What the macroeconomic indicators show: Slowing advanced economies, but a resilient India

Amidst all the news of job cuts across global technology majors, increasing interest rates, a falling but still high inflation and funding crunch for start-ups, there is justifiable fears of the world slipping into an economic recession. Or will it actually? The macroeconomic data coming out of developed western economies is still mixed and quite far from a recession. And India’s macros certainly suggest that there would be no such eventuality here, though a slowdown in exports could hurt the economy a tad bit.

Developed economies such as the US, UK and Euro Zone have tightened interest rates as inflation touched decadal highs. This increase in rates is expected to hurt growth in these economies sometime in 2023. China is opening up after nearly following three years of zero-covid policies with strict restrictions on people movement, leading to a massive spike in COVID-19 infections. Crude oil prices have cooled down reasonably, but the Russia-Ukraine war is still far from over and so there is no certainty on the direction fuel prices would take.

Curiously, despite all the headwinds, the US markets were down just 9% in 2022, while the UK was up 1%. French and German markets were down 9% and 12% respectively, while India and other Asian markets such as Singapore were up 4-5% in 2022. These are moves that are normal and nothing extraordinary. Global markets appear to have shrugged off macro challenges, as yet.

Here we look at key macroeconomic variables affecting the advanced economies and also get down to how the indicators are faring in India’s case. Gauging these metrics gives us an idea that India is relatively better placed than most countries in the world to weather a global slowdown.

What macroeconomic variable indicate in advanced economies

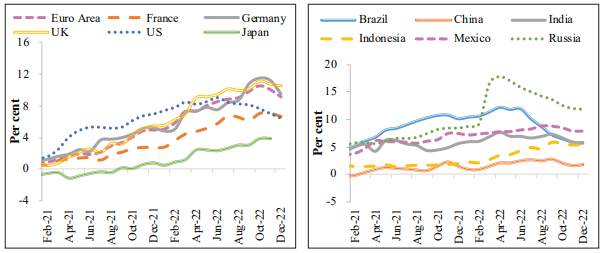

After the global financial crisis, the central banks of most developed economies went on a bond-buying spree (quantitative easing). Interest rates were at near-zero levels for over 10 years. Then, with COVID-19 striking, every country increased welfare spending. Then, there was a spike in the prices of commodities such as metals. Global supply chain disruptions were also challenging. Finally, with the Russia-Ukraine war, and all the factors mentioned earlier playing a part, inflation ballooned to gargantuan proportions. From 0-2% usually, inflation almost touched double-digits in late 2021 and 2022. As a result, policy interest rates were increased to 4.5% in the US, 3.5% in the UK and 2.5% in the Euro Zone, within a span of 12 months. Here’s how macros have played out in these countries.

