Mutual Fund Performance: What factors should you check before choosing mutual funds?

Last year, thanks to the Santa rally, equity mutual funds ended on a super-high. Your portfolio must have delivered good returns, but how have different equity mutual funds performed? Did you miss not having the best-performing ones in your portfolio?

In this blog, we try to explore the performance of different mutual funds in the short and long term and help you pick the best one for your portfolio. Let us get started.

Recent Mutual Fund Performance

In December 2023, the MF AUM crossed 50 lakh crore, so the overall industry is doing well. For investors, at the end of the day, returns matter. Equity outperformed the other traditional asset classes in 2023 quite comfortably. It was a great relief for the investors as 2022 returns were muted - lower single digits.

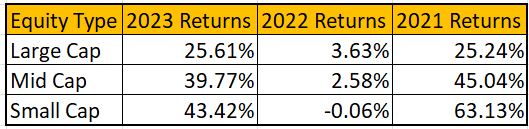

The large-cap mutual funds delivered 25.61% returns in 2023 after poor 3.63% returns in 2022. Mid and small-cap gave exceptional returns in 2023 with 39.77% and 43.22%, respectively.

Mutual Funds Long-Term Performance

The short-term returns (three years or less) are never a good indication of an asset class performance. So, in this section, we will look at how large, mid, and small-cap have performed in a five and ten-year period.

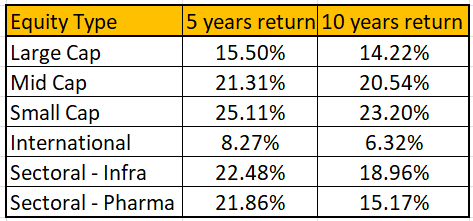

Thanks to the exceptional rally last year, the small-cap is a clear winner in the long period also. In a 5 and 10-year period, the small-cap has delivered 25.11% and 23.20% returns, respectively. The midcap is slightly behind with 21.31% and 20.54% returns, respectively. Large-cap funds have delivered the lowest returns among the three, but are still strong at 15.50% for a 5-year and 14.22% for 10 years.

The only equity fund category that has given below-par returns (below 10%) in the 5 and 10-year periods is international funds. Equity ELSS, Flexicap, Sectoral-Infrastructure, Sectoral-Pharma, and Sectoral-Technology, all have delivered more than 15% returns in this period. So, which of these should you select? We have answered this in the next section.

Factors for Selecting Mutual Funds

The returns across categories are exceptional for mutual funds in the short and long term. The essential question now is - what factors you should look at while selecting a mutual fund:

Investment Objective: The starting point is to identify your investment goals, whether it is capital appreciation, income generation, or a combination of both.

Choose a fund that aligns with your specific objectives and time horizon.

Your investment horizon: Presently, everything looks investable if you look at the returns as we have seen above. However, the scenario could change, and correction could happen. The maximum correction would happen in small- and mid-cap funds. The recovery will take time. Therefore, you must invest in them only if you have a long-investment horizon.

Returns compared with benchmark: You need to pay a fee to the fund house to manage your funds. It only makes sense to pay this fee if a fund can beat the benchmark index by a considerable alpha. As per a recent study, around 50% of equity mutual funds schemes have underperformed their benchmark indices in 2023.

You may not want to make investments in funds that are unable to beat the benchmark for a considerable period. So, before comparing the fund's performance with peers. But first, check the benchmark.

Fund Manager's Track Record: Evaluate the fund manager's experience, track record, and investment strategy. A seasoned and successful fund manager may contribute to the fund's overall performance.

Expense Ratio: Consider the fund's expense ratio, which represents the annual fees and expenses as a percentage of the fund's average net assets. If two funds are at par in terms of returns, you should pick the one with a lower expense ratio (small category). Lower expense ratios are generally more favorable for you as you save a considerable amount over a long duration.

Market Conditions: Assess the prevailing market conditions and economic outlook. Some funds may perform better in certain market environments, so it is important to choose one that suits the current economic climate.

In one of our previous articles, we have covered all essential ratios that help you compare and select mutual funds. Do check our article for detailed understanding.

Before you go

Diversification is mandatory, and therefore, you must not only have equity mutual funds in your portfolio. Look to diversify through debt mutual funds, which can give you good returns. Alternatively, choose hybrid funds which have exposure to both equity and debt. Whatever you choose, remember that it is crucial to regularly review your investment portfolio and adjust it as needed based on changes in your financial situation and market conditions.

Data Source: Value Research Mutual Fund Return Page, TOI