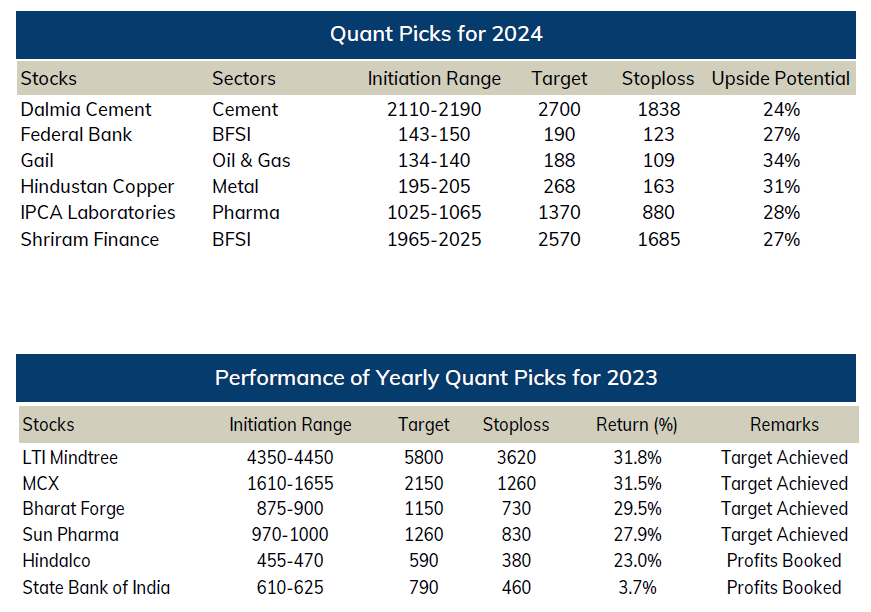

Recommended Stocks

- Dalmia Bharat Cement

- Federal Bank

- GAIL

- Hindustan Copper

- IPCA Lab

- Shriram Finance

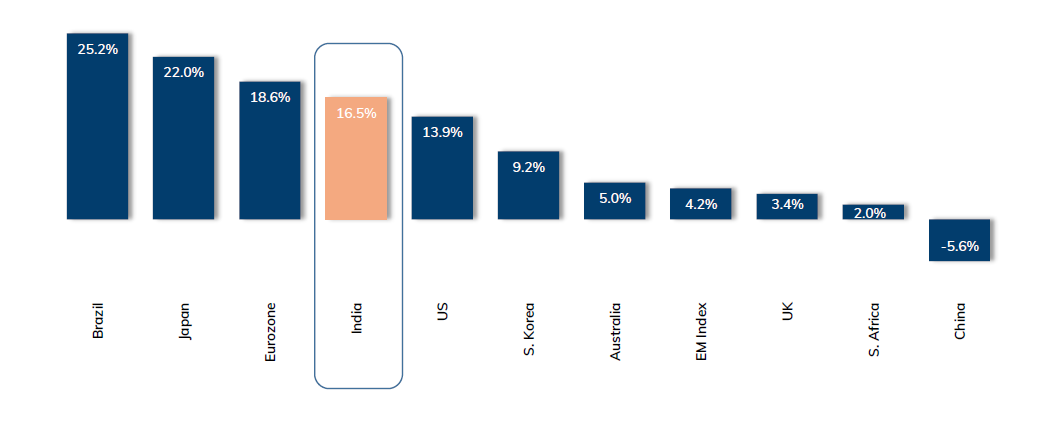

1-year performance is also almost in-line

- Despite trading near highs and gaining almost 7% in December series only, Nifty has delivered ~16% returns so far in the last 12 months, which is relatively at par with other markets.

Nifty target for CY-24 @ 24,200

-202401031131318256330.png)

- Heavyweight stocks from BFSI, Auto, Cement and Healthcare should lead Nifty towards 24,200 levels in CY-24.

- The Nifty has tendency to extend the move towards mean+3*sigma levels after crossing life highs.

- We expect volatility to be sticky around current levels in coming months. Hence in the first half of 2024, one should adopt “Buy on dips” strategy.

Why is ICICIdirect Bullish?

