Nifty Realty: What is causing the rally, and will it sustain?

We know that NIFTY50 has delivered excellent returns in 2023, but do you know a sector has given 4X better returns this year. Yes, the NIFTY realty index has given over 70% in 2023 compared to 15% returns delivered by NIFTY50 (as of 11 December 2023).

Here is an interesting point to tell you why we are talking about NIFTY Realty in today's article. The NIFTY realty index has crossed the 600 level mark after nearly 15 years. The last time it did the same was in October 2009. So, what is going on with the index? Why an excellent rally? We will look at the details in this article.

The Nifty50 index and underlying companies

The NIFTY Realty index is designed to reflect the performance of real estate companies that are primarily engaged in the construction of commercial and residential properties in India. The index has performed much better than NIFTY50 - here is the comparison.

|

Index |

1 Month |

6 Month |

YTD |

5-years |

|

Nifty50 |

7.99% |

12.88% |

15.38% |

94.32% |

|

Nifty Realty |

12.33% |

47.43% |

70.89% |

214.19% |

As you can see, the realty sector has performed well in the recent years compared to Nifty50. In has delivered better returns in all the time frames shown above.

No point in guessing, the index has increased because the underlying stocks have performed well. Let us look at some stocks and how much returns they have performed in 2023.

|

Company Name |

YTD approx Returns (11 Dec) |

|

Prestige Estate |

152.44% |

|

Macrcotech Developers |

66.41% |

|

DLF |

75.40% |

|

Godrej Properties |

55.49% |

|

Swan Energy |

51.20% |

|

Phoenix Mills |

55.08% |

|

Oberoi Realty |

65.93% |

|

Brigade Enterprises |

76.51% |

|

Sobha |

83.06% |

|

Mahindra Lifespace Developers |

46.08% |

Based on the above table, we can see that Prestige Estate has been the top-performing stock with a gain of over 150%, while the least returns have come from Mahindra Lifespace but even that is much better than most stocks from other sectors.

Why the rally in realty stocks?

Let us look at different reasons to understand the reasons for the stock rally:

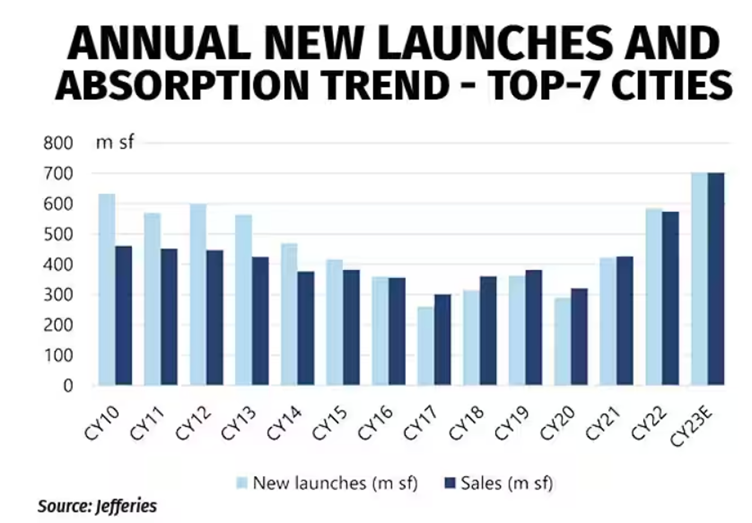

The increase in demand: If we look at numbers, there has been excellent growth in demand for residential property in 2023. As per Housing, across the top seven cities - Hyderabad, Mumbai Metropolitan Region (MMR), Pune, Bengaluru, Chennai, Kolkata, and Delhi-NCR, approx 1,20,280 units were sold in the period between July and September 2023. In the year-ago period, the total sales were only 88,230 units in these seven cities which gives a growth of 36% YoY. The growth numbers are there for previous quarters as well. Overall, in 2023, residential sales are expected to increase by 8.7%.

Strong economic recovery: The realty stocks are riding the strong economic recovery in India. The interest rate has been stable for a while now. The RBI has not shown an intention for the rate cuts. The home prices are stable in most cities, which move in sync with commodity prices. The commodity prices have cooled in the second and third quarters of 2023.

Unorganized to organized: Another reason the sector is doing exceptionally well is because of the consolidation that has happened from unorganized to organized, which ensures that the top players are getting higher sales. This is a long-term change and is expected to benefit the sector going forward too.

Foreign Investor Inflows: Another reason for the rally in the realty sector is because of strong inflows from foreign investors. It has sent the signal that the sector is worth considering, and it drove the index to new heights.

Will the rally continue?

In the last 12 to 18 months, we were in the interest rate upcycle. Yet, the sector has done well. To add to all that we have discussed so far, this year will be the best in the last decade - the highest sales after 2014. As per experts, the real estate upcycle will continue for the next few years. The segments that will do better are the luxury and mid-income housing categories.

Another positive for the sector is that the net debt of the top eight listed developers stood at Rs 23,000 in FY23 from Rs 40,500 crore in FY20. The only problem is the current valuation, and if there is an uptick in debt levels or slowing pre-sales, then investors must become cautious. It might be better to look at individual stocks and their valuation for investing.