Nifty consolidating on expected lines

Market Outlook:

- Global equities witnessed some profit taking after the FOMC meet last week and Nifty also gave away most of the gains and closed the week marginally negative. Once again Technology space was the major laggard along with the FMCG space. Even banking lost some of its shine last week as profit booking was experienced after 6 weeks of consecutive gains. However, broader markets did relatively better and small cap index close the week in green.

- Global markets came under pressure as Fed maintained its instance on pace of interest rate hikes despite cooling down inflation. It reignited the recession worries, and weakness was observed across the asset classes. However, Dollar index and US bond yields remained largely range bound suggesting no major change in risk perception and we believe that the recent weakness seems to be of short term. Also, despite US equity markets moving near their month lows, VIX index remained lower suggesting the same.

- Going ahead we expect levels near 18,000-18,200 to act as immediate support levels and expect recovery towards fresh highs in the coming weeks.

- Since June 2022 lows, index has not corrected for more than three consecutive weeks. With two weeks correction done, we expect market to present buying opportunity in coming week.

- India VIX has not seen significant jump indicating low risk perception of market participants

- Breadth in terms of percentage of stocks above 200 DMA has entered bullish trajectory (above 60%). Historically on 8 out of 10 occasions such breadth thrust has provided double digit returns over subsequent 12 months.

- Mid/Small over Large: Ratio chart of Nifty500/Nifty100 has turned up from lower band of one year range, indicating outperformance of Mid/small caps. We expect both indices to relatively outperform and head gradually towards their respective high

- Our preferred large caps: Reliance Industries, Axis Bank, SBI, L&T, Ultratech

- Preferred mid-caps: Apollo Tyres, Carborandum Universal, Sterlite Technologies, Supreme Industries, GPPL, GSFC, IDFC First Bank, KEC, Mahindra CIE, Balrampur Chini

Oil & Gas:

Triggers such as US$60 price cap on Russian crude, followed by interest rate hike by the US Fed and falling Chinese manufacturing indicators (Covid lockdown), has pressured crude on both fundamental and technical front (oil market has also lately been illiquid as less traders are inclined to take sides in this volatile market).

OMCs have been a beneficiary on both fronts during this volatile period, as a mix of falling crude oil prices and range bound product spreads is helping the PSUs to emerge stronger from the mayhem. Singapore GRMs continue to improve from lows US$(0.4)/bbl in October to current US$7.2/bbl as on 14th Dec (avg GRM during the quarter stands at US$5.5/bbl). Indian companies will continue to command premium over the Singapore GRMs, as Diesel continue to stay at US$35-40 range.

On the OMC marketing front, losses on diesel have reduced from |15 per litre in October to current loss of Rs 2 per litre and trends suggest that soon OMCs will break even on diesel. Petrol on the other hand has been profitable for the OMCs (Rs 8.4 per litre during Q3). On a blended basis, OMCs marketing segment will incur a loss of Rs 3 per litre in Q3.

However, a third factor, OMCs will also incur a onetime inventory loss during the quarter due to fall in crude oil prices

Upstream companies have insignificant impact due to movement in crude oil prices, as Government of India have capped their realisation at US$73-75 per bbl levels

Reliance FMCG Foray:

- Reliance Consumer Products, the FMCG arm and wholly-owned subsidiary of Reliance Retail Ventures, announced the launch of its FMCG brand ‘Independence’ in Gujarat, with products across staples, processed foods, beverages and other daily essentials. It's product portfolio includes category like edible oils, pulses, grains, packaged foods and other daily needs products.

- The FMCG foray through brand independence could lead to increase trade margins, promotions & advertisement spend across industry. Thought, it is difficult to establish brands & distribution network in short Span of time, but reliance foray could squeeze margins of other FMCG companies in foods space like Tata Consumer & ITC. We believe margins expansion from the current level would become difficult for these companies, which could result in contraction in premium valuation multiples

PSU Banks:

Post elevated NPA and muted credit off-take, PSU banks have witnessed a recovery with credit growth inching up in double digit while NPA trending downwards with improved PCR. Thus, RoA for PSU banks have been inching towards 0.8-1% gradually.

