Share market outlook of the week: Correction approaching maturity, Nifty poised for a breakout

ICICI Direct

23 Mins 16 Feb 2024

2 Comments

200 Likes

- Nifty gained >1%, outpacing Midcap index (+0.3%), and performed in tandem with major global equity indices (up 0.5%).

- Nifty formed a higher bottom above 50-day ema (21,400) and looks poised for a breakout from five weeks of consolidation as seasonal correction in election year approaches maturity (historically, in election year, index tends to bottom out in Feb/March followed by pre-election rally).

- We expect Nifty to surpass life highs of 22,126 and head towards 22,700 by end of March 2024 while key support is placed at 21,400.

- Heavyweight Banking index (commanding >35% weight) has formed a strong base at 200-day ema and expected to lead Nifty higher, well supported by IT, Oil & Gas and Auto stocks.

- Furthermore, steady domestic fund flow, robust global market setups are likely to act as tailwind.

Corporate Earnings grow healthy 15% on YoY basis during December quarter

- Corporate earnings (ex-financials) at Nifty for Q3FY24 came in on expected lines with PAT growth on YoY basis deaccelerating to 15% for the quarter vs. 25%+ run-rate recorded in the previous two quarters i.e. 26% in Q1FY24 and 33% in Q2FY24. For Q3FY24 topline growth came in at 5% on YoY basis with EBITDA growing 12% on YoY basis amid 110 bps expansion in EBITDA margins.

- Margin expansion on YoY basis was primarily driven by lower raw material prices, the benefits of which are however tapering down with RM costs up 100 bps on QoQ basis. At the PAT level, Nifty (ex-financials) PAT grew 15% YoY. Headline numbers were broadly flat on QoQ basis.

- Management commentary was encouraging over the resilience shown by the domestic economy amid muted global macroeconomic growth scenario, consistent government thrust on infrastructure development (capex outlay in union budget for FY25 pegged at Rs 11.1 lakh crore, up 11.2% YoY) and stable commodity price outlook.

- On the sectoral topline front, growth for the quarter was led by the Auto, Capital Goods and Pharma pack. In the Auto space, volumes for the quarter were up 16% YoY which coupled with premiumisation trend led by 21% growth in revenues. While in the Capital goods domain, execution was healthy across the universe with very strong order inflows.

- On the sectoral PAT front, growth for the quarter was led by Auto, Capital Goods & Pharma pack. In Auto space, outperformance at JLR (EBITDA margins at 16.5%, up 130 bps QoQ) at Tata Motors & low margins in base quarter lifted the overall performance. In Pharma space, strong US sales in the specialty domain which is margin accretive lifted the sectoral performance.

- Nifty earnings including financials was a marginally tepid show this time wherein PAT growth for the index for Q3FY24 was pegged at 13% vs. 15% for excluding financials universe. Topline growth, however, fared better at 9% on YoY basis. Muted PAT growth in the financials pack was primarily due to one-time exceptional charge (provision for pension liability) at SBI.

- Interestingly for the small cap domain earnings growth was again very healthy at 20% on YoY basis.

- For the listed universe (~3,900 companies) as a whole PAT growth came in encouragingly at 23% on YoY basis. PAT was broadly flat on QoQ basis.

Going forward we don’t foresee any risk to our double-digit earnings estimates. We stick to forward numbers and shall revise them post Q4FY24 results.

- Going forward, we expect Nifty earnings to grow at a CAGR of 16.3% over FY23-26E. Our Dec 2024 target for Nifty is set at 25,000 wherein we have valued Nifty at 20x PE on FY26E EPS of Rs 1,250/share with corresponding Sensex target set as 83,250; offering a potential upside of ~14% from current index levels.

Auto OEMs posted healthy performance in Q3FY24

Mahindra & Mahindra

- At M&M, on the standalone basis, topline for the quarter came in at Rs 25,289 crore (up 17% YoY) with automotive segment volumes growing 20% YoY at 2.1 lakh units and tractor sales volume at 1.02 lakh units (down 4% YoY).

- EBITDA in Q3FY24 came in at Rs 3,236 crore with corresponding EBITDA margins at 12.8% (up 20 bps QoQ). Resultant PAT for the quarter stood at Rs 2,454 crore (up 61% YoY).

- Automotive segment EBIT margins improved further to 8.3% (up 40 bps QoQ) while Farm Equipment segment margins declined to 15.5% (down 50 bps QoQ, it includes 70 bps one-time impact of World Cup sponsorship in Q3F24, adjusting for which it stood at 16.2%).

- The margin performance at the company was broadly in line with expectations. For FY24E it expects domestic tractor industry to decline by 5% on YoY basis with Q4FY24 decline pegged at 10%. On the SUV side its orderbook stands healthy at 226k units with aspiration to grow mid to high teens in FY25E amidst domestic PV industry growth pegged at <5%.

- In the SUV space its present booking run rate is still ahead of monthly production capacity. With capital efficiency to the core (RoE at 19% in YTDFY24), the company is well poised for more profitable growth going forward. At the valuation standpoint, it trades inexpensive compared to its peers. We have a positive view on the company.

