Retail investors getting smarter: Buy low, Sell High!

Market volatility no more a fear for retail investors as data indicates, investors utilising market declines as a buying opportunity. In last one year, since October 2021 all-time high level till October 2022, Foreign Portfolio Investors (FPI) have sold equities worth ₹ 2 lakh crore. Such significant selling has been highest during any twelve months’ period for Indian equity markets in recent times. However, despite such significant selling by foreign investors, Nifty 50 Index is trading near all-time high level. This has happened because of buying led by Indian mutual funds. During this period, domestic mutual funds have been net buyers of almost equivalent amount of ₹ 2 lakh crore. Domestic mutual funds have been able to support the markets because of the Indian retail investors, which are getting smarter and matured as equity investors. Retail investors now don’t get swayed away by the market volatility and use it to their advantage to accumulate at lower levels. Domestic liquidity is not only getting stronger but also smarter.

This domestic buying has prevented the significant fall in Indian equity markets which otherwise would have happened, had this domestic buying not there.

Domestic mutual funds have been able to support the markets because of the Indian retail investors, which are getting smarter and matured as equity investors. Retail investors now don’t get swayed away by the market volatility and use it to their advantage to accumulate at lower levels. Domestic liquidity is not only getting stronger but also smarter.

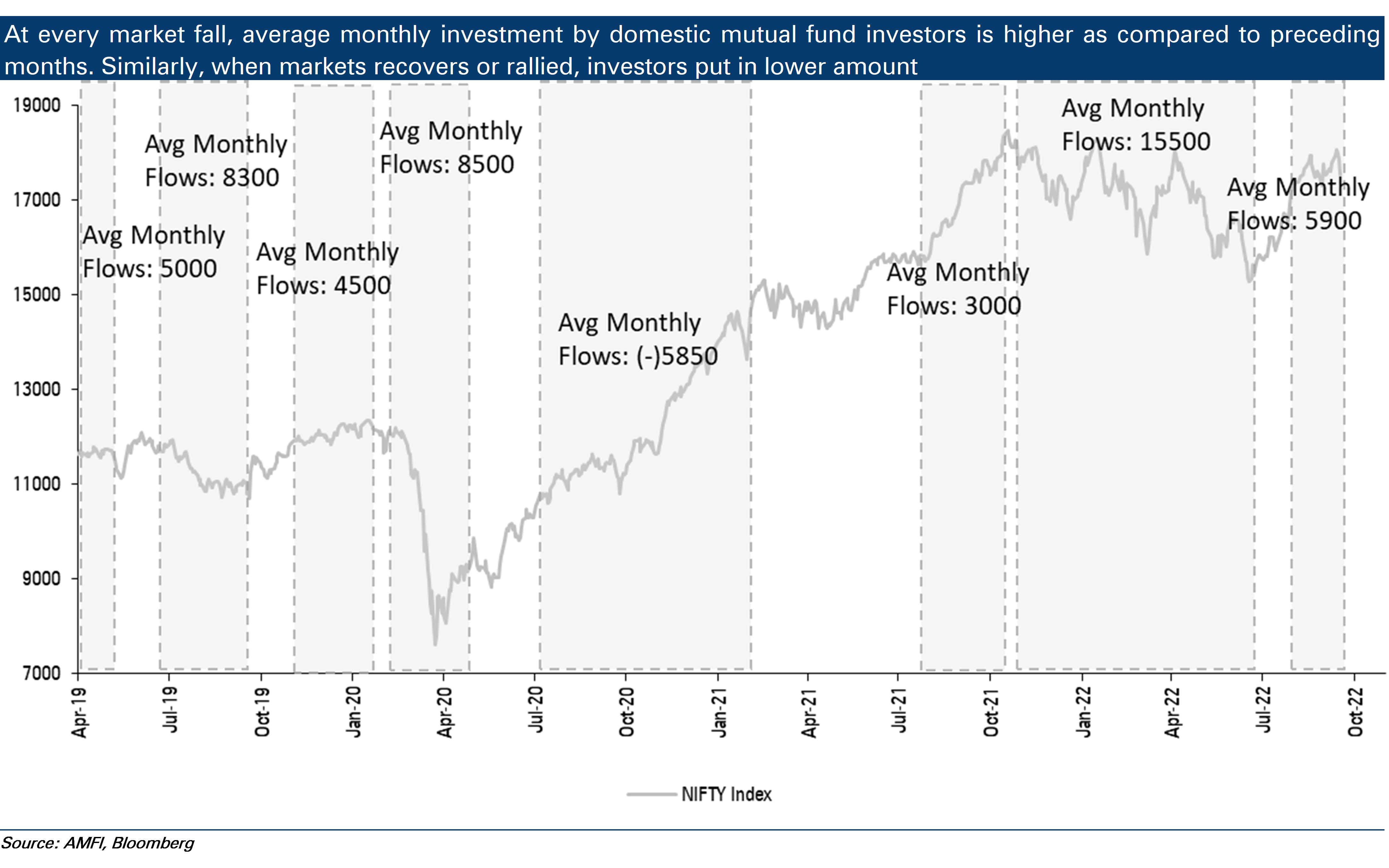

Over the last few years, retail investors have invested higher amount when there is a fall in equity markets. On the other hand, whenever there is a significant or continuous rally in equity markets, investors have turned cautious and invested lower amount at higher levels.

In last 3 years, there have been 2 major market fall and one minor fall. One of the major fall was during COVID pandemic (Feb/March 2020) and the other major fall was from the all-time high level in October 2021 (October 2021 to June 2022). The minor fall was during the period of the period of June to July 2019. During all these market fall period, investors have put in higher amount as compared to pre-fall period. On the contrary, whenever markets have continued to rally, investors have turned cautious at higher levels and invested lower amount.

For instance:

- During the last June 2019 to August 2019: Nifty 50 index fell by around 8% => Average monthly inflows into domestic mutual funds increased to ₹ 8,300 crore from ₹ 5,000 crore in immediate previous months.