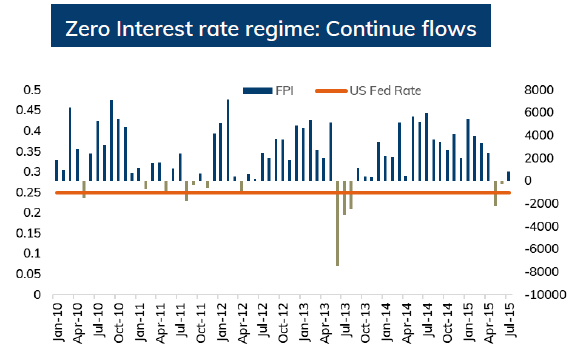

India FPI flows- Inversely proportional to US rates

- Indian markets saw continued flows for almost 5 years between 2010 to 2014 as US FED has maintained zero interest rates post 2008 crisis.

- The free money helped risk assets to exhibit significant outperformance.

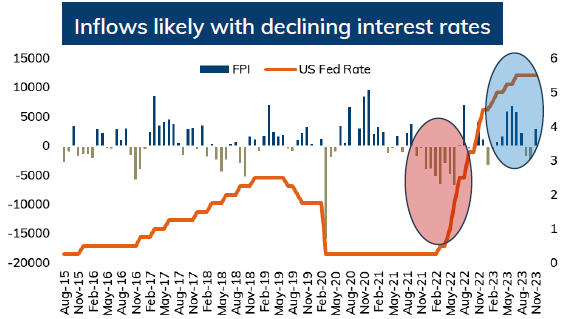

- CY-23 saw resumption in FII flows as interest rate peaks and expectations of rate cut sets in. Fresh flows were seen as market anticipated a halt and then gradual decline in interest rates.

- Earlier in CY-22 we saw severe pullout from FPIs as US FED accelerate interest rates to historical highs.

US Fed likely to reduce rates ahead

-202401031022408598332.png)

- Dollar index has started losing its steam after US Federal Reserve (FED) hit a pause button in September. Recently they also signaled end of policy tightening and cuts in 2024. Currently, FED is guiding three interest rate cuts in 2024 while market is envisaging up to 5 cuts next year.

- As a result, we expect Dollar index to weaken further and capital flows should be seen into emerging markets. Historical evidences suggests that India should be the major beneficiary of these flows.

Dissecting FPI Flows

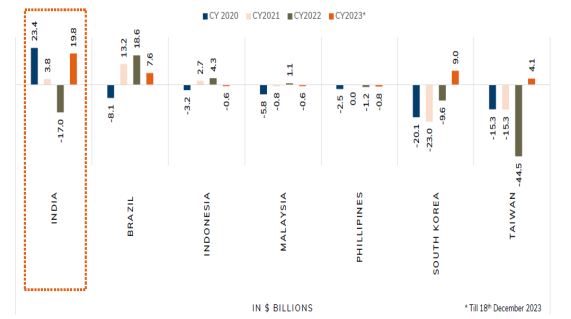

- Indian Indices made fresh life highs in December 2023 and were among the best performing markets. The outperformance was aided by resumption of foreign flows which was highest among peers.

- The net flows for the current calendar year is nearly of $20 billion while rest of the emerging markets have seen nominal flows. In the post covid era, while most of the markets are still reeling near their 2021 highs, Indian markets have given significant returns.

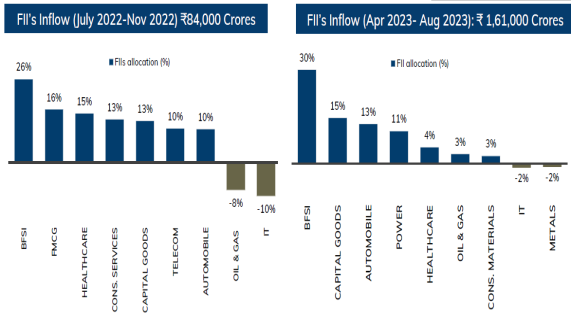

Recent allocation of FPI inflows

- After significant outflows seen in CY21 and early part of CY22, FPI poured almost Rs 84,000 crore in Equity markets between July 2022 till Nov 2022.

- During the period, FMCG along with healthcare stocks were among the major beneficiaries of the flows. Financial inflow was more or less inline with their index weight.

- While CY-23 started with significant outflows amid US rate hikes. However, equity markets witnessed return of FPIs since Apr-23 as US rates seems to be peaked and they bought almost Rs 1,61,000 crores till Aug-23.

- Surprising higher flows were seen in Capital goods along with Auto and Power sectors. IT and Metals remained laggard as their performance remained subdued.

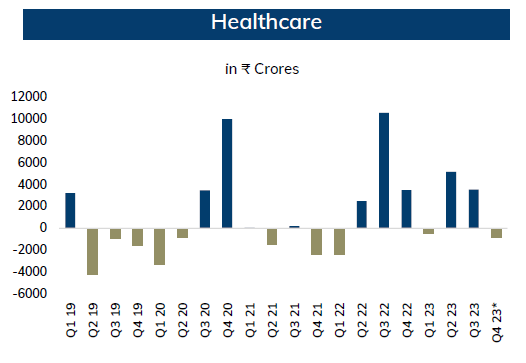

FPI flows: Healthcare, Financials remain in favour

- Healthcare stocks have seen good reversal as they witnessed significant allocation from FPIs since Q3 CY-22. Even during the outflows, the sector saw minimal outflows in the past few months.

- We expect fresh flows should continue in the healthcare space which should trigger further out performance in the months to come.

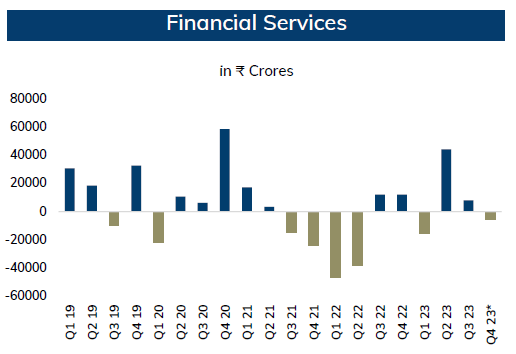

- Financial Services have been relative underperformer in the market and they have received reduced flows compare to their sectoral weight in market.

- However, recent data suggests change of trend as Financials seems to attract higher flows. We expect in declining interest rate cycle, stocks from Financial space should garner more interest from FPIs.

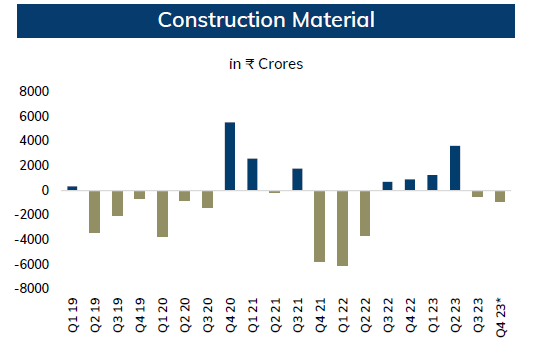

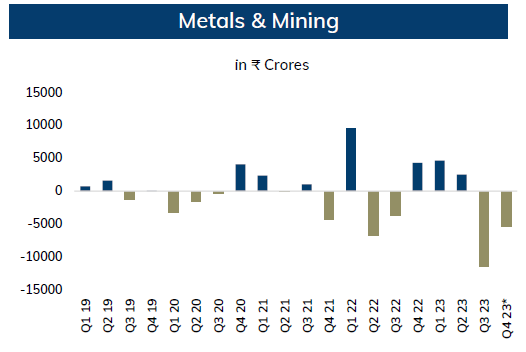

Infra and Metals should see renewed flows

- Construction related stocks have seen continued outflows and heavyweights from the sector have relatively underperformed the market.

- However, due to interest rate cut expectations, fresh flows are likely to be seen in CY-24 which should propel the outperformance from this sector.

- Metal as a sector has been significantly underperformer and witnessed continued outflows. The volatility in Chinese growth was a reason behind reduced exposure in the metal segment.

- With expectations of rate cut, we expect flows to be back in the Metal space. The underperformance so far seen by the sector may turn into outperformance in the next year.

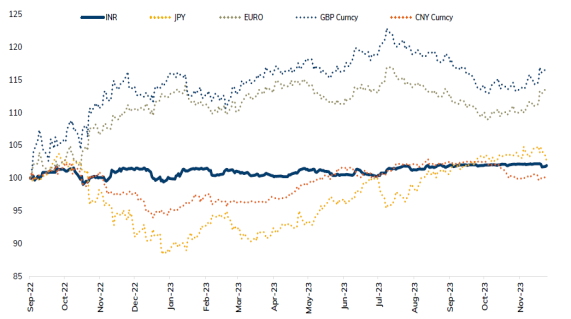

Stable INR to act as an catalyst for flows

- Indian Currency (₹) has shown significant resilience against Dollar ($) in recent months. It has absorbed all the volatility and remained largely near 83 levels despite significant volatility seen in major currencies across the globe.

- With stable currency, the underlying returns will dominate the flow allocations.

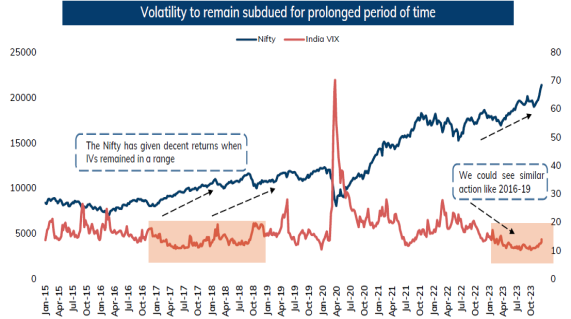

Volatility likely to remain subdued for prolonged period

- Volatility can be in a downward trend for a prolonged period of time, which, in turn, has been one of the best return periodsfor the Nifty. While the low volatility could be a cause for concern due to lack of risk perception, historical evidences suggeststhat low levels of volatility may remain for an extended period of time.

- Both US VIX and India VIX has failed to sustain at higher levels suggesting inherited strength in Equity markets. Since 2021,India VIX has failed to sustain above 20 and remained in a declining trend. We expect volatility upsides to be limited in 2024 as well and remain on the lower side.

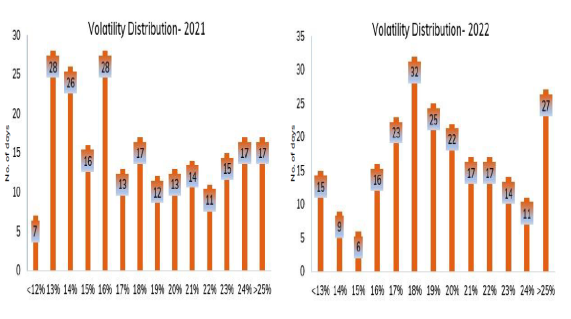

Volatility: Domestic flows helping to curb Vols

- Volatility has been on a declining trend post COVID and CY-23 has seen sharp declines in IVs. From the average range of 18-19% seen in CY-22, CY-23 has been largely near 12% throughout the year.

- Deepening domestic liquidity and stable currency has played crucial role in curbing the vols and we expect them to remain lower in coming months as well.

- While Lok Sabha elections in India and Presidential elections in US may trigger near term volatility (spike) in markets but declines are likely to be limited.

Domestic flows: Structurally Deepening the Indian markets, curbing volatility

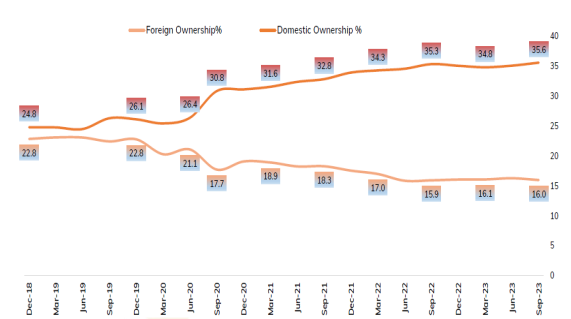

- Fund flows from domestic investors have witnessed a sharp rise in last few years. Total market share of domestic investors (DII+HNI+Retail+QIBs) has moved to near 36% from 25% in 2018. On the other hand, FPIs stake has declined over the period and now they hold near 16% share against 23% seen in 2018.