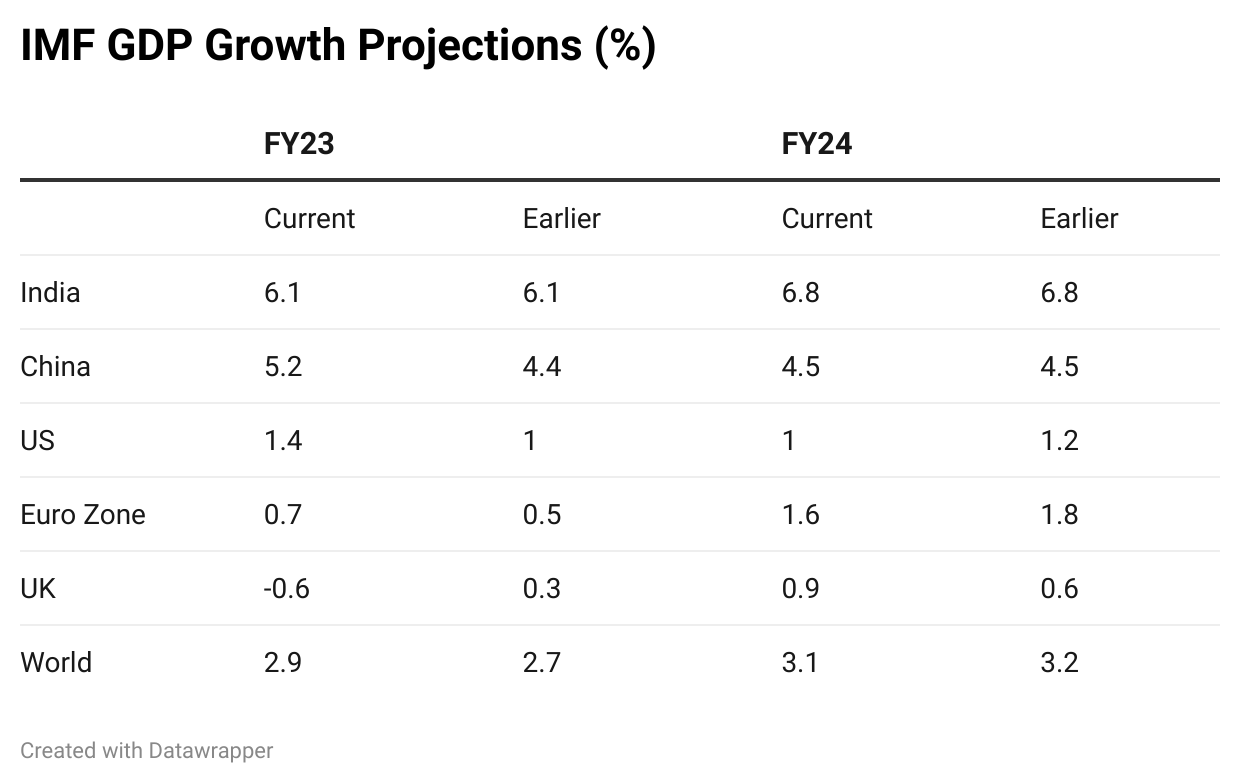

GDP growth: The US recorded GDP growth of 1% and 1.9% YoY in the previous two quarters. We had the UK growing at 1.9% and 4%, while the Euro Area grew 2.3% and 4.2% YoY in the preceding quarters. Though growth is slowing no developed economy has gone into a recession. And even in FY23, except the UK, no major geography is expected to have a negative growth in GDP.

Inflation: Price rise has been declining steadily even in the western economies. From near double digits, inflation is down to 6.5% in December 2022. In the UK, after decadal highs, inflation came down to 10.1%, while it was 9.2% for the Euro Area. Given that inflation has been steadily declining, in the US, there are expectations of the Federal Reserve pivoting or in other words not rising rates beyond 5% from 4.5% currently.

Source: Economic Survey

Labour market: In a slowdown, you would expect the labour market to be hurt. The unemployment rate has actually come down in recent months to 3.5%. Initial jobless claims are down to 186,000 from 192,000 earlier. The number of unemployed persons is at 5,722,000 from 6,000,000. In the UK and Euro Area, unemployment rates have remained stagnant.

Other indicators: Business indicators such as the composite purchasing managers index (PMI) and car production have been declining. PMI has been below 50, which indicates contraction.

But as indicated earlier, these were expected aftereffects of interest rate hikes and have nothing to be surprised about. The following table gives IMF’s GDP growth projection for key economies.

Indian macros on a strong wicket

In the background of a slowing world economy, India has been on a steady recovery path post-COVID. Across all key metrics such as GDP growth, inflation, unemployment, IIP (index for industrial production), PMI, tax collection, currency performance and so on, the country has been on revival path. Here are some key data points with charts to illustrate.

- GDP growth is expected to be above 6% in this fiscal as well as the next, making India one of the fastest growing economies in the world.

- After stubbornly remaining in double digits for many months, even the WPI (wholesale price index) has come to low single digits in recent months. The consumer price index (CPI) has also come down to 5.72% in December 2022, indicating that the Reserve Bank of India’s (RBI’s) rate hikes to the tune of 225 basis points have worked. There is expectation that the RBI would pause rate hikes at 6.5% in the February meet.

- The PMI Manufacturing, Services, and Composite indices have been in excess of 55 levels, indicating healthy expansion in manufacturing and services activity. A value above 50 indicates expansion.

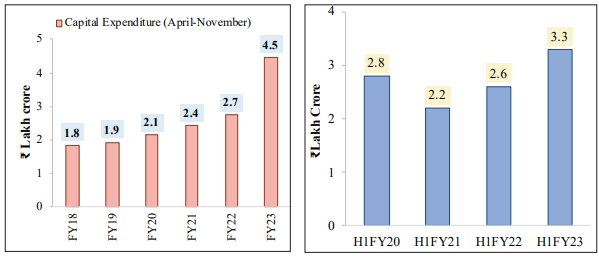

- Capex expansion and private investment have been on a sharp uptrend in the last year. A staggering Rs 4.5 lakh crore is expected to be spent as capital expenditure in FY23. In the first half of FY23, private investment is up to Rs 3.3 lakh crore, up nearly 27% over the H1FY22 figure of Rs 2.6 lakh crore.

Source: Economic Survey

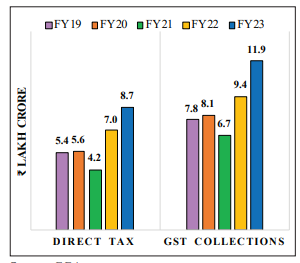

- Tax collections are extremely buoyant. Both direct taxes as well as GST (goods and services tax) have risen sharply in the last couple of years. Both have grown at over 23-26% in FY23, indicating robust business activity and reasonable profitability.

Source: Economic Survey

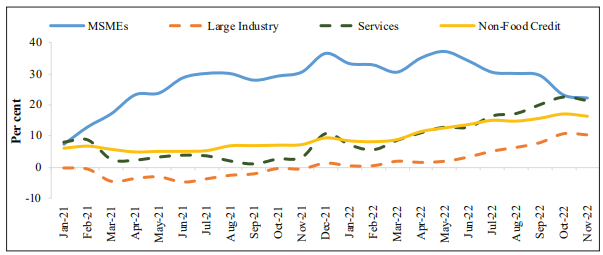

- Bank credit on the rise across the board, with loan disbursals in double digits for MSMEs, large industry, services and non-food credit. This clearly shows corporate, individual and small industry’s appetite for leverage on the back of reasonable demand.

Source: Economic Survey

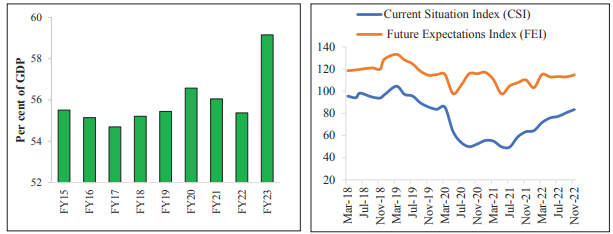

- Private consumption and consumer confidence are on a fresh high. In fact, private consumption is a good 2 percentage points higher than the pre-COVID levels, at 59% of the GDP. The revival in consumer spending is a clear indicator of an economic revival.

Source: Economic Survey

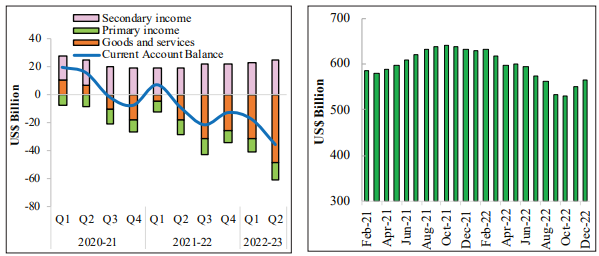

- The widening of the CAD (current account deficit) is a concern. With Indian exports also likely to be soft given the slowing advanced economies, the government may find the situation challenging. However, given India’s sound foreign exchange position with $564 billion reserves, the concerns may well be addressed smoothly.

Source: Economic Survey

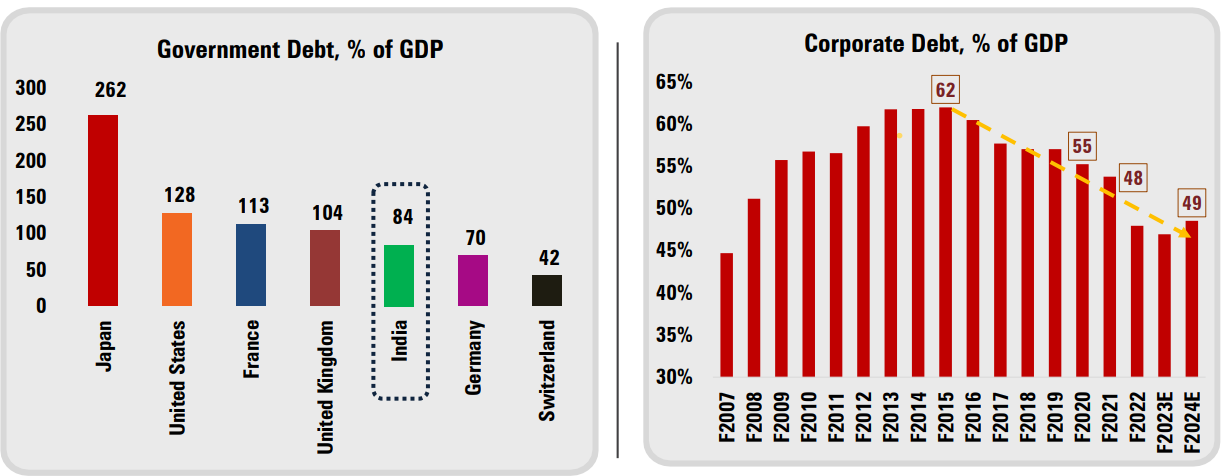

- Indian government’s debt as a percentage of GDP is much lower compared to most other western economies, lending considerable comfort at the macro level. Corporate debt has also been on the decline and is only at 49% of GDP, giving considerable room for more leverage.

Source: ICICI Prudential AMC

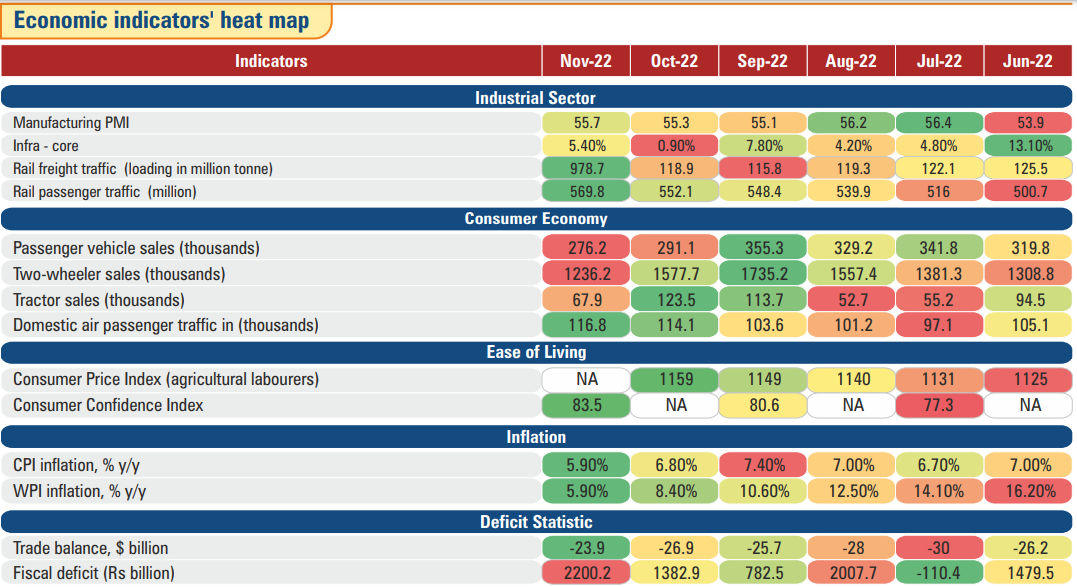

- A snapshot of some the high-frequency macroeconomic indicators is shown below. Though there are fluctuations in some of these factors, the overall economic situation is one of revival.

Source: ICICI Prudential AMC

From macroeconomic indicators, though there are challenges in the form of a slowing global economy, India appears to be chartering a course of its own. All indicators pointing to a revival and a resilient economy. While a few western economies may slip into recession, there certainly is no cause for concern for India, at least from the standpoint of economic indicators.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The securities quoted are exemplary and are not recommendatory. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.