With recovery in growth and return ratios, PSU banks are set for further re-rating. Large PSU banks (SBI, BoB, Canara Bank) are trading at ~0.8-1x P/BV which paves way for further re-rating as peak valuation remain at ~1.2-1.5x in FY12-14, while for mid and small players, currently trading at 0.5-0.7x P/BV have touched ~1x. Thus, we believe sustained growth in credit coupled with improving efficiency and lower credit cost will boost return ratios (close to 1% mark) of PSU banks and thereby further re-rating in PSU banks.

|

Banks |

P/BV |

|

STATE BANK OF INDIA |

1.3 |

|

BANK OF BARODA |

1.0 |

|

CANARA BANK |

0.8 |

|

INDIAN BANK |

0.8 |

|

UNION BANK OF INDIA |

0.9 |

|

BANK OF INDIA |

0.7 |

Plastic Pipes:

- Plastic piping companies have witnessed a muted performance in H1FY23 dragged by lower rural demand and EBITDA margin pressure amid volatile PVC prices. The PVC prices have seen sharp correction of ~50% (to ~Rs 80/kg from its peak of Rs 160/kg in Jun’22) , which led to heavy inventory losses for plastic piping companies resulting in 500-600 bps fall in EBITDA margin fall of on a YoY basis.

- In H2FY23 we believe the PVC prices are now stabilising after a sharp fall. This along with subsiding high cost inventories will lead a sharp margin recovery for key piping players. We believe Supreme Ind and Astral Ltd will see a sharp recovery in EBITDA margin to the range of 400-700 bps in H2FY23 over H1.

- On the demand front, fresh inventory build-up at dealer’s levels amid strong agri & housing demand will drive volume growth H2FY23. Over the medium to long term, we maintain our positive stance on the sector factoring in higher government capex, real estate upcycles and new product launches by piping players. We therefore build in strong volume CAGR of 16-17% for Supreme Ind and Astral over FY22-25E.

Under our coverage we have BUY rating on Supreme Ind (TP of Rs 2,850) and Astral Ltd (TP of Rs 2,380) considering their strong volume growth, EBITDA margin recovery and robust balance sheet condition.

Wire companies:

- Wire & Cable players have reported price led revenue CAGR of 15-17% over the last three years. The companies have reported muted volume offtake during the same period owing to lower government/private capex and slow inventory build-up at dealer’s level amid volatile copper prices.

- Copper contributes ~70% of total RM costs for wire & cable companies. A sharp fall in the international copper prices by ~ 20% to ~US$ 8000/tonnes (by Nov’22) from its peak of ~US$ 10,500/t in April’22 had led to significant inventory losses for players like Havells. While for Polycab, the EBITDA margin at ~12% remained lower by 100 bps to its pre-covid level EBITDA margin of ~13%.

- We believe stabilising copper prices will lead to subsiding inventory losses in the in H2FY23. We build in EBITDA margin expansion of ~100-120 bps YoY in H2FY23 supported by easing raw material prices and improved operating leverage for Havells and Polycab. Also, we build in a strong demand of wires & cables in H2FY23 (volume growth of ~17% YoY) led by revival in government capex and fresh inventory build-up at dealer’s level. Under our coverage we like Polycab (TP Rs 3,300/share) and Havells (TP Rs 1,565/share) as the major beneficiaries’ of higher government/private capex and easing raw material prices over FY22-25E.