- COVID-19 pandemic induced market fall in the year Feb/Mar 2020 => Monthly inflows in domestic mutual funds almost doubled to ₹ 8,500 crore from ₹ 4,500 crore.

- Fall from all-time high levels in October 2021 => average monthly inflows from November 2021 to June 2022 increased to ₹ 15,500 crore as against inflows of ₹ 3,000 witnessed pre market fall period of August 2021 to October 2021.

Similarly:

- Just before COVID-19 pandemic induced fall in February 2020 => Inflows were lower at an average of ₹ 4,500 crore per month as markets had rallied around 11% from the lows of 11,000 on Nifty 50 index level in August 2019 to 12,200 levels in January 2020.

- Markets continued to rally post COVID induced fall in 2020 => investors turned net sellers (outflows of ₹ 5,850 crore per month from July 2020 to February 2021).

- Currently, since last 3 months from August 2022 to October 2022 => As markets have moved up and trading near all-time high levels, inflows have reduced to an average of ₹ 5,900 crore per month from ₹ 15,500 crore (average during November 2021 to June 2022).

While this approach of lower investment at higher levels have been rewarding, investors got it wrong during the recovery in the year 2020 and 2021 as markets continued to rally while investors booked profits early into the recovery (sold off early since July 2020 while Nifty continued to rally till first major correction in February 2021).

Domestic liquidity to grow stronger: Significant growth in retail equity AUM for domestic MF, continuous rise in SIP flows despite extreme volatility and rising number of investors

- AUM in retail oriented Equity, Hybrid and Index mutual funds have grown 5x in last 6.5 years from ₹ 3.6 lakh crore in March 2016 to ₹ 18 lakh crore in September 2022.

- Monthly inflows through SIP into domestic mutual fund has increased more than 4x in last six and a half years from ₹ 3,100 crore in April 2016 to ₹ 13,040 crore in October 2022.

- Number of folios in pure equity oriented funds have grown almost 3x in last 6.5 years. Unique investors have grown by around 2.5 to 3 times during similar period from around 1 crore to 3.5 crore.

We strongly believe that while the domestic financialisation story is well acknowledged, the maturity and smartness of retail investors in under-appreciated. This maturity among wider retail investors will ensure stable and consistent domestic inflow into the Indian financial sector and equity markets in particular.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism.The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds