SEBI's consultation paper on mutual fund expenses: What it means for AMCs and investors

Market regulator SEBI’s recent consultation paper on bringing transparency into how much mutual funds can charge unitholders is expected to reduce expenses that investors pay to asset management companies (AMCs).

The key suggestion made in the paper was that fund houses must charge expenses (total expense ratio: TER) at the AMC level by arriving at a weighted average expense ratio – for which SEBI has given a slab-wise structure depending on asset size – for each category of investment, equity debt and hybrid. For example, the regular plans of all actively managed equity funds would thus be charged the same expense ratio.

Regulation of distributors’ commission and a performance-based TER were other key discussion points in the paper.

Now, SEBI has stated in its paper that AMCs Rs 30,806 crore as TER in FY22. With the new proposal, that figure would have been Rs 29,404 crore, according to the market regulator, a reduction of 4.55%.

Here’s more on the likely impact of these proposals for investors and AMCs.

Setting the background for new slabs

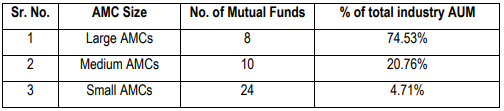

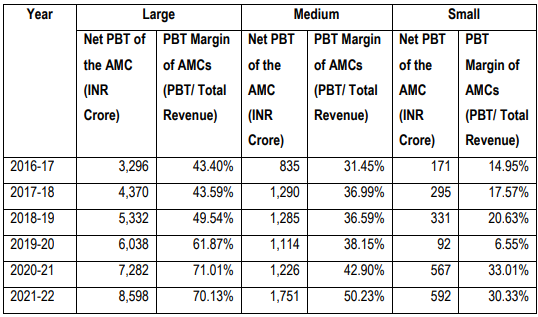

SEBI’s noted that for AMCs, profitability has been on the rise for most of the large and mid-sized ones. Therefore, the regulator was of the opinion that the scale advantages in terms of cost and margin of AMCs must translate to lower and transparent charges for investors.

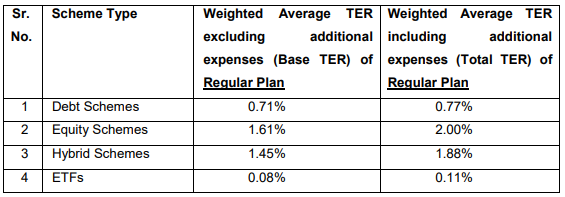

Many fund houses were also charging much more than the base TER to investors. The base TER is roughly, the charges for the direct plan plus distributor commission in the case of a regular plan. The additional charges were: 1. Brokerage and transaction costs; 2. 0.3% point additional charge for investments from B-30 or beyond 30 cities; 3. Additional 5 basis points as provision for schemes allowing exit load; and 4. GST on investment and advisory fee.

And SEBI found that there was a substantial difference in the base TER and total TER in the case of equity and hybrid funds. It was to the tune of 39 basis points to 43 basis points more.

The regulator found that many AMCs did not execute trades through the top brokers by volume. They ran trades through brokers who charged more. If these were for research reports, as AMCs contended, SEBI turned around and questioned why investment and advisory was charged then.

New TER and the impact on investors and AMCs

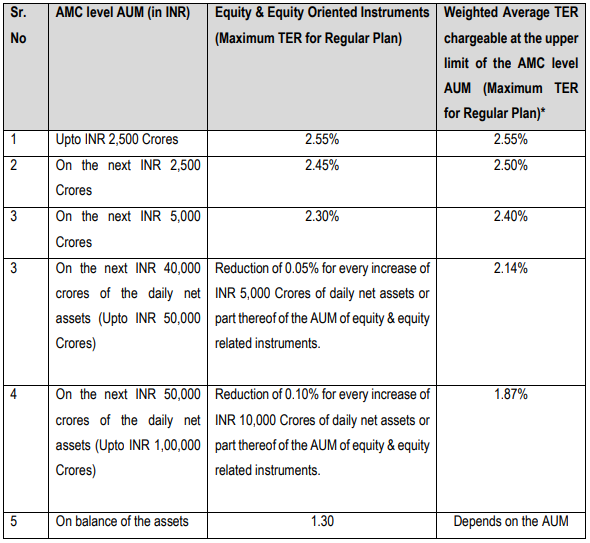

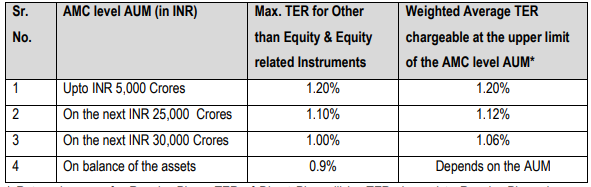

After the study, SEBI proposed a new slab for equity oriented mutual funds, which is as follows. More importantly, these charges would not be at the scheme level, but would be at the AMC and category levels.