Eicher Motors

- On the consolidated basis, Total operating income for the quarter came in at Rs 4,179 crore (up 12% YoY) amid 3% rise in Royal Enfield sales volume at 2.3 lakh units.

- EBITDA in Q3FY24 came in at Rs 1,090 crore with corresponding EBITDA margins at 26.1% (down 30 bps QoQ).

- Resultant PAT for the quarter stood at Rs 996 crore (up 34% YoY, down 2% QoQ). Share of profits from the VECV arm stood at Rs 114 crore.

- At its CV arm, it has launched an Electric- LCV (2-3.5T) with deliveries to begin in Q1CY25 while EBITDA margins at VECV arm came in at 8% (flat QoQ) and have been lagging its peers.

- Margin performance on the standalone basis (Royal Enfield franchise) was satisfactory at 27.5% (down 40 bps QoQ) amidst stable gross margin profile. Going forward management guided for healthy demand prospects primarily on the back of market expansion as well as new launches such as Himalayan 450 & Shotgun 650. It is witnessing ~15-16% YoY growth in enquiries and ~11-12% YoY growth in bookings. Its team size on the EV front has inched up to 140 people.

- Over the long-term investment horizon, we like the stock amidst market leadership in premium motorcycle space and wide opportunity landscape both domestically as well as globally.

- Capital efficient business model and cash rich B/S remain structural positives.

PSU mining major continue their impressive performance

Coal India: Posted robust performance in Q3FY24

- Total operating income for the quarter came in at Rs 36,154 crore (up 3% YoY & 10% QoQ) with coal sales volume of 191 million tonne (up 9% YoY and 10% QoQ). Topline growth came ahead of our expectations primarily driven by higher average realization from e-auctions, which reported a premium of more than 100% to FSA price despite decline in international coal prices.

- Reported EBITDA for the quarter came in at Rs 11,373 crore with corresponding EBITDA margins at 31.5% (up ~200 bps YoY). EBITDA/tonne for Q3FY24 came in at Rs 594/tonne vs. Rs 468/tonne in Q2FY24. Along with higher realization from e-auctions, decrease in raw material cost and flat employee expense (YoY basis) supported the margin profile.

- PAT in Q3FY24 stood at Rs 9,094 crore, up 18% YoY and 33% QoQ basis. The company declared a second interim dividend of Rs 5.25 per share.

- We remain positive on the stock, given the double-digit growth of volumes driven by strong demand from power sector, inexpensive valuation, and healthy dividend yield.

NMDC: Reported healthy performance in Q3FY24

- Total operating income for the quarter came in at Rs 5,410 crore (up 45% YoY & 35% QoQ) with iron ore sales volume of 11.4 million tonne (up 19% YoY and QoQ). Topline growth was driven by higher sales volume and increase in iron ore realization.

- Reported EBITDA for the quarter came in at Rs 2,007 crore with corresponding EBITDA margins at 37% (up 644 bps YoY). EBITDA/tonne for Q3FY24 came in at Rs 1,762/tonne vs. Rs 1244/tonne in Q2FY24 vs Rs 1,191/tonne in Q3FY23.

- PAT in Q3FY24 stood at Rs 1,484 crore, up 63% YoY and 45% QoQ basis. It’s included an exceptional cost item of Rs 252 crore towards levies for diversion of forest land at its iron ore mines in the state of Karnataka.

- The company expects dispatches to be at 46-47 million tons in FY24. Volume guidance for FY25 is pegged at ~50-53 million tonne.

- We remain positive on the stock amidst healthy volume growth in offerings and considerable price hikes in the recent past resulting in strong profitability outlook going forward.

Pharma and Chemicals – revival in the offing

PI Industries Q3FY24- noteworthy results among weak global agrochem trend

- In a quarter where most of the agrochem companies suffered due to pricing pressure and customers de-stocking in exports market, PI numbers stood out with decent growth supported by agrochem CSM.

- Revenues grew 18% YoY to Rs 1,613 crore, driven by 13% growth in CSM business to Rs 1504 crore and consolidation of Pharma CSM business (Rs 127 crore). Ex-Pharma revenues growth was 10%. Domestic business on the other hand de-grew 6% YoY to Rs 267 crore. Adjusted EBITDA grew ~20% YoY to Rs 498 crore and the margins stood at ~26%. PAT grew 28% to Rs 449 crore.

- CSM growth was driven by volume growth and newly commercialised products which contributed ~60% to the overall growth. This also suggests that the pressure in the agrochem global markets is confined to generics while the innovative CRAMS space continues to remain lucrative.

- CSM order book remains strong at US$ 1.7 billion. The margins trajectory for CRAMS remains strong at 33%. The company is also focusing on CSM business in non-agrochem space.

- PI remains a standout performer among other Indian Agrochem players in tough times due to strong and sustainable CSM performance.

