Nifty's Technical Outlook for CY23

The COVID-19 pandemic adversely affected the stocks and its prices. As the world was not ready for an enigma like this, it took around 3 years (2019, 2020, 2021) for the earth to settle. As the year is drawing to a close, ICICI Direct comments about the technical outlook on Nifty. Despite of conditions such as high inflation, rising interest rates, geopolitical unpredictability, COVID, currency volatility, and FII selling in 2022, the Indian Stock Market outperformed the global market. The Indian stock market is considered to be the year's shining example as it has maintained and is still outperforming the international markets.

The world and Indian stock markets have seen a roller coaster ride, but as of December 27, the Nifty has gained 5.6% despite a 10–20% decline in most international markets. Additionally, the Nifty 50 reached a new high of 18,888 in November, while the Nifty midcap increased 7.6% year to date. The banking stocks, especially the PSU banks, were the biggest winners of the year.

Indian markets are likely to show a decadal move of 5x on headline indices. The ICICI Direct Research Team’s technical study expects that Nifty can reach to 50000 by CY30. Nifty has performed well in the years 2021 and 2022, thereby proving our trajectory right. This journey and the long term trends often comes along with volatility.

The Nifty Target for CY23 is stated at 21,400, with the strong support placed at 16,200 levels. Support is the price when demand is sufficiently high to prevent the stock from falling further. This projection is supported by several studies which are as follows:

- Seasonality: Third-year returns of each decade for the past four decades have been positive, with a median of 18%. Additionally, a pre-election year has produced profitable results 70% of the time.

- Conventional chart work: ICICI Direct Research team is assuming a breakout from 13 month’s range (18,300-15,200) projecting the price of 21,400. A breakout occurs when a stock price moves with significant volume outside of a clearly defined support or resistance level.

- Long term breadth thrust: For the last two decades, 60% of Nifty 500 constituents have triggered average 25% returns in the Nifty in subsequent 12 months. These constituents have rose above 200 Day Moving Average (DMA).

Small and Mid-caps to outperform large caps:

Midcap universe's relative outperformance is in mid-cycle of a bull phase. A financial market is said to be in a bull market when prices are rising or are anticipated to rise.

The word "bull market" or “bull phase” can refer to anything that is traded, including bonds, real estate, currencies, and commodities, however it is most frequently used to describe the stock market.

Our Research Team is expecting this outperformance to get further amplified over the next couple of years, and increase by almost 20% in CY23. BFSI, automobiles, PSU, capital goods & infra, and telecom are the sectors being focused, while IT offers favourable risk/reward conditions.

Deciphering decadal cycles of Indian Equities:

Since its start in 1979, the Sensex returns have been 4x on average in every decade. The study aids investors in gaining a wider perspective and maintain their path even during difficult situations. Despite several geopolitical concerns, increased inflation, and higher interest rates, the Nifty maintained its path and hit its anticipated target of 18,900 for CY22.

Union Election Cycle:

A significant phenomenon in the equity markets is the election cycle. Election year, post-election year, midterm years, and pre-election year are the four segments of the Election Cycle. Depending on the current election cycle, various traits have also been highlighted by the Indian equity markets.

The fact that CY23 is a pre-election year will have a big impact on how equities markets are falling. Benchmark indices have shown a tendency to perform favorably during pre-election years. Seven out of ten times the index had a profitable return. Two of the three negative return occurrences occurred in 1995 and 1998, when India's political climate was unstable, and the third occurred in 2008, amid the global financial crisis.