For other than equity schemes, that is debt-oriented funds, the new slabs are as follows:

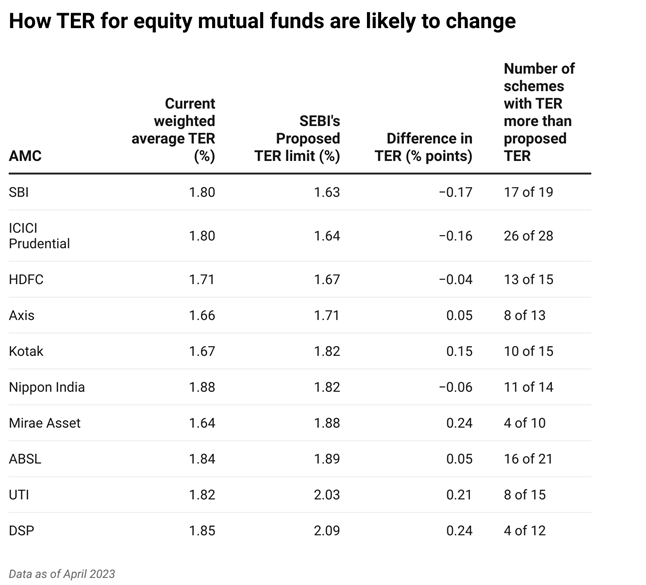

A study of the current total expense ratio (TER) and the proposed revised charges by Fisdom Research on SEBI’s proposals for all three categories – equity, debt and hybrid – indicates that among the top 10 AMCs, the impact is more on equity-oriented schemes. These are based on April 2023 assets of fund houses.

Overall, out of 378 active equity funds, as many as 171 schemes may have to adjust their TERs with the new proposal, if accepted.

In equity-oriented schemes, ICICI Prudential, SBI, HDFC and Nippon India are the fund houses whose weighted average TER is more than the regulator’s proposed limit. Mirae Asset, UTI and DSP have charges that are well within the proposed expense ratio.

But even among fund houses charging lower than the proposed TER at the aggregate level, between 40 per cent and 70 per cent of the equity schemes levied higher charges than SEBI’s new suggested limit.

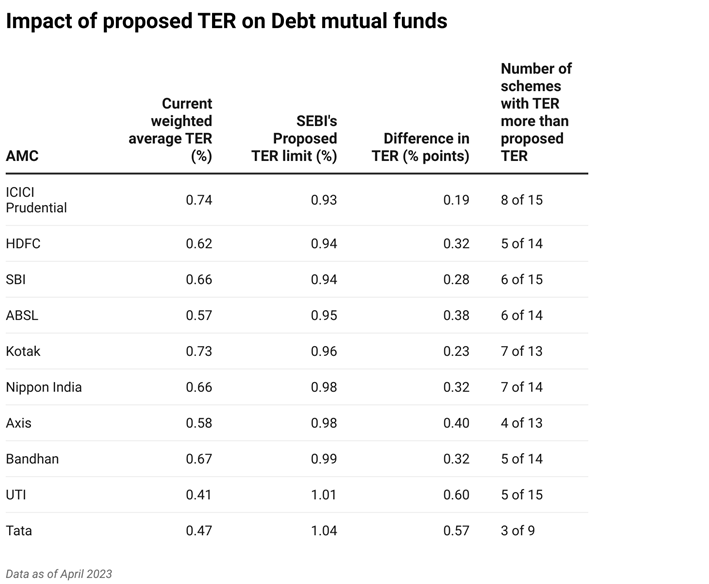

Debt and hybrid funds less impacted: One of the points raised by SEBI in its discussion paper was that in the debt-oriented category, which is dominated by corporates by assets under management, fund houses actually charged much less as their bargaining power was more.

And sure enough, going by Fisdom Research, none of the top 10 fund houses in the debt category currently charge more than the proposed TER limit. In fact, they charge 19 to 60 basis points lower.

But at the scheme level, there are still many that charge more than the proposed limit. About 30-50 per cent of the schemes charged more than SEBI’s proposed limit.

Overall, 89 out of 284 debt schemes may have to reduce their TER to align with the new proposed slabs.

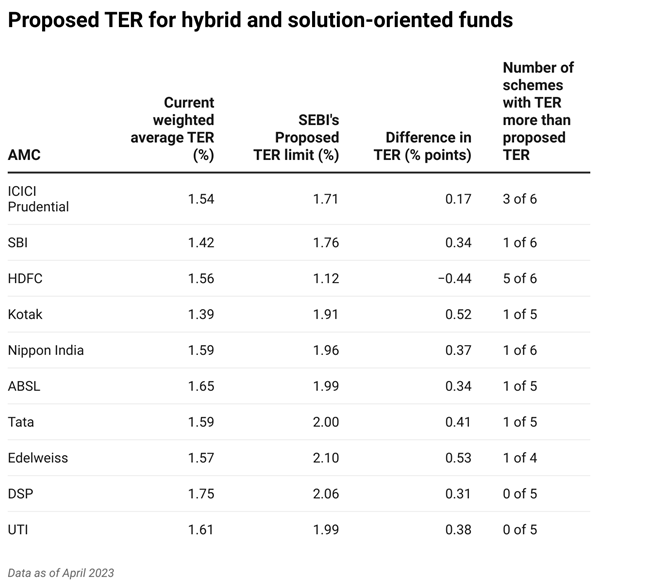

Among hybrid schemes, only HDFC in the top 10 AMCs charged more at the aggregate level and at the scheme level. Five of its six hybrid schemes charged more than the proposed limit, while for ICICI Prudential, it was 3 of 6.

If SEBI’s proposals are accepted, retail investors can hope for reasonable reduction in scheme TERs, which when compounded over the long term can result in significant savings.

Regulating commission for distributors

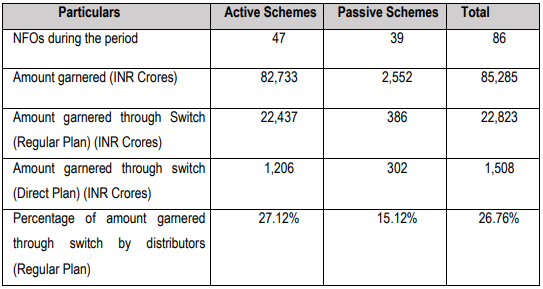

The surge in new fund offers (NFOs) meant that a lot of money flowed into these schemes from exiting funds via switches, mostly at the behest of distributors given the higher commission they are likely to receive.

As seen above, from the Rs 82,733 crore garnered via NFOs from April 2021 to September 2022, as much as Rs 22,437 or 27.12% was generated via switches from regular plans of existing schemes.

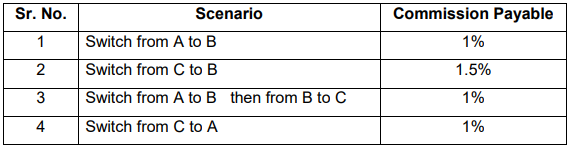

SEBI has therefore proposed a new structure. In the case of a switch transaction, the distributor will get the lower of the commissions offered under the two schemes of any switch transaction. It gives example. So, if the distribution commission offered by an AMC for Scheme A is 1%, Scheme B is 1.5% and Scheme C is 2% the commission for switch transactions would be as follows.

The market regulator has indicated that the first year’s commission should not be more than 25% committed to the distributor for the first three years. Alternatively, the commission paid to the distributor should be equal for all years.

These moves are expected to discourage unnecessary switches and also reduce TER for smaller schemes.

In another suggestion, the SEBI has proposed to lower exit loads in open-ended schemes from 5% currently to 2%.

Performance-based TER for funds

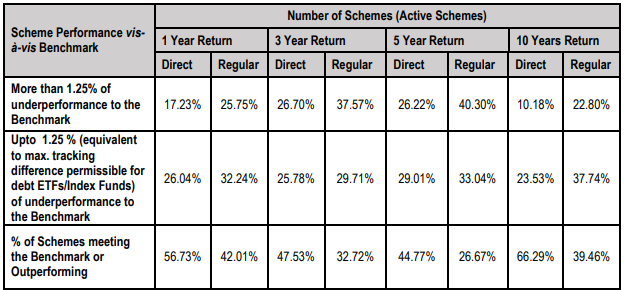

SEBI noted that as many as 22% of all active funds have an underperformance vis-à-vis their respective benchmarks, of more than 1.25% points, which is the maximum permitted for debt ETFs and index funds.

The regulator observed that AMCs outperforming their benchmarks consistently could perhaps charge unitholders a performance-linked TER, wherein the management fee is based on scheme performance.

SEBI has suggested two approaches to implement performance-linked TER.

A: First, a base TER may be charged. When an investor redeems units, management fees may be charged and deducted from the amount if higher-than-indicative-rate is generated, or annualised return received by the investor is above the hurdle rate.

B: A higher expense limit for performance-based TER may be fixed and TER inclusive of management fees may be charged to the investor. At the time of redemption, if the AMC fails to generate returns above the indicative return for investor or the annualised return for the investor is below the hurdle rate fixed in advance, the AMC can charge only base TER and must then return the remaining expenses charged to the investor.

Mutual funds already have regular and direct plans. So, will mutual funds have to come out with a third plan for every active scheme for performance-based TER? If so, it would add to the confusion of investors and as such retail investors may be not be in the best position to judge the hurdle rate and so on. But the idea itself is welcome as it would hold fund managers accountable and reward consistent outperformers and penalize regular underperformers.

Source: SEBI, Fisdom Research