Real Estate : Sales remain robust despite increased interest rates; inventory at life lows

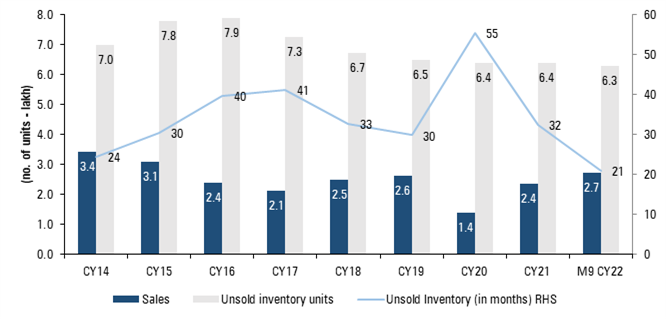

- The repo rate hike of 225 bps in FY23 till date, has translated into sharp increase in home loan rate but real estate sales have remained robust with H1FY23 witnessing a ~13% YOY sales in real estate units in the top 7 markets driven by a) Post pandemic inherent demand of big units, b) relatively strong track record of big developers in terms of execution/delivery, c) salary hikes in last two years driving housing demand in IT hubs (like Bengaluru/Chennai/Pune etc.) and d) wealth effect driving drive luxury housing demand

- Real estate sales in for calender year 2022 for top 7 markets is on course to hit 8 years high absorption (achieved sales of 2.7 lakh unit in M9CY22). The inventory overhang (month needed to clear the inventory) is also now at 21 months (lowest levels in last 8 yrs).

- Most importantly, funding crunch, weak environment in last couple of years, has meant exit of small/marginal unorganized players, which has resulted in sharp market share expansion in top players. With less competition, and well placed balance sheet, we expect top developers remain the key beneficiary of this upcycle.

Prefer Brigade Enterprises, Mahindra Lifespace, Phoenix Mills from our coverage as the key beneficiaries.

5G: A huge Opportunity:

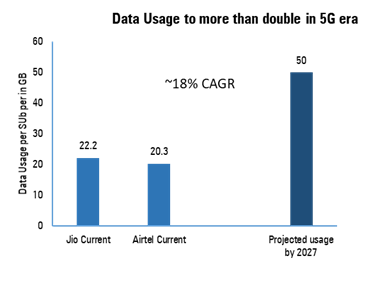

- The opportunity in 5G wireless segment will be led by a) higher data usage (Ericsson expects data usage per sub to more than double from current ~21-22 GB/month to 50 GB by 2027) and b) tariff hike. We highlight currently as the telcos are launching 5G, they are offering the existing 4G customers to upgrade (wherever available) to 5G without any incremental ARPU. However, given the huge 5G capex lined up, we do expect a tariff hike in the medium term by telcos.

- One segment which, we believe will drive the major upsides from 5G will be Enterprise. To put into perspective, currently the enterprise segment served by telcos have two broad category a) Connectivity (which includes traditional enterprise business like voice/data solutions, NLD/ILD connectivity, managed services and conferencing solutions, etc) and b) Adjacent ((IoT, CPaaS, cloud, cybersecurity and data centers), the size of which is Rs 40,000 crore and Rs 40,000-50,000 crore, respectively. Ericsson-Arthur D Little study says that 5G will enable Indian service providers to generate $17 billion in incremental revenue from enterprises by 2030, which is clearly 1.5x of current addressable market.

- We, thus see Telcos to tread a robust growth trajectory in medium term with overall industry structure being favourable (two strong player market), along with a chunk of capex cycle, already done and under process currently.

We continue to remain constructive on Bharti Airtel (Target Price - Rs 960) and Reliance Jio (subsidiary of RIL – Target Price Rs 2,700 ), given their relative strong competitive position

Hotels:

- Post sharp rebound in CY22, we expect performance of Indian Hotel Industry to continue to stay healthy in CY23 as well.

- Domestic air traffic now inching towards pre-Covid levels with average daily traffic surpassing 4lakh mark. Hotel booking data also suggests continuation of strong buoyancy in the demand led by wedding & holiday season along with healthy corporate demand.

- Further, India’s G20 presidency in 2023, ICC world cup and easing of E-visa rules would lead to sharp rebound in the foreign tourist arrivals in CY23.

- The government is also targeting to make India one of the top five tourism destinations in the world by 2030 under the new tourism policy. This would provide growth visibility from long-term perspective.