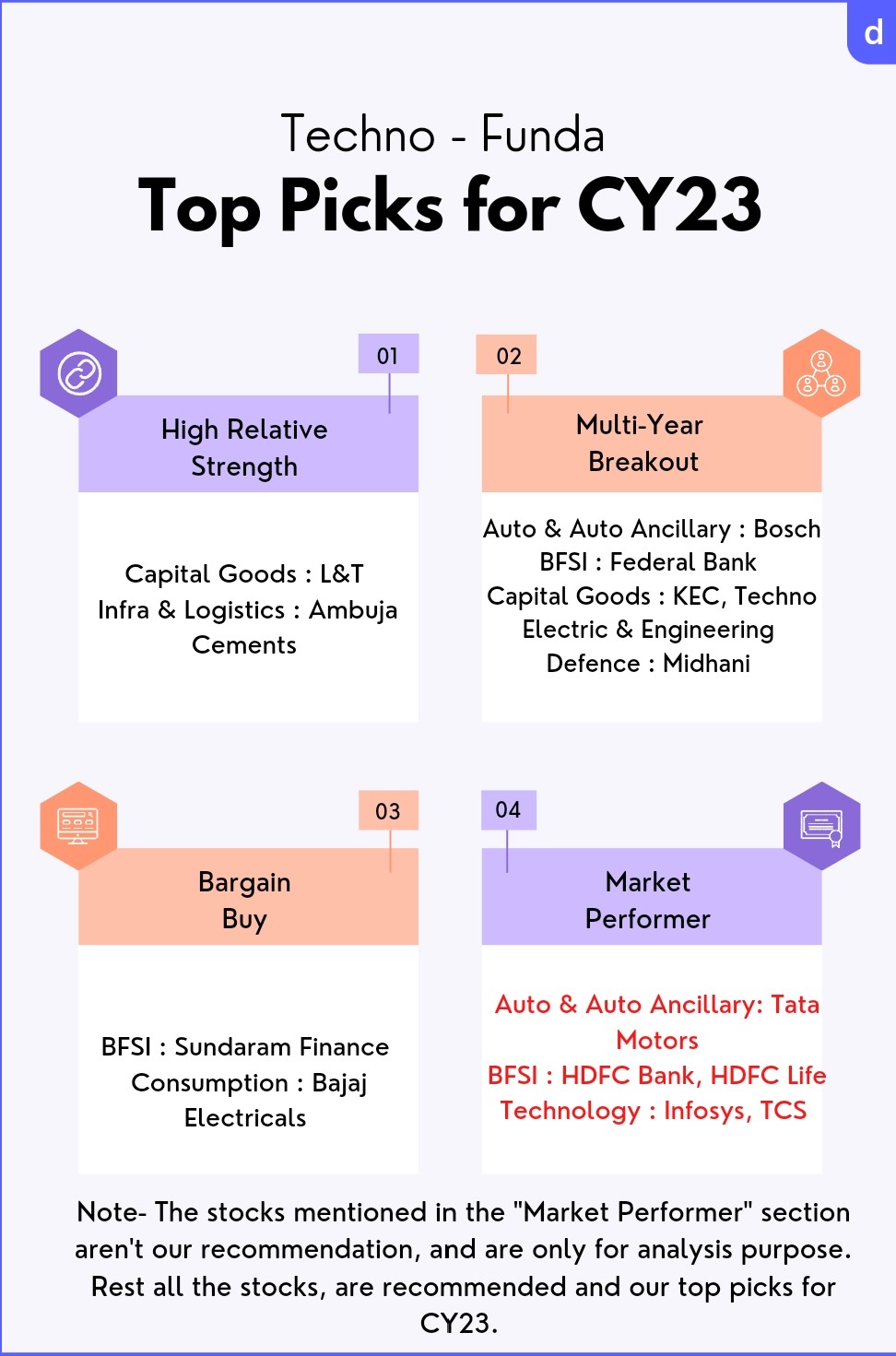

Top picks for CY23:

The top Techno Fundamental picks for CY23, according to the ICICI Direct Research Team are:

Based on tried-and-true technical criteria including traditional patterns, relative strength ranking, Fibonacci price prediction methodologies, moving averages, and oscillators, we have divided the whole universe of companies listed on the NSE into four groups which are as follows:

- High Relative Strength

- Multi-Year Breakout

- Bargain Buy

- Market Performer

The stocks having high Relative Strength are expected to outperform in the CY23. The sectors influencing High Relative Strength are BFSI, Capital Goods, Defense, and Telecom.

Technical analysts and value investors use relative strength, a form of momentum investing. Selecting investments that have outperformed their market or benchmark is what it entails. Investors that focus on relative strength believe that the pattern of outperformance will last.

Multi-Year breakout implies that the under owned equities and sectors that were out of favour for a while are suddenly seeing prices break through multi-year highs with substantial volumes. The sectors that influences this parameter are PSU, Auto & Auto ancillaries, and Hospitality.

In the Bargain Buy, stocks are placed around the strong support, and are currently out of favour. They provide good risk/reward set up, and their primary structural trend is up. The sectors associated with Bargain Buy are Pharma& Chemicals, IT, Consumer Discretionary, Chemicals, Insurance, Oil & Gas, Infra.

On the other hand, Market Performer refers to the stocks which are expected to perform in line with the overall market movement. In Market Performer, primary trend is up but lag on relative strength score. The sectors in line with Market Performer are Retail, Consumer Staples, and Metals.

The top two categories of High Relative Strength and long-term breakouts, in our opinion, offer the greatest potential for outperformance.

FII and DII with respect to Dollar:

A notable increase in DII activity over the past few years has helped to lessen sensitivity to foreign outflows. From a liquidity perspective, this is a significant adjustment in favour of Indian shares. The relationship between FII flows and the US Dollar Index is inverse. We anticipate FII inflows to increase once more in Indian equities under the current circumstances, where the dollar is beginning to show symptoms of weakness, which will accelerate the upward trend in the Indian equity market.

Indian stocks held up well in CY22 despite FII (Foreign Institutional Investors) withdrawals of more than 1,35,000 crore, as robust DII (Domestic Institutional Investors) inflows 1,69,000 crore, offset the negative effects.

The term "foreign institutional investors" (FII) refers to institutional investors who make investments in assets located in nations other than their own. In any economy, foreign institutional investors are crucial. These are the large corporations that make significant financial investments in the Indian markets, including investment banks, mutual funds, etc. Markets tend to rise upward when these major players acquire assets, and vice versa. They have a significant impact on the economy's overall inflows.

Institutional investors who invest in securities and other financial assets within their own country are referred to as domestic institutional investors. Investments made in a nation's financial or physical assets by institutions or organizations like banks, insurance firms, mutual fund houses, etc. are referred to as institutional investments. Simply put, domestic institutional investors trade in domestic equities and assets using pooled funds.

Glossary:

- Trends: The general direction of a market or the price of a stock is called a trend.

- Support: Support is the price when demand is high enough to prevent the stock from falling any further.

- Breakout: A breakout occurs when a stock price moves with significant volume outside of a clearly defined support or resistance level.

- Resistance: The opposite of a support level is a resistance level. It is a price level (ceiling) above which it is not anticipated that the stock price would increase.

- Day Moving Average (DMA): A five-day simple moving average (SMA) calculates a new average each day by adding the five most recent daily closing prices and dividing the total by five. The single flowing line is created by connecting each average to the one before it.

- Small cap and Mid Cap: Companies with a market capitalization of worth more than Rs 5,000 crore but less than Rs 20,000 crore are considered mid-cap. Companies classified as small-cap are those whose market capitalization is less than Rs 5,000 crore.

- Market Capitalization: The total value of all the company's shares of stock is referred to as market cap, also known as market capitalization.

- Risk Reward Ratio: The risk/reward ratio shows how much an investor might profit from an investment for every dollar they risk.

- Relative Strength Ranking: The performance of a stock's price over the previous 12 months is gauged by the Relative Strength Rating, which ranges from 1 (worst) to 99 (highest). As they begin a fresh climb, the best stocks typically have an 80 or better RS Rating.

- Moving Average: A moving average (MA) is a stock indicator that is frequently used in technical analysis. It creates a continuously updated average price to assist smooth out price data. A stock is in an uptrend if its moving average is increasing, whereas a downtrend is indicated by a dropping moving average.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.