- The structurally deepening domestic liquidity has curb the Vols and helped markets to remain resilient even at the time of global turmoil.

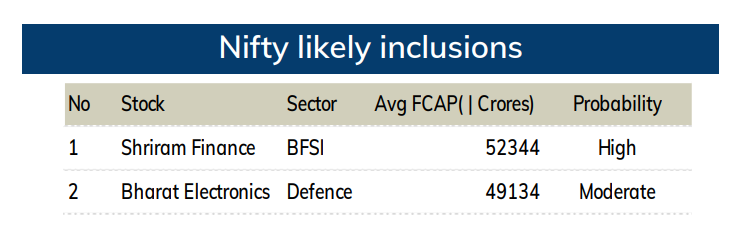

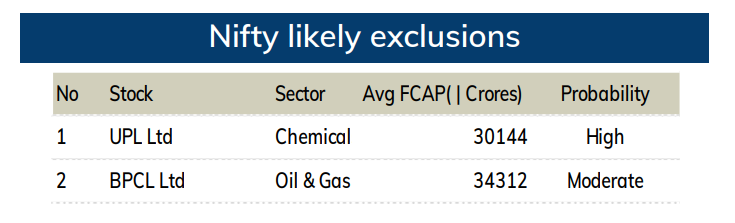

Nifty rebalancing expected in 2024

For the coming Nifty50 rebalancing, based on free float market capitalisation method, probable candidates to find the

place in Nifty are Shriram Finance and Bharat Electronics replacing UPL and BPCL.

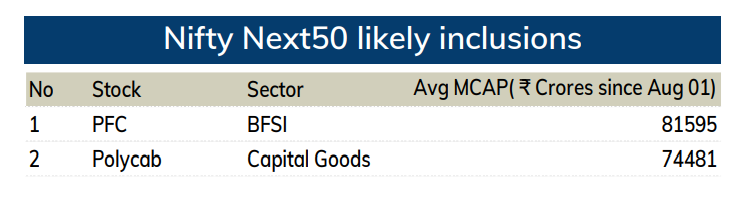

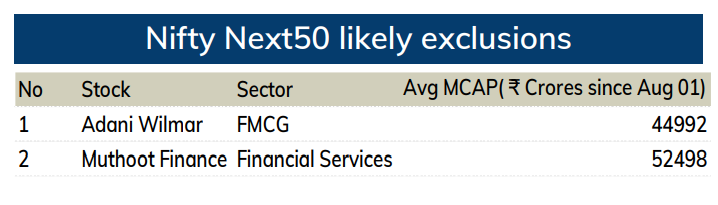

- For the coming review, we believe PFC and Polycab would be a part of NSE100 whereas Adani Wilmar and Muthoot Finance would be excluded from the NSE100 basket.

- Adani Energy solution along with Hindustan zinc and IRFC continues to be the top contender for Nifty next50 inclusion. However, since they are not part of F&O, they may not be considered for inclusion.

Exclusion of non-F&O stocks from Nifty Next50 may trigger major reshuffle

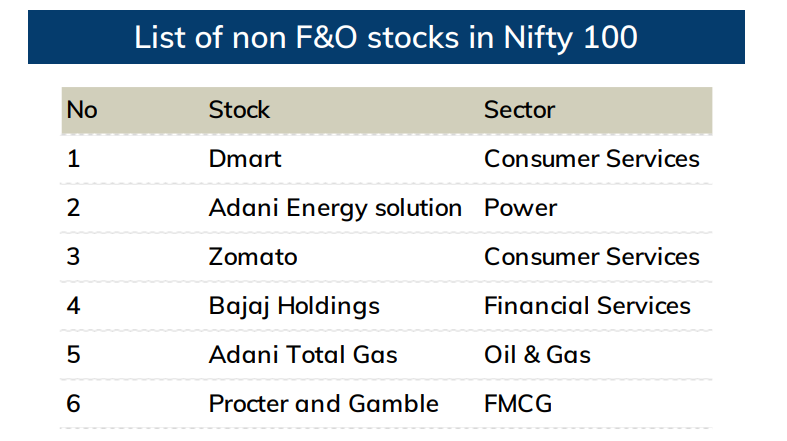

- The National Stock Exchange (NSE) has came out with a consultation paper suggesting that constituents of Nifty Next 50 index should be only stocks where derivative contracts are traded. Reason for the above recommendation being, the number and asset size of passive funds tracking the Nifty Next 50 index increasing, ensuring index constituents’ liquidity and ease of index replication by passive funds gains more importance.

