The Zomato Saga: From food review to restaurant aggregator to going public and finally turning profitable

After the Paytm and Yes Bank Saga, we thought of coming up with a story on the positive side - a story where investors have made money no matter when they invested in the company - it is at an all-time high. As an investor, you can look at this story and the previous ones we have covered to evaluate why there is a difference in outcome (as of now, the future outcome can be different).

Zomato, originally founded as Foodiebay in 2008 by Deepinder Goyal and Pankaj Chaddah, has undergone a remarkable evolution from a simple food review website to a comprehensive food ordering and delivery platform. Over the years, it has expanded its services, ventured into new markets, adopted innovative technologies, and finally made its initial public offering (IPO) in July 2021. Let us look at their journey so far.

Early Days: Foodiebay to Zomato

Foodiebay was launched with the simple aim of helping users find information about restaurants and food outlets in their vicinity. The platform started in Delhi-NCR, India, and quickly gained popularity due to its user-friendly interface and comprehensive database of restaurant listings, menus, and reviews. In 2010, Foodiebay rebranded itself as Zomato, a name derived from the word 'tomato,' symbolizing freshness and variety in food. This rebranding marked the beginning of Zomato's journey as a global food-tech company.

Growing Years: Expansion and Diversification

After establishing a strong foothold in the Indian market, Zomato set its sights on international expansion. It began operations in multiple countries across Asia, Europe, Africa, and the Americas, acquiring local competitors to accelerate its growth in new markets.

Simultaneously, Zomato expanded its services beyond restaurant reviews to include features like online ordering, table reservations, and food delivery. It allowed the platform to cater to a broader audience and capture additional revenue streams.

The Game Changer: Entering the Food Delivery Space

Recognizing the growing demand for convenient meal delivery services, Zomato launched its food delivery vertical in February 2015, enabling users to order food from their favorite restaurants with a few taps on their smartphones.

Initially, it partnered with companies such as Delhivery and Grab to fulfill deliveries from restaurants that did not have their own delivery service. Later, it started delivering on its own.

Food delivery was the turning point for the company because that was a large pain point to solve for both restaurants and consumers. If we look at the numbers, no individual restaurant (2014-2015) had the scale of orders to afford a dedicated delivery unit.

As per the latest data, today, most restaurants that are listed on online platforms derive nothing less than 30% of their business via Zomato and Swiggy.

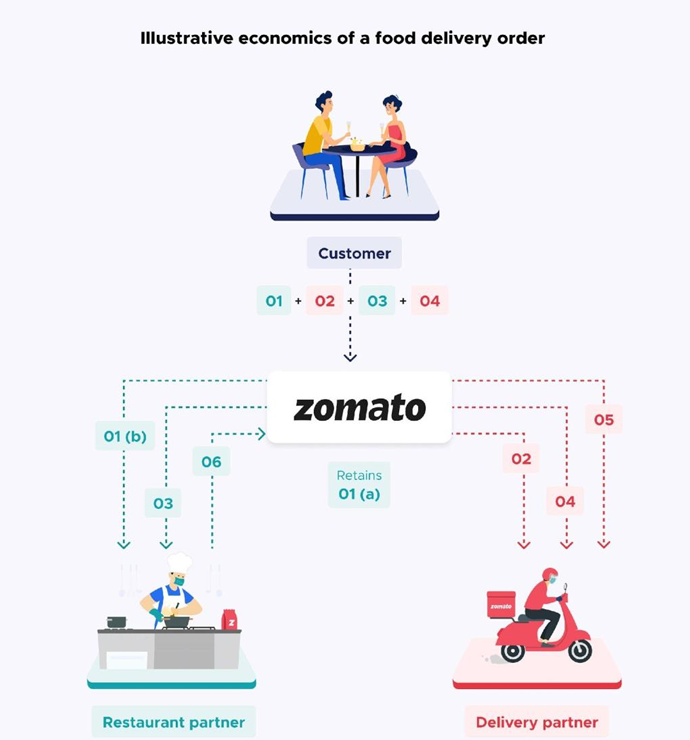

Since it is the most vital segment of their business, let us understand it better. The three critical stakeholders in this business are:

- Customers: Food delivery allows customers a convenient, on-demand solution to search and discover local restaurants, order food, and have it delivered reliably and quickly.

