What you need to know about Technical analysis

While in school, you must have determined a pattern of learning. It starts with ABCD and ends with a huge syllabus of lessons and poems. Similarly, the study of stock market also starts with some commonly used terminologies that surely helps a trader to understand this enormous field of trading in the stock market.

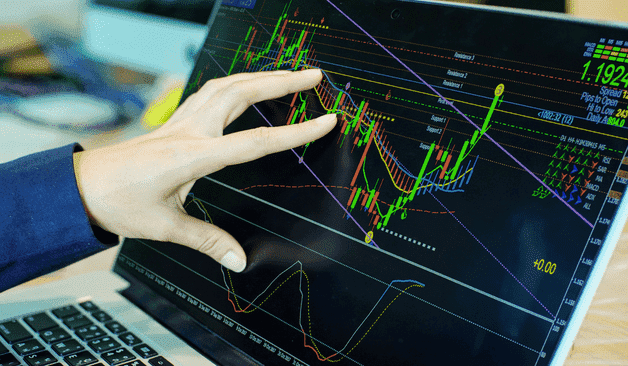

What is a Technical Analysis?

Technical Analysis is the study of statistical figures and chart patterns to understand the market trends and choose the stocks accordingly. For example-

Consider a stock that is going up and down in a specific interval. But over time, if you look at its movement, you will be able to see some specific trends, and patterns that emerge. The detailed study of these patterns and trends is called Technical analysis of stocks. Now, before even diving in-depth into how to analyze the market basis the trends and patterns, let us first know – some commonly used terms in technical analysis.

- Resistance: Resistance, as its name implies, is something that prevents a price increase. The resistance level is the price on the chart where investors anticipate a huge amount of selling to occur for the stock. The resistance level is always higher than the price in the market. High probability exists that the price will increase to the resistance level, then stabilize, use all available supply, and decline. One of the crucial technical analysis tools that market players consider in a bullish market is the resistance. The resistance frequently serves as a selling signal.

- Support: Support is anything that stops the price from falling any further. The support level is the price on the chart at which the trader anticipates the greatest amount of demand (in terms of buying) entering the particular stock. When the price touches the support line, it will probably rise again. The support level is below the price in the present market. The price has the greatest chance of falling till the support, consolidating, absorbing all of the demand, and then beginning to rise. One crucial technical level that market participants search for in a declining market is the support. The support frequently serves as a buy trigger for the traders.

- Uptrend: When the stock’s price movement has an overall upward direction, it is said to be in an uptrend. In an upward trend, each peak and trough that follows is higher than those that were discovered earlier in the trend. Therefore, higher swing lows and higher swing highs make up the uptrend. The uptrend is regarded as intact as long as the price is making these higher swing lows and higher swing highs. Some traders only engage in transactions during uptrends. These "long" trend traders employ a variety of tactics to profit on the price's propensity to make higher highs and higher lows.

- Downtrend: A downtrend is a steady decline in the stock price, commodity value, or activity on the financial markets. An upswing and a downward trend can be compared. Lower peaks and troughs characterize downtrends, which in turn replicate shifts in the trader’s perception. A change in the supply of stocks traders want to sell, relative to the demand for the stock traders want to acquire is what drives a downtrend. Downtrends are reactions to changes in the security's environment, including macroeconomic and business-related changes.

- Consolidation: In technical analysis, consolidation describes an asset's oscillation between a well-defined pattern of trading levels. Market indecision that lasts until the asset's price moves above or below the trading pattern is commonly understood as consolidation. A collection of statements that display (consolidates) a parent and subsidiary company as one entity is known as consolidation in financial accounting. Price charts for any time period can show periods of consolidation, which can extend for days, weeks, or months. Technical traders search price charts for levels of support and resistance before using these levels to decide whether to buy or sell.

- Retracement: A modest pullback or change in the direction of a stock, is referred technically as a "retracement." Retracements are merely transient and do not signify a change in the overall trend. Retracements are brief declines or changes in the course of financial instruments like stocks or indices. The term describes a brief shift in a stock's price in relation to an overall trend and is used by technical analysts to examine the price of assets. Retracements are expected to cease with the prior pattern developed. Reversals differ from retracements in that the price of the asset must break through levels of support or resistance in order for there to be one.

- Trendlines: Trendlines are distinctive lines that traders draw on charts to link a sequence of prices or demonstrate the best fit for specific data. The trader can then utilize the resulting line to get a solid indication of the potential direction of a stock's value movement. A trendline is a line drawn above or below pivot highs or lows to indicate the price's primary direction. Support and resistance in any time frame are represented visually by trendlines. They depict patterns during times of price contraction and show the direction and pace of the price. Trendlines show which single line or curve fits some data the best. To better illustrate the trend in a chart, a single trendline might be used. The highs and lows can be used to build a channel by applying trendlines to them. Each trader uses a different time frame for analysis and a different set of precise points to draw a trendline.

- Breakout: When the price of an asset crosses above a resistance region or below a support area, this is referred to as a breakout. Breakouts suggest that the price may begin to trend in the breakout direction. A breakout to the upside from a chart pattern, for instance, can signal that the price will begin to trend higher. High volume breakouts (compared to typical volume) demonstrate more conviction, which increases the likelihood that the price will trend in that direction. A breakout occurs when the price crosses over or under a barrier or support level. Since not all traders will recognize or use the same support and resistance levels, breakouts might be arbitrary. Breakouts present potential trading chances. Traders might consider going long or closing out short bets when there is a breakout to the upside. A breakout to the downside alerts traders to potentially enter the short or long side. Price is more likely to keep advancing in the breakout direction after breakouts with a comparatively high volume since these signals demonstrate conviction and interest. Price is less likely to move in the breakout direction because low relative volume breakouts are more likely to fail.

- Breakdown: A breakdown is a downward movement in the price of a stock that typically occurs through a recognized level of support and indicates future falls. When there is a breakdown, it frequently happens on high volume, and the ensuing move lower usually has a short length and severe amplitude. Traders can spot a breakdown using technical indicators like moving averages, trendlines, and chart patterns.

- Moving Average: In technical terms, Moving Average (MA) is typically a stock indicator that helps to smooth out the price data by building a constantly updated average price. An average price is the mean price of a particular stock observed over a specific period of time. It is important to calculate the Moving Average as it mitigates the impacts of random, short-term fluctuations on the price of the stock over a specific time frame. A Simple Moving Average (SMA) is calculated by taking the arithmetic mean of a pre-determined set of prices of the stock over a specific tenure in the past. An Exponential Moving Average (EMA) is a weighted average that lays high importance on the price of the stock in recent days rather than the past. Therefore, it is an indicator that is more responsive towards new and latest information which makes this as a reliable source for traders nowadays.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.