Divi’s Q3FY24- margins still below-par but recovery in Custom Synthesis a welcome sign

- Revenues were up ~9% YoY at Rs 1,860 crore mainly driven by ~25% growth in Custom Synthesis (CS) to Rs 853 crore. However, APIs de-grew ~2% to Rs 848 crore and so was Carotenoids which de-grew 4% YoY to Rs 153 crore. Gross margins improved ~~400 bps YoY to 60.7% mainly due to better products mix (higher CS sales). EBITDA improved ~20% YoY to Rs 489 crore whereas EBITDA margins increased 245 bps to 26.4%. Adjusted PAT increased ~31% YoY to Rs 358 crore.

- Although the overall print was still below the consensus estimates on the API and EBITDA margins front, we take solace from a much-awaited CS recovery after a prolonged gap. On the API front, the management expect meaningful recovery two-three quarters down the line as the prices continue to remain under pressure due to customers destocking.

- Things are looking promising on the CS front with continued traction from two contrast media products besides promising projects in peptides and diabetology (dedicated facility). One more contract execution in contrast media is expected in FY25. The Kakinada greenfield plant is likely to start production in Q2FY25 which will cater to both CS and APIs. The next key monitorable aspect would be recovery in EBITDA margins which are languishing between 24-28% range for the last five quarters. We believe the momentum and sustainability of CS performance will be the key for margins recovery and ultimately the investors sentiments.

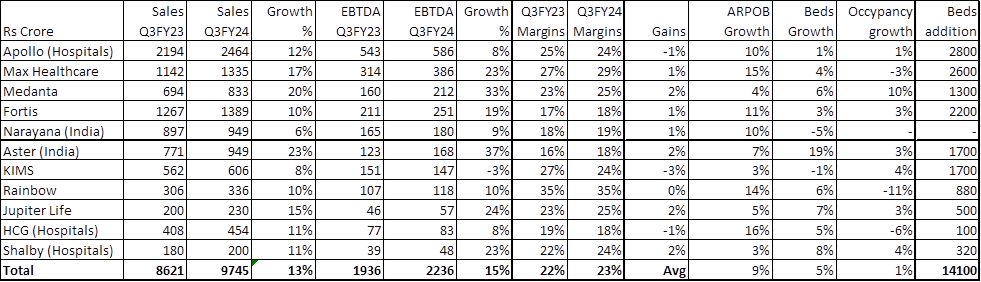

Hospitals stocks in pink health on the back of good Q3, upbeat outlook

- Hospitals continued to witness buoyancy in quarterly performances with decent sales growth and firm EBITDA margins in Q3. Combined revenues of 11 pan-India hospitals put together grew 13% YoY to Rs 9,745 crore and EBITDA grew 15% YoY to Rs 2,236 crore with 23% EBITDA margins (100 bps improvement) with relatively lesser mean deviation.

- The revenues growth on an average was driven by 10% ARPOB growth, 5% addition in Beds and 1% improvement in occupancies.

- Qualitatively, better case mix (i.e. higher number critical surgeries such organ transplants, cardiovascular surgeries, targeted oncology), Better patient profile (higher insurance covered patients, growing medical tourists), Higher super specialty hospitals penetration in tier II-IV towns are some of the aspects for growth momentum.

- With most of the new hospital assets inducted in the last 5-7 years turning profitable, the ROCE for most of the hospitals are trending in 15-18% range as against 8-12% range few years ago.

- With very less balance sheet stress and comfortable leverage position, the sector is now entering into a new capex phase (14,000 beds additions over the next 4-5 years) which almost 25-30% of the existing capacity.

Hidden Gem

Mastek: Acquisitions aids to diversify & expand business (CMP: Rs 3,068 ; Target price: Rs 3,500)

- Mastek is an IT services company providing enterprise digital and cloud transformation services to public & private enterprise in the UK, US, & RoW regions. Mastek revenue in dollar terms grew by 20.2% CAGR between FY18-23 & 25.7% in Rupee terms while PAT grew by 33.2% CAGR. In FY23 UK & Europe region contributed 62% of revenue while Government & Healthcare segments together contributed ~59% of the revenue mix. For 9MFY24 it reported revenue of US$ 274.7 mn, up 18.5%.

- In last 18 months Mastek has diversified its business to reduce UK region revenue concentration by expanding its business in the US. The company acquired MST Solutions & BizAnalytica which not only helped to increase its business in US but also expanded its offerings in Salesforce, Snowflake, AWS and data & analytics among others. The acquisitions increased the revenue contribution from US region from 16.7% in FY21 to 24.4% in FY23 & 28% in 9MFY24.

- Mastek's 12M Order backlog grew at 20% YOY growth in Q2 & Q3 of FY24 and it 12M Order backlog stood at US$ 248.5 mn in Q3FY24. The company’s revamped client mining strategy & additions of new logos keeps the pipeline healthy and also help the company to sustain its growth momentum.

- We expect the company to report revenue CAGR of 15.6% between FY23-26E in dollar terms & 17% in rupee terms. We also expect the company’s EBITDA margin to increase from 17.8% in FY23 to 19% in FY26E while EBITDA & PAT is expected to grow at CAGR of 19.7% & 18.7% respectively between FY23-26E.

- Valuation: We value Mastek with TP of Rs 3,500/- at 22xP/E of FY26 EPS of Rs. 158.2.

Source: ICICIdirect Research