What are immediate annuity plans and should you invest?

After working long and hard for 3-4 decades, you finally decide to hang your boots and settle into a life of comfortable retirement. The key ingredient to a financially stress-free life in your silver years is that your retirement corpus must be able to generate an income that is comfortably enough for all your expenses.

There are many options available for generating a post-retirement income. But one option that comes with a relatively assured level of income throughout your life is the immediate annuity product offered by insurance companies. An immediate annuity gives you – and if you so desire for your spouse as well – a pension for life.

For those accumulating a corpus via the NPS (National Pension System), it is compulsory that they annuitize 40 per cent of the sum accumulated in their account. For others it is a conscious choice.

Given that most non-governmental employees wouldn’t get any pension after their retirement, should they consider immediate annuities?

As interest rates near their peak, what are the yields on immediate annuities like? Are they good enough to beat inflation?

Here’s more on how immediate annuities work, the options available, the likely yields, and the taxes you will have to pay on the pension income. We also highlight the factors to be considered while making a choice.

Options available

When you invest in an immediate annuity product, you pay a lump-sum upfront to the insurance company. With the premium paid by you, the insurance company gives you a fixed income till the end of your life. The premium is called the purchase price.

These immediate annuities come in many formats. So, you can choose to have income only for yourself – called annuity for life. In such cases, after your time, the purchase price is not returned.

Then, there is an option to take annuity of life and also have the premium given to you after your time to your nominee – annuity for life with return of purchase price.

The third variant is the option to have pension for both you and your spouse – joint annuity with or without return of purchase price.

Annuity is the pension you would receive periodically – monthly, quarterly, half-yearly and yearly. You can buy an immediate annuity policy and start receiving a pension from as early as age 40. The maximum age of entry allowed is 80 years.

Once you buy the immediate annuity product, you can start receiving payments from as early as the next month after purchase.

The rate of annuity payout varies depending on the option that you choose. For example, annuity for life without return of premium would typically give you a higher payout than if the purchase price is asked to be returned after death.

What annuities offer as yields

Given that immediate annuity products offer a regular stream of income for multiple decades, it is important to assess the kind of returns or yields that a buyer would get.

The most popular option is usually pension for self with return of purchase price to the spouse or nominee. This is the option taken for calculating yields from annuities.

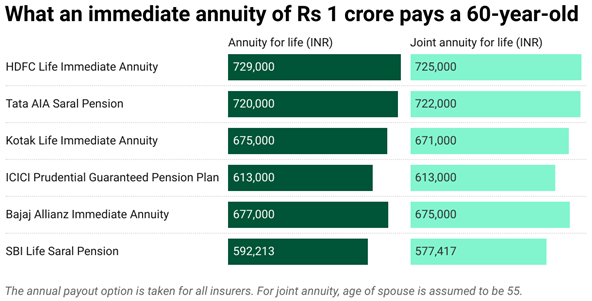

We have taken the immediate annuity plans offered by six insurers – HDFC Life, SBI Life, Kotak Life, ICICI Prudential, Bajaj Allianz and Tata AIA.

The age of the person taking this immediate annuity plan is assumed to be 60 currently, while the spouse’s age is taken as 55. The purchase price is assumed to be Rs 1 crore.

The pension is assumed to be received annually, starting from the month after the purchase of the annuity policy.

For immediate annuities, there is a GST (goods and services tax) charged at the rate of 1.8 per cent. Therefore, the purchase price increases to Rs 10,180,000. We assume that the annuitant (person receiving the pension) would live till the age of 85. So, annual payouts for 25 years are considered.

Data from Policy Bazaar indicates that for the annuity for life with return of purchase to the nominee option, these six insurance companies pay Rs 5.92 lakh to Rs 7.29 lakh on annual mode for a Rs 1 crore policy.

In the case of Joint annuity for life with return of purchase price, the annual payouts range from Rs 5.77 lakh to Rs 7.25 lakh, a bit lower than the earlier option.

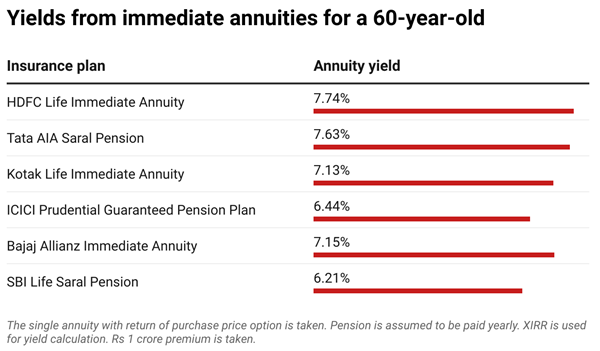

When we calculate the yields from the immediate annuity policy, we consider the XIRR (extended internal rate of return) formula for arriving at the figures as a series of cashflows are involved.

As mentioned earlier, for 25 annual payouts from the annuity policy, the XIRR based yields work out to 6.21% to as high as 7.74% in the case of these insurers. At least three insurers offer yields higher than 7% and these are fixed.

These returns are comparable to what investors can get from debt funds or bonds, even higher in some cases.

If inflation is assumed to be around 6% annually, then these policies do offer more than the prevailing rate of price rise.

Deciding on the right plan

Though returns from immediate annuities aren’t spectacular, one key aspect to remember is that the amount is fixed and assured for life, irrespective of any change in interest rates in the future. The fact that there is certainty of cashflows as you are locked into a specific rate is comforting, especially in your retirement years. And these are mostly safe investments, with little to no risk risk in payouts at any stage.

The choice of plan must be based on your specific requirements. If you are single, with no dependents, you can opt for just single annuity without return of purchase price and enjoy a 20% higher annual payout than you would with return of purchase price.

In case you have a spouse, you can opt for annuity with return of purchase price. But if you doubt your spouse’s ability to handle a large sum after your time, you can opt for joint annuity for life so that your spouse continues to receive a pension.

Another key aspect to note is that you must have multiple sources of income and not just depend on annuities alone.

So, if systematic withdrawal plans (SWPs) from debt funds, high-interest deposits, and small-saving schemes must ideally all be part of your income generating scheme.

But with deposits and small-savings schemes, the interest rates are reset periodically by the government, banks or non-banking finance companies based on prevailing interest rates. Therefore, during periods when interest rates are low, your deposits might earn less than inflation.

Also, some portion of your retirement kitty must be in equities given that the asset class helps inbeating inflation convincingly over the long term.

All payouts from immediate annuities are added to your income and taxed at the slab applicable to you.