- Delivery partners: They have one of India’s largest hyperlocal delivery networks in terms of the number of delivery partners. Their delivery network collected food from restaurant partners and delivered it to customers.

Restaurant partners: Restaurants are the backbone of their business, and they strongly believe that they can only be viable if they help the restaurant industry grow and succeed more than it could do without them.

They also have a Hyperpure business. It is their farm-to-fork supplies offering for restaurants in India. They source fresh, hygienic, quality ingredients and supplies directly from farmers, mills, producers, and processors to supply to their restaurant partners, helping them make their supply chains more effective and predictable while improving the overall quality of the food being served.

Technology and Innovation: The Growth Drivers

Throughout its journey, Zomato has leveraged technology and innovation to enhance the user experience and streamline operations. The platform employs data analytics, machine learning, and artificial intelligence to personalize recommendations, optimize delivery routes, and improve order accuracy.

Zomato's mobile app and website feature intuitive interfaces, real-time tracking, and seamless payment options, making it easy for users to discover restaurants, place orders, and track their deliveries in real time. And how can we move to the next section without giving a mention to their app notification? They are always going viral!

Going Public: Initial Public Offering

In 2021, Zomato made headlines by announcing its plans to go public with an initial public offering (IPO). The IPO, one of the most anticipated in India's tech sector, marked a significant milestone in Zomato's journey from a startup to a publicly traded company.

The IPO received an overwhelming response from investors, underscoring confidence in Zomato's business model, growth potential, and leadership team. The IPO was launched at an issue price of Rs 76 and made a stellar debut at a 51% premium. The company had a bumpy ride, like most tech companies post-listing. After the initial rise, the stock price went down and came below Rs 50 after a year - July 2022.

Addressing the elephant in the room: The losses

Even though there was confidence among investors about their business, the road to profitability was always questionable. Since listing and till Q4FY23, the company has reported losses consistently. In Q3FY23, the net losses were Rs 347 crore, which decreased to Rs 187.60 crore in Q4FY23. The pressure was visible in their share price.

The company announced that it plans to turn profitable by FY25. The CEO was quite clear that the company needed to do only two things to become profitable:

- Increase profits in food delivery

- Reduce losses in quick commerce (Blinkit)

The company made the required changes - shut down many dark stores and stopped operations in 225 cities in January 2023. And finally, it did what many thought was impossible for the company in the near future - it turned profitable.

Change of Tide: Turning Profitable

In Q1FY24, the company reported its first-ever profit of Rs 2 crore. The profit came as the company received a deferred tax credit of Rs 17 crore during the quarter, contributing to its net profits. For Q2FY24, they reported a profit of Rs 36 crore, and the momentum continued as they reported a profit for the third consecutive quarter of Rs 125 crore.

You can check the detailed Q3FY24 result here.

The other businesses under Zomato like Blinkit are far from turning profitable. The company has said that the segment's losses continue to decline, and they are on track to meet their guidance of adjusted EBITDA break-even on or before Q1FY25. Also, as per industry experts, Hypercure B2B supply to restaurants is an important revenue generator for the company for its next leg of growth.

The Future: Roadblockers

The company has cleared the grey clouds after it turned profitable. However, the company still has a long way to go. They need to consistently remain profitable.

They face competition from Swiggy, which is expected to get listed in the near future, and the premium they are getting at present, may not be available once Swiggy gets listed.

Another problem with the company is that its monthly active users (MAU) have remained stagnant at 1.75 crore for years. The company has not been able to find a way to grow its MAU. And now, under the pressure of remaining profitable, the growth will become even harder.