What is the 15-15-15 rule in Mutual Funds?

When you invest in a mutual fund, you must have a goal in place - how much return to expect on investments, and by investing X amount every month - how much corpus you will generate in Y years. Once you have the clarity - your mutual fund investing journey becomes easier. One of the ways to have this done is through the 15-15-15 rule. In this article, we discuss the 15-15-15 rule for mutual funds.

Meaning of the 15-15-15 rule in Mutual Funds

The 15-15-15 rule for mutual fund investing has three parts to it:

- The Investment: You should invest Rs 15,000 per month

- The Tenure: The total of your investment should be 15 years. It means that you will invest Rs 15,000 every month for the next 15 years.

- The Return: Your expected returns on your investment should be 15%

If you can take care of investment and tenure and your portfolio generates a return of 15% in this duration, you will end up with more than a crore at the end of the tenure.

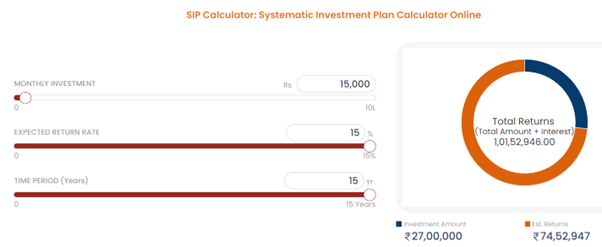

Don't believe us? Here is the result from the SIP calculator. As you can see, with the above numbers, you will have Rs 1,01,52,946 in your portfolio. How did it happen? An investment of only Rs 27 lakh became over a crore? The answer is compounding. Let us look at it in the next section.

Meaning of Compounding

Compounding refers to the process of earning interest on both the initial principal amount you invest and the accumulated interest from previous periods. It is essentially like a snowball rolling downhill, growing in size as it picks up more snow along the way. Here's a breakdown of how compounding works:

- Initial Investment: You invest a certain amount of money, called the principal, in a savings account, mutual fund, or other investment vehicle.

- Interest Earned: This investment earns interest over time, at a specific rate.

- Adding Interest to Principal: In compounding scenarios, the earned interest isn't just paid out to you. Instead, it gets added to your principal amount.

- Earning Interest on Interest: In the next period, you not only earn interest on the original principal but also on the accumulated interest from the previous period. This snowball effect is what makes compounding so powerful over time.

Power of compounding

The longer your money is invested and the more frequently it's compounded (e.g., monthly vs. annually), the greater the impact of compounding. Even with a relatively low interest rate, consistent investment and allowing your returns to the compound can lead to significant wealth creation over long periods. Let us take some examples and understand the power of compounding.

Examples of compounding

Example 1: Suppose you invest a lump sum amount of Rs 1,00,000 in an equity mutual fund with an average annual return of 12%. You plan to hold onto this investment for 20 years, and all dividends and capital gains are reinvested back into the fund. After 20 years of investing in the equity mutual fund with an average annual return of 12%, your investment could grow to approximately Rs 964,600. Do note that over Rs 864,600 of this growth is attributable to the power of compounding.

Example 2: The aim of this example is to show the power of compounding for mutual fund (SIP) investment. Also, what we meant when we said that compounding works best when given time. Let us assume you invest Rs 15,000 every month and generate 15% returns on your investment. In the first five years, your investment will be Rs 9 lakh, and you will accumulate Rs 13.45 lakh. No magic, right?

You continue your SIP, and at the end of 10 years, your invested amount is Rs 18 lakh, and your corpus is Rs 41.80 lakh. Excellent, but not magically. And as we have seen, if you continue for 15 years, you accumulate nearly Rs 1.01 crore. Magical. But the real magic happens when you stay for one more year. With an investment of only Rs 36 lakh, you accumulate nearly Rs 2.28 crore. It is magic, for sure.

|

Tenure |

Total Investment with 15K per month |

Total Corpus |

|

5 years |

Rs 9 lakh |

Rs 13.45 lakh |

|

10 years |

Rs 18 lakh |

Rs 41.80 lakh |

|

15 years |

Rs 27 lakh |

Rs 1.01 crore |

|

20 years |

Rs 36 lakh |

Rs 2.28 crore |

Benefits of the 15-15-15 rule in mutual funds

Here are some of the benefits of the 15-15-15 rule for mutual fund investment:

- Encourages Discipline and Consistency: One of the toughest things for most investors is discipline. Of the reasons why most fail in investing is that they don't have a clear goal and plan. The rule sets a clear and achievable goal (Rs 1 crore in 15 years) and emphasizes consistent monthly contributions of Rs 15,000. This regular investment habit is crucial for long-term wealth creation.

- Leverages Compounding: By consistently investing and reinvesting returns, the rule allows you to benefit from compounding. Your returns generate returns over time, leading to significant potential growth.

- Simplicity: The 15-15-15 rule is a straightforward concept that's easy to understand, even for people new to mutual funds. It provides a basic framework to get started with regular investment.

Conclusion

To sum up, the 15-15-15 rule provides a useful framework for retirement savings planning. If you still are unsure about it, you should consult with financial advisors as they may help you create your financial plan taking into consideration your unique financial goals, circumstances, and investment objectives. By adhering to this rule and leveraging the growth potential of mutual funds, you can take proactive steps toward securing your financial future and enjoying a comfortable retirement.