- Currently there are 6 stocks from Non F&O basket with the cumulative weightage being capped at 10%. List of Non-F&O stocks are highlighted above.

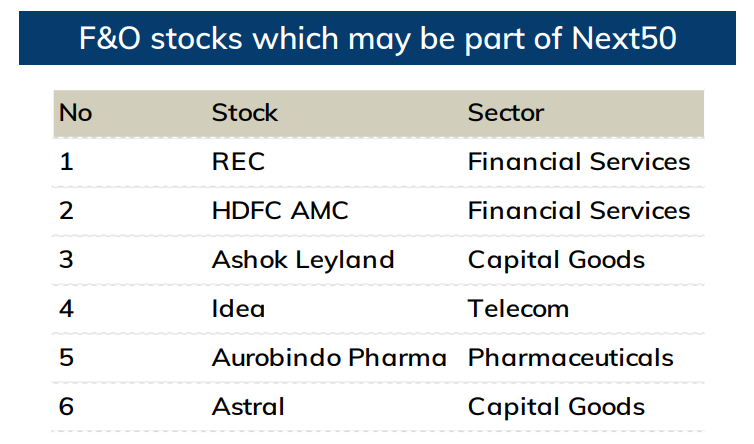

- Hence, in case of implementation, significant churning of flows can be expected. As per current data, we believe that stocks like REC, HDFC AMC, Ashok Leyland, Idea, Aurobindo Pharma and Astral are likely to replace the non F&O stocks.

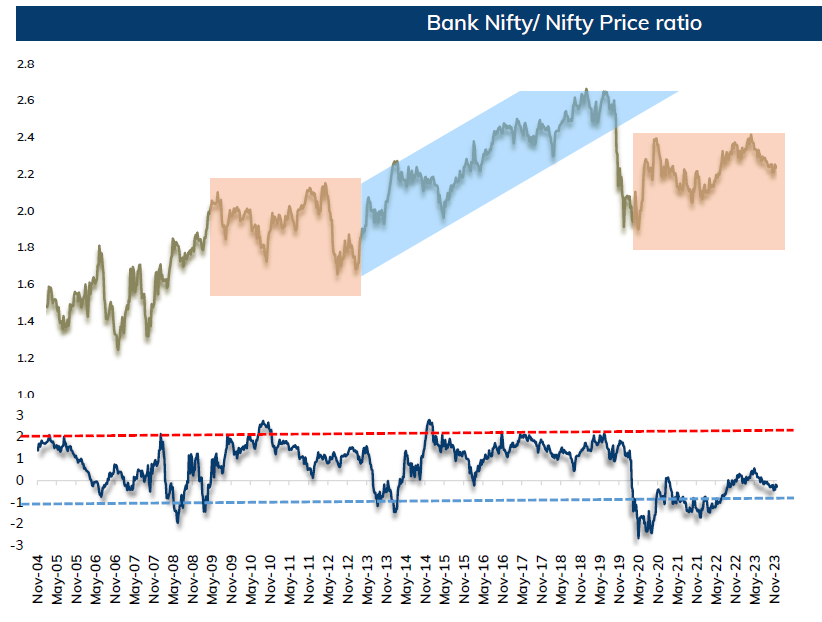

Banking should take the lead

- The Bank Nifty has been the major driver of the Nifty in the cycle of 2012 to 2020 bull run which is visible through price ratio. Earlier there was significant correction and time based consolidation seen for 3 years between 2008 to 2011.

- Similar kind of patterns and consolidation moves are visible in the last three years of 2020-2023. Considering price ratio hovering near major support of mean-2*sigma levels, we feel banking stocks should lead Nifty in the coming months.

Source: ICICIdirect Research