- The current inventory growth is significantly lower than the growth witnessed during FY09-13 post global financial crisis. The hotel supply pipeline is expected to grow only at 5 year CAGR of 3.5-4%, adding approximately 18,400 rooms to the current pan India premium inventory of 90,974 rooms across 10 key cities.

- This will facilitate the up-cycle as demand improves over the medium term while supply will lag demand with cautious expansion approach by hoteliers. The significant part of the recent inventory is coming mainly through management contracts and operating leases.

Indian Hotels - CMP Rs 329 ( TP: Rs 380 (Upside 16%))

- Under AHVAAN 2025, the company plans to have 300+ hotel room portfolio with zero net debt status. IHCL also aims to achieve 33%+ margins (35% for new businesses) through cost efficiencies

- We Expect revenue CAGR of 41.8% during FY22-24E. Business to recover fully to pre-Covid levels while EBITDA to surpass pre-Covid levels in FY23E; margins seen at over 33% in FY24E, which has the potential to further expand by ~100 bps thereafter

- Improved cash flows and divestment of non-core assets to help the company grow faster

Lemon Tree Hotels - CMP Rs 86 (TP: Rs 110 (Upside 28%))

- Lemon Tree is the largest hotel chain in the mid-priced segment in India. It operates 8,489 rooms in 87 hotels across 54 destinations in India and abroad

- Lemon Tree’s Q2FY23 performance remained ahead of our estimates bolstered by strong room rates and focus on cost optimization. With EBITDA margins closer to 50%, the company remains the most efficient players in the hotel space

- The company is expanding its footprints across mid & premium segment given the strong demand outlook. Post major capex, LTHL will be operating ~10,462 rooms in 105 hotels across 64 destinations, in India and abroad by FY24E

Hidden Gem:

Bharat Forge (MCap: Rs 41,100 crore, Rating: Buy; Target Price: Rs 1,050; Potential Upside: 19%)

- Bharat Forge (BFL) is India’s leading auto component exporter with strong engineering, technological competencies in forging, metallurgy. With global forging capacity of 7 lakh tonne per annum, its products find application in domestic, exports markets across Passenger Vehicle, Commercial Vehicle, Oil & Gas, construction & mining, power, defence, etc.

- In terms of vehicle category, its FY22 standalone segment mix is – ~42% CV, ~44% Industrial and ~14% PV

- The company stands to benefit from the cyclical recovery underway in the domestic CV space coupled with steady demand prospects in its key export markets in CV domain i.e. US Class 8 trucks

- BFL has recently outlined its Vision 2030 with key targets by FY30 being (i) 12-15% revenue CAGR, (ii) EBITDA margin >20% at consol level, (iii) RoCE at 25% at consolidated level & (iv) dividend pay-out at 30%+, which bodes well on the longevity of earnings growth and overall wealth creation for investors.

- BFL’s capabilities in defence space need special mention wherein it has indigenously developed armoured vehicles, Artillery guns (successfully tested, ready for induction in Indian Army, order anticipated anytime soon), bullet shell casing, etc., with IP rights staying with the company and opportunity size in this space pegged at thousands of crores over the next decade

- We have a positive view on BFL given its capabilities in auto, non-auto space with growth opportunities that lies ahead in defence, aerospace & e-mobility domains (including retrofitting of CV’s). With capacities & capabilities in place, sales, PAT at the company is seen growing at CAGR of 15% over FY22-25E with EBITDA margins improving to 19.4% by FY25E

- We assign BUY rating on the stock valuing it at Rs 1,050 i.e. 33x P/E on FY24-25E average EPS of Rs 31.7/share

Conclusion

The recent weakness in the markets is triggered by weak global cues. Historically, we have seen Indian markets witnessing some positive flows in the second half of the December. Hence, we believe instead of sector specific, heavyweights across the sectors may perform in market recovery.

Source: ICICIdirect Research

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. The non-broking products / services like Research, etc. are not exchange traded products / services and all disputes with respect to such activities would not have access to Exchange investor redressal or Arbitration mechanism. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds